Nxt-ID Gets A New Lease On Life

[TM Editors' Note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.]

Nxt-ID (NXTD) is going to split its two main businesses. On the one hand, it's got its health business called LogicMark (PERS, Personal Emergency Response Systems) which is responsible for nearly all its revenues.

On the other hand, it's got a promising finance business called FitPay which will be distributed as PartX to shareholders in a tax-free distribution. The plan was announced already last September but hit a roadblock in the existing debt covenant.

But this has now been removed by a new (and somewhat cheaper) finance deal and the plan will go ahead. The shares have not been doing well as LogicMark hasn't generated enough cash to pay the interest on its debt while FitPay has seen its main business decline, but we will argue that it's likely better times are ahead.

The reasons for our optimism are:

- LogicMark will be relieved of financing FitPay, generates surprisingly high gross margins, just won what could be a break-through distribution deal with Walmart (WMT), and last but certainly not least, LogicMark produced positive free cash flow in Q1.

- FitPay's TRM (Token Requester Management) Platform has several advantages and is highly scalable and leverageable.

But there are also considerable risks:

- The company received a delisting notice

- PartX lacks funds

- LogicMark has substantial debts

LogicMark

LogicMark is Nxt-ID's other main business and the one responsible for almost all of its revenue, which remains after FitPay is split off.

LogicMark produces PERS, or Personal Emergency Response Systems, enabling two-way communication, medical device connectivity and patient data tracking of key vitals through sensors, biometrics, and security enabling home health care. The PERS market splits into different categories:

- Monitored (subscription based)

- Non-monitored (one-off fee)

- Landline

- Mobile

- Standalone

The company doesn't sell directly to consumers but uses dealers, distributors and the VA (United States Department of Veterans Affairs). The latter is a really strong channel growing at 7% a year and management expects this to grow 7%-10% in 2019.

Management is also pursuing other government channels. The company doesn't sell directly to end customers but leverages partnerships with companies like Walmart and Walmart.com, and BestBuy (BBY).

The market is driven by several trends:

- Demographics

- The rise of virtual care or telemedicine

- Rising healthcare cost

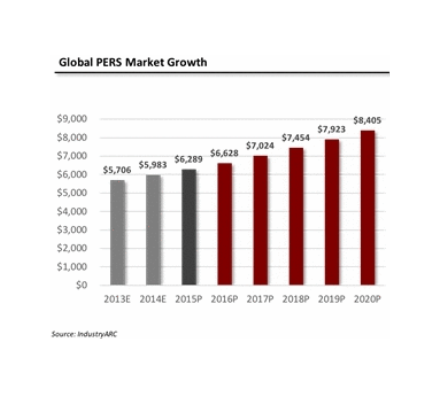

The market is expected to grow at a compound annual growth rate (“CAGR”) of 5.83% to $8.4 billion in 2020 according to IndustrryARC, (from the 2018 10-K):

The latest product, launched in December, the Notifi911 is a wearable cellular pendant that connects directly to 911 at the touch of a button, and this can now be bought through WalMart:

Notifi911 is a self-contained unit that does not require a base station, landline or cellular plan, follows extensive in-store trials. There is no annual contract, no monthly charges and no monitoring fees to use the device, which offers a distinct value proposition and disruption over other monitored devices currently on the market by providing consumers with a product at less than 10 percent of the cost over the lifetime use of monitored devices offered by competitors.

Walmart could be a bit of a breakthrough and we are aware that these cheaper pendants have other use cases besides frail pensioners at home. What to think of hikers, climbers, fisherman, hunters, and children.

Indeed, some national parks are beginning to consider these devices for safety reasons for all visitors. Then there are other classes of people exposed to a dangerous situation like hotel workers or people who visit homes.

Management hinted at upcoming developments for these other segments during the latest couple of conference calls, for instance, Q1CC:

we're in the process of developing solution opportunities in other key market. So we're doing testing now in new channels such as real estate. We are in the process of moving forward on strategic opportunities in the hospitality segment, and are looking for key partners in other areas to help us continue to drive our mPERS strategy as we move forward.

The company is also working on a WiFi product to replace the landline products which are in slow decline as now even older people are shifting away from landlines (much of the growth of LogicMark comes from the cellular product sold via the VA). The company is also upgrading their wireless devices to 4G.

