Nvidia Is Positioned For Strong Returns

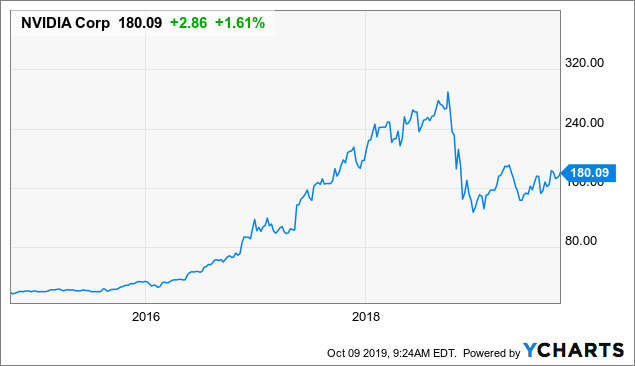

Nvidia's (NVDA) stock has produced outstanding returns for investors over the long term. However, the business has slowed down in recent quarters, and the stock has significantly pulled back from its highs. In this context, investors have reasons to wonder if the retracement in Nvidia's stock represents a buying opportunity over the long term.

Data by YCharts

The following paragraphs will be taking a look at Nvidia's stock from a quantitative factor-based perspective, considering variables such as financial quality, valuation, fundamental momentum, and relative strength for the stock.

Top Quality

Nvidia is one of the most outstanding growth stories in the semiconductors business over recent years. Back in 2012, the company was making less than $4 billion in annual revenue. Fast forward eight years, and Nvidia is expected to make $10.78 billion in sales during 2020.

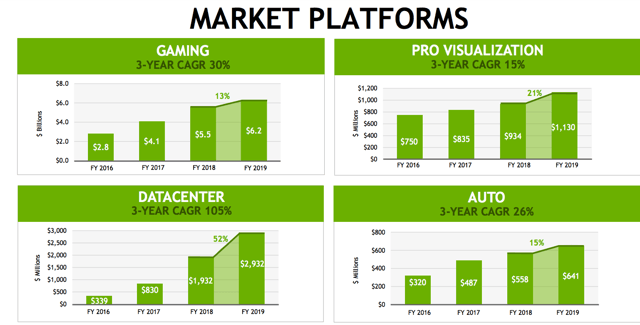

The industry is cyclical and volatile, and the business has faced a deceleration in growth over recent quarters. Nevertheless, when looking at the company's different segments over the middle term, it's easy to see that the big picture looks more than healthy for Nvidia.

Source: Nvidia

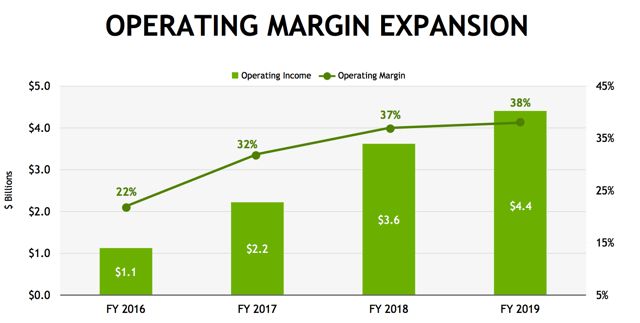

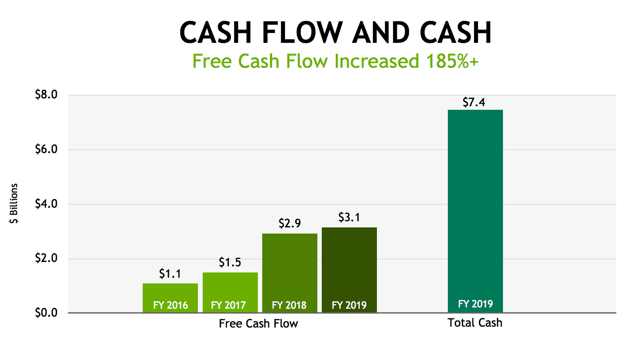

Because of industry cyclicality, both profit margins and cash flows are hard to predict on a quarter-to-quarter basis. But the company has proven its ability to deliver a solid expansion in both margins and cash flows over multiple years.

Source: Nvidia

Source: Nvidia

The table below compares several profitability metrics for Nvidia versus the median values for the sector. Looking at gross profit margin, EBITDA Margin, Return on Equity, Return On Capital, and Return on Assets, Nvidia is far superior to the median company in the sector across all of the indicators considered.

| NVDA | Sector Median | |

| Gross Profit Margin | 58.57% | 47.45% |

| EBITDA Margin | 25.63% | 10.39% |

| Return on Common Equity | 28.68% | 4.51% |

| Return on Total Capital | 12.04% | 3.74% |

| Return on Total Assets | 18.57% | 1.51% |

Data Source: Seeking Alpha Essential

Demanding Valuation

The semiconductors industry is notoriously risky, so many of the stocks in such an industry trade at discounted valuation levels in comparison to the broad market. Nvidia is an exception to the rule, because the company has a far superior potential for growth in the long term, so investors are willing to pay premium valuation levels for Nvidia in comparison to the industry.

