Oncobiologics IPO: We Suggest Holding Off

Oncobiologics Incorporated (NASDAQ: ONS) expects to raise $53 million in its upcoming IPO. Based in Cranbury, New Jersey, Oncobiologics is a clinical stage biopharmaceutical company, focused on developing, manufacturing and marketing biosimilar therapeutics for immune diseases and cancer.

We previewed ONS on our IPO Insights platform last week.

Oncobiologics will offer 5 million shares at an expected price range of $11 to $13.

ONS filed for the IPO on January 15, 2015.

Lead Underwriters: Barclays Capital and Jeffries LLC

Underwriters: Cantor Fitzgerald

Business Summary: Clinical Stage Biopharmaceutical Engaged in Developing Treatments for Immune Diseases and Cancer

(Click on image to enlarge)

(Source)

According to company filings, Oncobiologics is a clinical stage biopharmaceutical company that identifies, develops and markets complex biosimilar treatments for immune diseases and cancer. The company works on an accelerated basis, attempting to bring treatments to market relatively quickly.

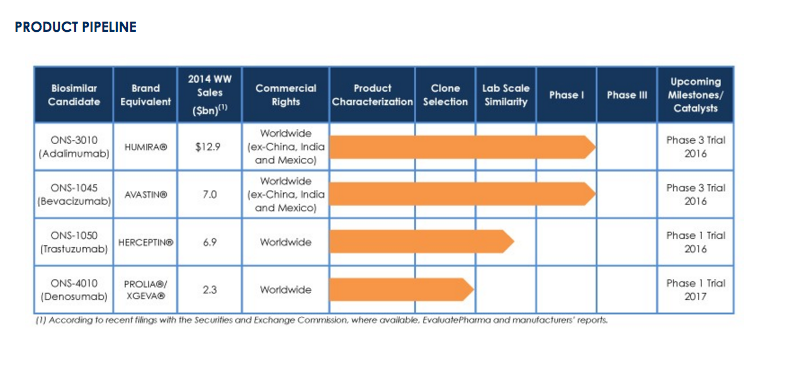

Currently, its product candidates include ONS-3010, and adalimumab (Humira) biosimilar, which is Phase 3 ready; ONS-1045, a bevacizumab (Avastin) biosimilar is also Phase 3 ready; ONS-1050, a trastusumab (Herceptin) biolsimilar; and ONS-4010, a biosimilar to denosumab (Prolia/Xgeva).

The firm has also established integrated in-house development and manufacturing capabilities, known as its BioSymphony Platform as described in its prospectus summary. This platform tackles the numerous complex regulatory and technical challenges associated with developing and marketing mAb biosimilars. It was also designed to create considerable pricing flexibility.

Use of IPO Proceeds

The company intends to use the net proceeds from the IPO for the following:

- Approximately $30.0 million to move forward clinical development of ONS-3010 through Phase 3 clinical trials.

- ·Approximately $5.0 million to fund further R&D, which includes preparing ONS-1045 for Phase 3 trials, and preparing ONS-4010 and ONS-1050 for Phase 1 trials.

- Any remainder would be for general corporate purposes and working capital.

Oncobiologics, Inc. has collaboration and license agreements with Selexis SA; IPCA Laboratories Limited; Laboratories Liomont, S.A. de C.V.; and Zhejiang Huahai Pharmaceutical Co., Ltd.

Executive Management Highlights

According to the company's description in its filings, Founder, Chairman, CEO and President Pankaj Mohan, Ph.D. has served in his positions since January 2011. His previous experience includes senior positions at Bristol-Myers Squibb, Genentech, and Eli Lilly. Dr. Mohan also served as a Scientific Officer for the Department of Atomic Energy for the Government of India. Dr. Mohan received a Ph.D. in Biochemical Engineering from the School of Chemical Engineering, University of Birmingham, United Kingdom.

CFO Lawrence Kenyon has served in his position since September 2015. His previous experience includes senior financial positions at Arno Therapeutics, Tamir Biotechnology, Par Pharmaceutical Companies, Alfacell, and NeoPharm. Mr. Kenyon received a B.A. in Accounting from the University of Wisconsin-Whitewater and is a Certified Public Accountant in Illinois.

Potential Competition: Pfizer, Amgen, Sandoz and Others

Oncobiologics faces competition from a variety of sources. Several large pharmaceutical companies have mAb products in Phase 3 clinical trials including Pfizer (NYSE:PFE), Amgen (NASDAQ:AMGN), Sandoz, Hoehringer Ingelheim, Samsung Bioepis, Coherus Biosciences (NASDAQ:CHRS), Momenta Pharmaceuticals (NASDAQ:MNTA) and Celltrion.

Competition also comes from pharmaceutical companies developing biosimilar products such as AbbVie (NYSE:ABBV), Genetech, Pfizer, Sandoz, Bioepis, Merck, Coherus, and Celltrion.

Financial Overview: Early-Stage Losses

Oncobiologics Inc. provided the following figures from its financial documentsfor the years ended September 30:

|

2015 |

2014 |

|

|

Revenue |

$5,219,237 |

$9,050,542 |

|

Net Income |

($48,669,854) |

($13,732,473) |

As of December 31, 2015:

|

Assets |

$31,322,869 |

|

Total Liabilities |

$45,871,473 |

|

Stockholders' Equity |

($30,914,816) |

Conclusion: Consider Holding Off

Noted risks include large levels of debt and no product revenues to date.

Following a handful of mixed non-healthcare deals (MGP, BATS,RRR) in the past two weeks, ONS brings focus back to clinical-stage biotech. Yet with just a small underwriting team, we suggest investors exercise caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 ...

more