FitPay

PartX will constist of FitPay, which is a contactless payment technology which is implementable (as a white label solution or under the company's own brand) on smart devices (smart watches, cards, etc.). From the company website:

The platform uses NFC technology to interact with over 10 million retail POS terminals worldwide, making it possible to pay for goods and services almost anywhere with a simple tap. FitPay’s end-to- end payment solution allows IoT and wearable device manufacturers to add payment and authentication capabilities to their products with very little start-up time, no investment in software development and access to the leading card networks.

Garmin (GRMN) has been FitPay's main customer (here is a case study). Recently they added Swatch, which started selling in Switzerland and will move to the rest of Europe, Asia and the US.

The main element is a TRM (Token Requester Management) Platform, which removes personal data from the device and replaces it with a unique identifier (token) to enhance security

FitPay is actually pretty impressive and has a number of important competitive advantages:

- The breadth of its network.

- The independence of its network (not beholden to a single OEM).

- The range of possible services.

- The security provided by tokens.

- The cost-effectiveness for payment card networks and issuing banks.

- It offers a comprehensive, end-to-end solution as a single source for all of its cloud-based and IoT applications, including full-featured APIs (application programming interfaces) and SDKs (software development kits) to simplify implementation.

- It works without internet connection at POS (the point of sale) or secondary device (like a smartphone).

- FitPay solutions are extendable to any operating system or device.

- It involves some switching cost and hence a degree of customer lock-in.

The company has virtually all the main card payment networks on board, as well as a large amount of issuing banks in numerous countries, from the 2018 10-K:

Fit Pay is currently one of the few platform providers that is certified by the major card networks (Visa, Mastercard, Discover and Maestro) to provide tokenization services, particularly within an embedded secure element chipset, which many wearables and IoT devices utilize because it requires less power and memory capacity.

This will be difficult to replicate for competitors, from the Q1 10-Q:

the geographic and issuer footprint for Garmin Pay™ is expanding and now is a network of more than 280 issuing banks in 34 countries with additions being made regularly. This represents a significant increase from year-end 2017, at which time the network included 60 issuing banks in 8 countries. As a part of this growth, Fit Pay announced recent agreements with Chase, Westpac, Discover and Mastercard’s Maestro network in Europe. This expansion of the Garmin Pay™ network increases the overall revenue opportunity of this flagship customer and establishes banking and network relationships that may be leveraged for future payment solution offerings.

By the end of Q1 2019, the network included 340 issuing banks in 245 countries and the company added Visa's Token Service as a partner (from the Q1 10-Q):

It was also announced in October 2018 that Fit Pay is a technology partner for Visa’s Token Service for credential-on-file (“COF”) token requestors. Through this program, Fit Pay will be able to tokenize COF digital payments on behalf of merchant and payment ecosystem clients, greatly expanding the addressable market for its platform services. Fit Pay leverages the EMVCo Payment Tokenization Standard to “tokenize” or replace sensitive personal information, such as payment card numbers and expiration dates, with a unique digital identifier or “token.”

And here is additional information of the possibilities, from the 2018 Q4CC:

We announced in October as a launch partner with Visa (V) with their card on file program and credential on file program, which essentially allow ecommerce and merchants that have large portfolios of credit cards we're billing ongoing purposes to use our tokenization services as part of their transaction. That will expand the capabilities beyond and physical wearable devices and to a whole new breadth of merchants and business opportunities as we bring on Visa and the other networks the same capabilities.

The TRM platform maintains the security keys for contactless devices, which limits the ability of its customers to change providers without a major service disruption so there is an element of customer lock-in.

The tokenization is also a cost-effective solution for the payment networks and issuing banks. It is secure and frugal (company website):

FitPay leverages Embedded Secure Element (ESE) chip technology within devices to offer a payment solution that is very power and memory efficient and does not need to refresh a token once it is issued. This frees devices like the vívoactive 3 from needing to be tethered to a host device or connected the Internet to transact payments, creating a better user experience.

At one level the technology is essentially a generic authentication solution, for which there are many more applications, from the 2018 10-K:

Fit Pay’s TRM Platform is built to securely authenticate and provision any credential, making it ideal for digital hotel room keys, transit, ticketing, access, and other use cases. Fit Pay believes that each of these markets represents an area of potential future growth.

