Old Men, Value Companies

A young man is a theory, an old man is a fact. − E. W. Howe

You think Joe Biden at 78 is too old to lead America? Well, think again! There has been a whole lot of debating going on recently about the efficacy of leaders who are past their prime, and whether their management skills still have some steam left. I thought it would be a good idea to dig into corporate America and check out the health of companies managed by CEOs in their golden years. Here's a list of four CEOs with a combined age of 326 years – that’s 83.5 years per - and they're managing very successful American companies.

1. BERKSHIRE HATHAWAY (BRK)

CEO: Warren Buffett

Age: 90 years

Market Price: $341,339, as of November 20, 2020

Market Cap: $533 billion

Neither The Oracle of Omaha nor BRK, a holding company, need any introduction. BRK recently bought back $9 billion of stock in Q3 2020, but COVID-19 stung its commercial insurance and reinsurance underwriting business.

BRK’s balance sheet is extremely robust: $35.6 billion additional capital, $409 billion retained earnings, $400 million in short- and long-term investments, and cash and equivalents worth $27 billion are the result of efficient and proactive management. The company does not pay a dividend.

In July 2020, BRK picked up Dominion Energy’s natural gas transmission and storage business for $10 billion. It also purchased a 5% stake each in five Japanese trading companies — Itochu (ITOCF), Marubeni (MARUF), Mitsubishi (MSBHF), Mitsui (MITSY), and Sumitomo (SSUMF).

A 1% fluctuation in the stock translates to a $3,350 movement in the stock price, and therefore it is not a stock for the faint-hearted.

2. UNIVERSAL HEALTH SERVICES (UHS)

CEO: Alan B. Miller

Age: 83 years

Market Price: $131, as of November 20, 2020

Market Cap: $11.1 billion

Alan founded UHS, a hospital and healthcare services provider, in 1986. He has managed it efficiently, and just recently UHS was conferred the Healthcare Supply Chain Achievement Award by the ECRI. If Obamacare is not repealed by the Supreme Court, and/or it is expanded after January 20, 2020, healthcare and hospital provider stocks are expected to witness heady days so long COVID-19 claims and reduction in government spending do not hurt their profitability.

UHS’s robust balance sheet had $1.1 billion in cash and equivalents, and $5.95 billion worth of retained earnings as of September 30, 2020. About 45% of its property and equipment has been depreciated so far, implying that the company has set up a strong moat.

UHS is a hugely profitable company – its EBITDA margin (TTM) of 16.6% and Return on Common Equity (TTM) of 15.47% outperform the sector medians of 5.82% and −36.79%, respectively. However, its dividend yield is poor at 0.31%.

3. FIRST REPUBLIC BANK (FRC)

CEO: James H. Herbert, II

Age: 76 years

Market Price: $130, as of November 13, 2020

Market Cap: $22.6 billion

James co-founded FRC in 1985 and has been its CEO since then. Of late, the stock has been under pressure because it expects gross proceeds of about $198.3M on its underwritten public offering of 1.5 million shares, translating to a price of about $132 per share, which is more or less equal to its last market price.

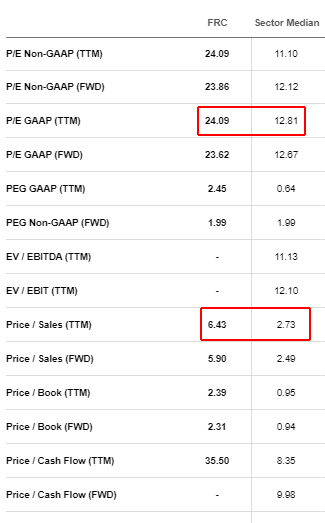

FRC is a well-managed company that reported a TTM Net Income margin of 28.33% and a Return on Common Equity (TTM) of 10.57% as compared to the sector medians of 20.91% and 8.07%, respectively. However, its TTM Price/Earnings (GAAP) ratio of 24.09 and a Forward Price/Sales ratio of 5.90 are high as compared to their respective medians of 12.67 and 2.49. Also, its current dividend yield is just 0.61%.

The stock looks expensive. Moreover, the financial sector is lagging because of low-interest rates.

Image Source: FRC’s Valuation Sheet

4. CENTENE CORPORATION (CNC)

CEO: Michael Neidorff

Age: 77 years

Market Price: $63, as of November 20, 2020

Market Cap: $36.5 billion

Managed care companies like CNC are possibly staring at a bright future, especially if the Supreme Court does not do away with the Affordable Care Act. In Q3 2020, the company beat EPS and revenue estimates by $0.30 and $791 million, respectively, despite the raging pandemic.

The stock with a Forward Price/Earnings (GAAP) ratio of 20.49 seems undervalued when you compare it to the sector median of 33.30. However, its low Forward Price/Sales ratio of 0.36 as compared to the sector median of 6.75 suggests that the stock is currently not being fancied much by investors. It also does not pay a dividend. However, 16 analysts have revised its earnings estimates upwards for Q4 2020, which is a bullish signal.

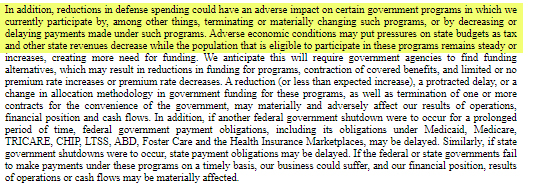

Image Source: CNC’s SEC Filing

CNC has disclosed to the SEC in its Q3 2020 filing that any cuts in defense spending or cuts in state budgets can adversely impact its profitability. It also fears that any delays in reimbursements can materially impact its operations.

Summing Up

I have just listed four companies managed by CEOs who are in their golden years. None of the companies mentioned above are growth companies, which is the theme these days. Global investors are chasing growth stocks and Post-COVID-19 themes such as tech, semiconductors, online education, gaming, WFH, cloud, etc.

I too would avoid investing in these four companies despite them being very successful and profitable companies managed by experienced men who are in their twilight years, and although many investors prefer value over growth these days.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more

Four examples of fairly old men running very successful companies. Certainly proof that it can be done by some people. But how old were they when the companies first took off and became quite profitable? Like many other talents and skills, their skills become better with practice. Sufficient practice does lead to improved skills, that holds in most fields, except competitive drinking, an area not on the path to success and prosperity. How nany folks aged 70 and over start a company that becomes a success? There is a big diffeence as I see it.