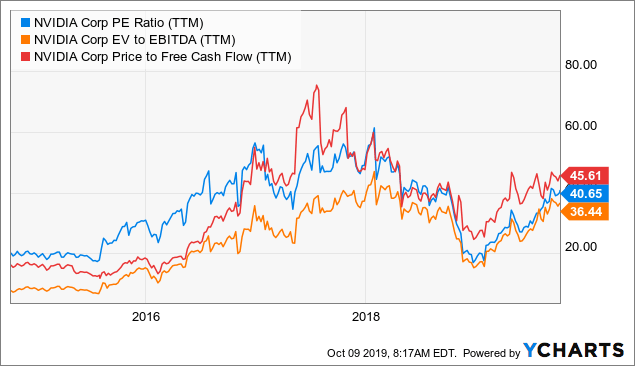

Looking at current valuation levels, the price tag for the stock has pulled back substantially from its highs, but Nvidia is still trading at relatively demanding valuations.

With a price-to-earnings ratio above 45, valuation levels don't provide much of a buffer, and the stock is vulnerable to the downside in case the company delivers disappointing financial performance over the coming quarters.

Data by YCharts

I wouldn't say that Nvidia is necessarily overvalued, but it's clearly not too cheap either. In order to deliver attractive returns from current valuation levels, Nvidia will need to keep delivering solid revenue growth and better-than-expected earnings in the coming quarters.

Vigorous Fundamental Momentum

Current stock prices reflect a particular set of expectations about the future of the business. If the company can consistently deliver earnings numbers above expectations, then earnings estimates will tend to increase, and the stock price will need to increase too for the valuation to remain stable.

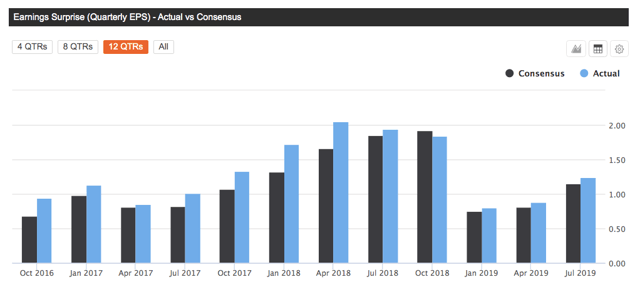

Nvidia has an outstanding track record in this area, the company has delivered earnings numbers above Wall Street estimates in 11 of the past 12 quarters. The notable exception was during the quarter ended in January of 2019.

Source: Seeking Alpha Essential

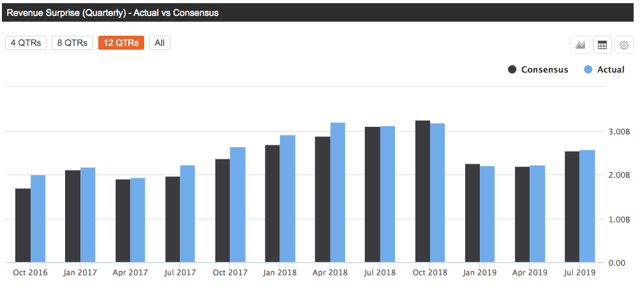

Looking at revenue beat rates, Nvidia has outperformed expectations in 10 of the past 12 quarters, with the two consecutive revenue misses being from October of 2018 and January of 2019.

Source: Seeking Alpha Essential

The main takeaway is quite clear, there was a massive reset in earnings expectations for Nvidia in the October to January period. Since then, the company has been delivering solid performance again and outperforming expectations by a modest margin.

As long as this trend remains in place, better-than-expected sales and earnings should provide a tailwind for Nvidia's stock going forward.

Solid Relative Strength

Price momentum is a pervasive force in the stock market, meaning that winners tend to keep on winning and vice-versa. Rising stock prices create a positive narrative around the stock, attracting more buyers.

Besides, investor capital has an opportunity cost. When you buy an investment with below-average returns, that money is not available to be invested in companies with superior performance. For this reason, we don't just want to buy stocks that are doing well. We want to buy the names that are performing materially better than others.

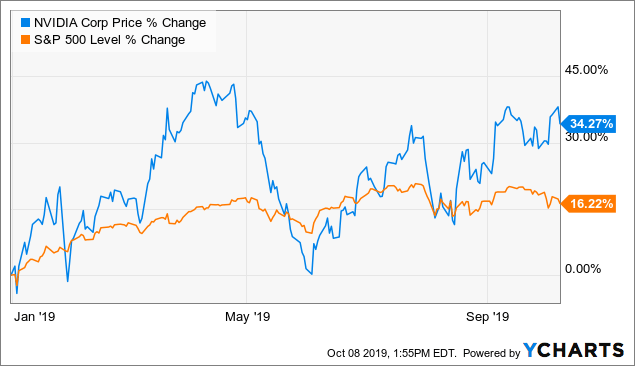

With this in mind, it's good to see Nvidia outperforming the market by a wide margin on a year-to-date basis.

