Nvidia: Warming

We had downgraded Nvidia (Nasdaq: NVDA) in mid-September at $275. Now, however, the fundamentals look like they're bottoming. I'm not fully there yet because of this dragged-out trade war. But this is worth looking at longer-term assuming the trade war ever ends.

Quick Review

We downgraded Nvidia in September worried about inventories and a lack of earnings upside. In November we called out earnings risk which soon crashed the stock.

(Click on image to enlarge)

We downgraded Nvidia for subscribers on Sept. 13, 2018, to a Neutral Rating. The downgrade was mostly because we didn't see upside in our earnings estimates and any risk. Inventory risk was building.

We were out publicly that we expected earnings risk ahead of the Nov. 15 drop of 19% thanks to a rough earnings report. Ahead of earnings we pointed out that the underlying revenue growth trends were slowing.

Revenue growth trends were slowing then. That was so key for us then. Now they look like they can start picking up again.

Revenue Growth About To Accelerate?

Tech stocks need momentum. That's why I'm so very focused on revenue growth rates.

Nvidia lost that revenue momentum with the end of the crypto boom and the inventory hangover. They also had a less than stellar then-launch of Turing and RTX. That all led to a slowdown in revenues.

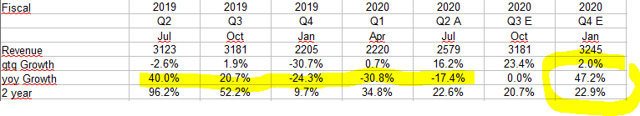

(Click on image to enlarge)

Source: Elazar Advisor, LLC Models, Data Pulled From Nvidia Reports

This is key for tech stocks in general and obviously what impacted Nvidia.

The left line of yellow above shows you a gradually slowing revenue growth rate. Not so gradual I guess. Tech investors hate slowdowns.

I like looking at the two-year growth rate which tipped us off to trends slowing. The two-year adds up this year's growth rate plus last year's same quarter growth. It smoothes out one timer and lets you see an underlying growth rate.

The two-year also slowed big time as you can see in the grid above.

Now, look at what we have for Q3 and Q4.

Q3 shows the one-year growth rate bottoming from negative numbers to zero. The two-year stops dropping and begins to bottom out and would be two quarters in the 20s%.

Our numbers for Q4 assume 20s% two-year which gets us year-over-year one year revenue growth rate for the first time in a while.

I'll show you what our biggest driver is that gets us there.

Datacenter Is The Biggest Driver That Gets Us There

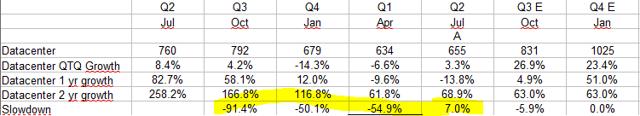

(Click on image to enlarge)

Source: Elazar Advisor, LLC Models, Data Pulled From Nvidia Reports

The July quarter looks like a bottom for Datacenter when looking at the two-year trends.

Look at the row marked "Slowdown." July was the first quarter in a year to halt the slowdown. The two-year trend bottomed in Q1 and went up in Q2.

Our estimates going forward assume that we roughly keep that two-year in Q3 and Q4. Since July's two-year was better than April's two-year I don't think our estimates are that aggressive. If anything I would be OK with expecting a continued acceleration off the April quarter two-year growth rate low. But I want to see them do it so I took somewhere in the middle of the last two quarters to get to 63% two-year in the coming Q3 and Q4.

If my non-aggressive estimates get hit though it implies a big sequential growth rate (this quarter versus the just reported quarter) of 26.9%. The Street would love that. Love.

Nvidia did say on last quarter,

"But yes, we do expect our data center business to grow..."

I think there's a chance for a Datacenter growth breakout based on the July quarter trends matched with easing year-ago comparisons (lower growth rates last year in the October and January quarters).

Upside Vs. The Street

The sell side typically blindly follows a company's guidance usually without much thought. But if you think about the two-year trends in Datacenter you can easily start getting upside.

Gaming is Nvidia's biggest driver. To get to our overall company revenue targets we have Gaming growing about inline with historical seasonality in Q3 and Q4.

But, again, what drives our big upside vs. the Street is thinking about Datacenter on a two-year revenue run-rate basis.

You see if you scroll all the way up to our overall revenue numbers we have over $3.1B and $3.2B for Q3 and Q4, respectively.

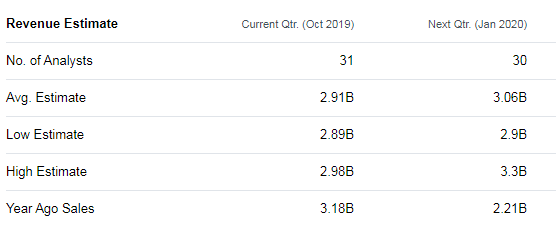

That compares favorably with the Street numbers below.

(Click on image to enlarge)

You can see we are higher than the Street for the next two quarters when assuming a similar two-year for Datacenter.

Upside, a bottom and faster growth rates would get the Street excited.

Inventories Cleared

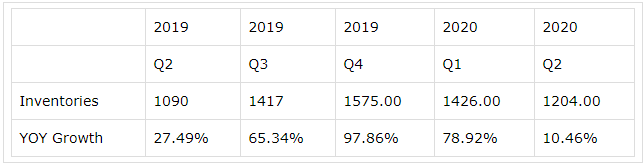

(Click on image to enlarge)

This is Nvidia's inventory numbers from their earnings releases. You can see that the growth rate has slowed materially to 10%.

This gives us comfort that the meat of the inventory overhang is behind us. That overhang meant big risk for numbers. That risk is more behind us than in front of us.

The China Trade Risk

A ton already has been said about China and trade. President Trump threatened Friday and over the weekend that US companies will need to leave China. Since then he may have softened. But this remains a real threat.

China is 25% of Nvidia's overall business (Page 71 of the 10K).

While I'm warming up to the stock, the back and forth of this trade war for now keeps me on the sidelines. Semis and intellectual property are at the center of this trade fight. So all semis have risk.

Personally, I think the building tension in Hong Kong is a huge risk. If that situation ignites with China I think a trade resolution is going to be very hard.

But Hong Kong aside, I think China is anyway waiting to see if they can deal with a new president elect come 2020-2021. Until then I would expect China buys time in negotiating. They don't want to give up their long-term plans.

That waiting can cause headwinds for semiconductor stocks in general.

Conclusion

Nvidia is showing signs that the numbers could start improving. I think the numbers bottomed. Did the stock bottom? A lot depends on this trade war not getting worse. I'm warming up but really I need the trade deal to settle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Ready to Nail Tech Earnings? Start your more