FitPay's revenues are still paltry and it requires funds and marketing nous to be able to expand. On the other hand, they have not been sitting on their laurels, there is significant expansion:

- The breadth of the network, with all the major card networks, now including Discover Network (Discover Card members can now use Garmin Pay) from January 2019 and now 340 issuing banks in 245 countries.

- Expansion at existing customers like Garmin, which now has FitPay in 16 of their models with price points between $199-$2500.

- Adding new customers like Swatch Europe. SwatchPay is now enabled by the company's TRM platform, starting with four models in Switzerland but expansion will follow.

- New devices like the Flip Chip (see below).

- There has been a 300% increase in device activation between the end of Q1 2018 and the end of Q1 2019.

Flip Chip

The company itself is coming up with new use cases to leverage its FitPay network, introducing the Flip Chip a digital wallet for Bitcoin (BITCOMP), enabling holders to pay seamlessly with Bitcoin at millions of POS systems. From the company website:

It's actually a broader instrument as value can be loaded on your Flip directly from a checking or saving account through your bank’s on-line service or mobile application, or by setting up an ACH transfer from your bank. Flip can also be loaded through direct deposit, cash deposits through Visa Readylink Load Network locations, or with some Federal benefits through the GoDirect service.

On the other hand, the Flip cost $29 and there are some (small) fees involved (company website):

There is a Monthly Account Fee of $1.99 to maintain your Flip account and a fee of $.99 to add more value to the Flip Chip. The Monthly Account Fee will be waived if you make three or more transfers totaling more than $500 in a single month. The Bitcoin to USD exchange fee is 3% (plus applicable miner fees).

In summary, this is an interesting way to leverage FitPay but like FitPay itself, it requires funds and marketing nous to be able to expand.

Finances

This is the part where it gets complicated, here is a five year (GAAP) overview:

Data by YCharts

EBITDA has been positive but since they pay a substantial amount of interest (among other things, like stock-based compensation and amortization and change in fair value of contingent consideration) net earnings aren't.

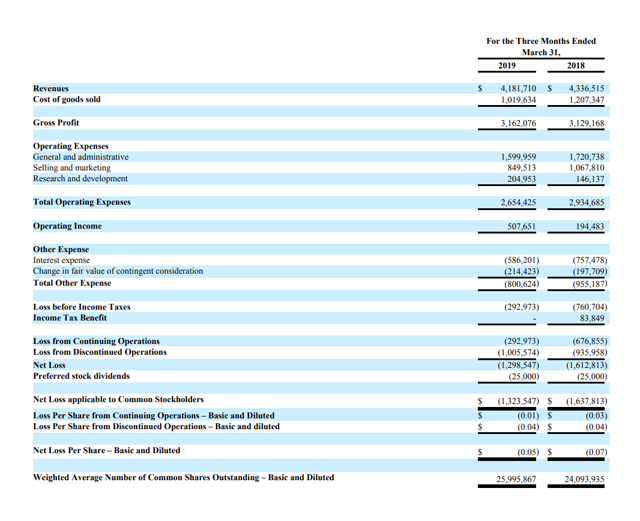

But the situation is improving, the net loss for LogicMark was just $292K in Q1 (with another $1M in loss for FitPay). From the Q1 10-Q:

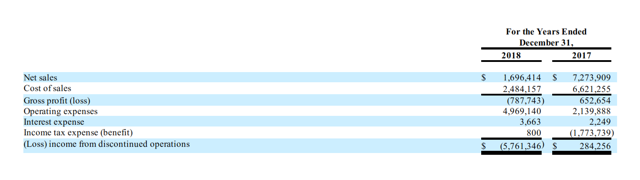

This is just the revenue from LogicMark, FitPay has been relegated to discontinued operations. But FitPay had a major sales collapse in 2018 (10-K):

This was due to (10-K):

During the years ended December 31, 2018 and December 31, 2017, we recognized revenue of $737,993 and $7,065,755, respectively from WorldVentures Holdings, LLC (“WVH”), a related party. Dr. D’Almada-Remedios, a director of the Company, was the former Chief Executive Officer of Flye Inc., a payment technology company owned by WVH.