Data by YCharts

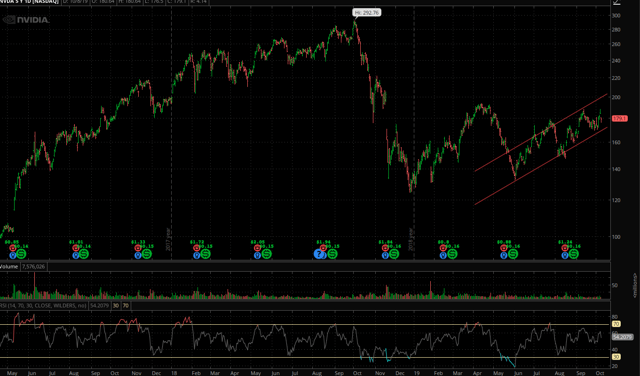

The stock is still down by almost 35% from its highs of the year, and the price chart is not overbought at all at current levels. However, it's encouraging to see Nvidia making a series of higher highs over the past several months. As long as the stock remains above $170 per share, the price action in Nvidia is looking quite bullish.

Source: Think or Swim

Putting It All Together

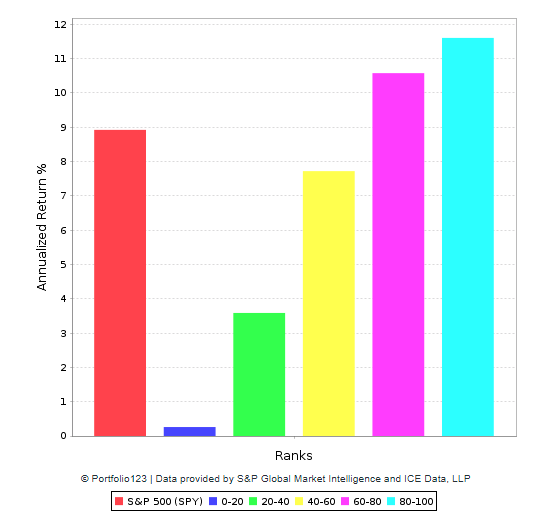

The PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of quantitative drivers, including financial quality, valuation, fundamental momentum, and relative strength. The backtested performance numbers indicate that companies with high PowerFactors rankings tend to deliver higher returns in the long term.

Data from S&P Global via Portfolio123

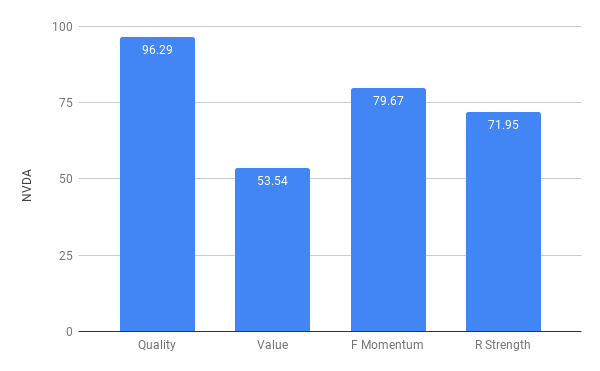

Nvidia has a PowerFactors ranking of 88 as of the time of this writing, meaning that the stock is in the top 12% of companies in the US stock market when considering financial quality, valuation, fundamental momentum, and relative strength together.

The chart shows how Nvidia ranks across the four dimensions in the PowerFactors algorithm. The company is roughly average in terms of value alone, but it more than compensates for such weakness with strong rankings in quality, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

Moving Forward

In terms of risk factors, Nvidia has considerable exposure to the PC market due to its large presence in gaming PCs. As this market matures, this could have a negative impact on revenue growth rates. In addition to this, the company faces tough competition in the automotive segment, with lots of different players fighting for a piece of the pie.

Nvidia's end markets are mostly related to discretionary spending, so the company's performance depends on the macroeconomic environment to a good degree. It is important to acknowledge that the semiconductors industry is deeply integrated on a global scale, and whatever happens with the trade war within China and the U.S. could have a big impact on the industry in general and on Nvidia's stock in particular.

In spite of these risk factors, Nvidia is a top player in the sector, producing attractive financial performance and driven by vigorous momentum. The stock is not too cheap, but not unreasonably valued either. As long as management keeps leading the company in the right direction, chances are that Nvidia's stock will continue doing well for investors going forward.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more