WorldVentures FlyCards didn't take off as expected, needless to say, and Q1 2019 was no exception (Q1CC):

So for the payments position, Q1 revenue was 221,000 for the quarter versus $514,000 for the previous period of 2018. The decrease was fully due to discontinuation of product sales to WorldVentures.

FitPay suffered a net loss of $1M in the quarter so this business is in need of significant funds. But with just $221K in revenues and $1M in net losses in Q1, there is quite some way to go, needless to say.

While there is potential (gross margin, for instance, is 72%), we feel that despite the promise and progress (see above) the business is in need of a major infusion of funds and/or a strategic partner.

Margins

Data by YCharts

The gross margins that the PERS products command is pretty amazing, and received a further boost from a mix shift to GSM-based PERS which carry higher prices and margins.

The business also produced a pretty decent operating income in Q1 of $507.6K which almost covers the interest expense of $586.2K. It's on the edge of being a viable business.

Cash

Data by YCharts

They are not really bleeding cash and in Q1 the company actually generated nearly 800K in free cash flow, although one has to factor in that it excludes the FitPay, which used $946K in cash.

That is, stand-alone the business seems pretty viable to us and with the free cash flow and lower interest expenses as a result of refinancing (see below), it could start deleveraging.

Interest expenses declined from $757K in Q1 2018 to just under $600K in Q1 2019. So while we have seen articles announcing imminent bankruptcy, things have improved (Q1 10-Q):

However, given the Company’s cash position at March 31, 2019, anticipated future cash proceeds from the sale of common stock from the January 2019 At-the-Market Offering and its projected cash flow from operations, the Company believes that it will have sufficient capital to sustain operations over the next twelve months following the date of this filing to alleviate such substantial doubt.

The same cannot be said for PartX, that is, FitPay. That is still bleeding cash to the tune of $3.8M a year (2018).

Financing

Mentioned in the above quote is the January 2019 At-the-Market Offering, from the Q1 10-Q):

On January 8, 2019, the Company entered into a sales agreement with A.G.P./Alliance Global Partners (“A.G.P.”) for an at-the-market offering, pursuant to which the Company may sell, at its option, shares of its common stock, par value $0.0001 per share, having an aggregate offering price of up to $15 million to or through A.G.P., as sales agent. The Company will pay A.G.P. commissions for its services in acting as the Company’s sales agent in the sale of its common stock pursuant to the sales agreement. A.G.P. will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from the sale of the Company’s common stock on the Company’s behalf pursuant to the sales agreement.

So they still have plenty of cash, but addressing this facility (which they did to the tune of $1.28M in Q1) this will also cause dilution so it's good that the company is now cash flow positive.

There is more recent financing, or actually re-financing in May in the form of a $16.5M term loan (PR):

The Company will use the proceeds from the Term Loan to refinance its existing loan facility and to pay other costs associated with the refinancing.

Key features of the Term Loan include:

- Interest rate of LIBOR + 11.00%;

- Maturity date of three years after closing, and

- Three-year term with minimum principal payments amortized over 96-months.

The refinancing also removes a covenant of the existing debt facility and allows the Company to proceed with the proposed spin-off of its Fit Pay, Inc. subsidiary and its payments, authentication, credential management business and other assets into a new company called PartX, Inc. ("PartX").

So that serves two goals at once although LIBOR +11% is of course pretty nasty but it's a little less than the previous 15% loan issued to buy LogicMark and which they were now able to pay off (there was $13M of that left at the end of Q1).

The Spin-off

There is also some noteworthy information of the spin-off from the Registration Statement, we summarize some salient points for investors:

- PartX will be trading under the ticker PTXX and each shareholder of NTNX will receive one share of PTXX.

- Nxt-ID will issue warrants to purchase PartX common stock to holders of certain outstanding Nxt-ID Warrants in order to meet certain obligations under such Nxt-ID Warrants.

- Holders of the Nxt-ID Series C Preferred Stock will exchange all of their shares of Nxt-ID Series C Preferred Stock for shares of PartX’s Series A Preferred Stock.

- PartX will also assume the remainder of the FitPay sellers earnout payment which is estimated at $2.9M in the registration statement.

- Then there is the $638K remainder of a Seller note which PartX will assume.

- As a result of these obligations, the company will start off with a debt of roughly $3.3M and on top of that there will be a $1M-$2M private placement to finance working capital and funds to expand the business.

- The company will also receive some financial assets from Nxt-ID but we've not found information as to their magnitude.

Valuation

Data by YCharts

Valuation metrics have come down a lot but two times sales is still a quite substantial valuation.

Conclusion

After the spin-off of FitPay, LogicMark is growing, profitable and generating cash flow and should be able to deleverage which will set in motion a virtuous cycle of falling interest cost, more cash generation, and faster debt reduction.

PartX or FitPay, while having a really promising infrastructure that can be greatly leveraged is still bleeding cash and in needs of funds.

While Garmin, Swatch and the Flip have only just started and are growing revenue sources, we're not sure when that will be sufficient to stop the cash bleed and likely dilution.

Winning new clients and revenue sources could significantly speed up that process, something we think is quite likely.

Related article: NXT-ID’s Crypto Play Awaits Traction Amidst Delisting Warning

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

Great article on $NXTD. Would like you to investigate the following from a journalistic point of view. I’ve emailed the SEC asking them if the Form 10 was effective and they responded, yes 60 days after they filed on April 29th. Gino said on the last webcast they’d announce the spinoff after the SEC made registration statement effective. That’s complete according to an SEC attorney. What’s the hold up?

so SEC confirmed for you that the Form 10 is effective?

That's what I was told.

Its strange. My understanding is that there is not really a decision to be made by the SEC. If you meet all the necessary requirements for the spin, you submit the Form 10 and automatically 60 days later it goes into effect. It almost seems like a formality. Yet, here we are 3 months + later and the company says nothing. The whole thing is odd.

I agree. @[Shareholders Unite](user:38036) or @[Nathan Feifel](user:56139), do either of you have access to the company executives to ask?

I'm not sure what the hold-up is, as puzzled as the commentators but I've contacted the company, stay tuned..

Thank you!

Will let you know what they answered ASAP.

$NXTD's stock price has not fared well since this was published.

This should garner much attention when the company gives us a bit of a tighter timeline with regards to the actual spin. The fact that bitcoin is back heading north will certainly help sentiment as well. Regarding the delist, that's a half a year out. I wouldn't lose any sleep over that. That's an eternity in micro cap land.

$NXTD sounds like a stock worth taking a closer look at. But I can't find any other analysts that cover it besides you! I hope there will be more articles about it soon.

There's not really much we can do about that Dan..

Very thorough analysis on $NXTD, a stock that gets little to no coverage. I'm impressed.

Thanks Dick, my pleasure

I own over 2% of the outstanding shares and expect big things. I love the article and hate the share price. It’s all manipulation and once real buyers arrive shorts will be on the run. They’ve had problems with timelines but everything they’ve been promising is coming through. Once they split the companies things should start to click.

You could always sell some now.

Forget about short sellers....non existent and immaterial

Yes, I agree with you @[Scott Lesser](user:96943).

Scott- don't worry about shorts that may or may not exist. That's not the problem here. The best hope here is that as we getter a tighter timeline with regards to the spin the stock will move up into the actual event. Also, if Fitpay can continue to sign up big name customers that can only help with the perception of what this can be

Thanks Dan. Why do you like $NXTD so much though?

I agree, ignore the $NXTD shorts. The future looks bright.

Good points.

Yes, I agree. I think many of the problems are behind them and they are on the right track. The delisting is a buying opportunity, no question about it. Bullish on $NXTD

The company has a lot of cash and big ideas. Looks like a promising opportunity to me. But how does the competition look?

My tech skills don't go beyond "cash or credit" but how does FitPay compare to ApplePay and the likes?

Sounds like I'll have to take a deeper look at this company. Thanks for the extensive analysis.

Thanks, my pleasure Bill.

Spinning off #FitPay was a very smart move. Personally I think the positives far outweigh the risks. $NXTD has plenty of cash and a ton of upside potential.

I've heard great things about the XNTD's Notifi911 product. Much better than the old "I've fallen and I can't get up" Life Alert product which charges almost as much for a single month or two of service. But I would think this product is easy to replicate no? As far as I know there is no patented technology involved.

Loading comments, please wait...