Nuance: A Powerhouse Mean Reversion Buy

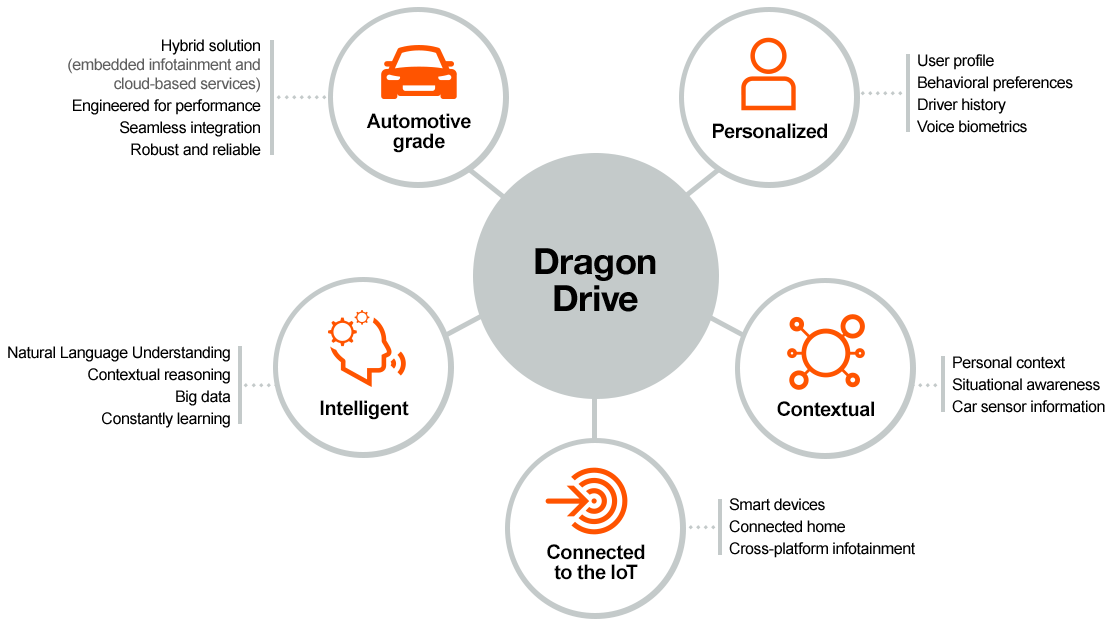

Nuance Communications (NUAN) is a really interesting technology company that we believe is ripe for a mean reversion trade. We really like the prospects of this company, particularly in its Dragon Drive offering, however the Street has growth concerns. We believe the issues with growth stem from the company streamlining and transitioning its business lines, and these impacts will be recognized later in 2018. It is our thesis that shares will rebound well ahead of this time, led by advances of Dragon Drive in multiple sectors.

Source: Nuance Communications

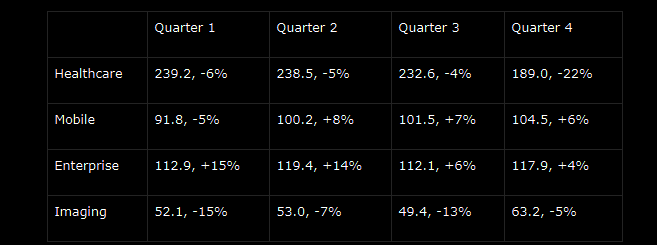

Take a look at the table below summarizing fiscal year 2017, which summarizes the yer-over-year growth in segment revenues:

Source: SEC Filings data, graphics by Quad7Capital

As you can see, revenues have been volatile. After a disappointing year, the stock suffered, only to rebound in Q1. Q1 performance wise was a higher quarter than each of the quarters in the last fiscal year. The enterprise segment also continues to be a positive segment for the company, with continued revenue increases. The numbers will look slightly different in the future, when automotive is broken out from mobile into a separate segment. The remaining mobile will be combined with enterprise.

So what happened here in Q2? Well GAAP revenue of $514.2 million, wasup 3% compared to $499.6 million a year ago, with 71% of total GAAP revenue as recurring revenue, compared to 74% a year ago. Thanks to a goodwill impairment of $137.9 million in the quarter related to two businesses, Subscriber Revenue Services and Devices, GAAP net loss of was $164.1 million, or $0.56 per share, compared to a loss of $33.8 million, or $0.12 per share, in the second quarter of fiscal year 2017. Ouch. What about on an adjusted basis?

Well adjusted revenue of $518.3 million was up 1%, compared to $511.1 million in the second quarter of fiscal year 2017. This may seem like low growth, and it is, but surpassed expectations. Organic revenue growth was 1% compared to the prior year, led by 8% growth in Healthcare and 12% growth in Automotive. (Recall the company is now reporting in 5 segments).

The stock is getting hit hard, but we see some zones forming:

Source: BAD BEAT Investing

One thing that was indeed bearish was that net new bookings were $376.6 million, down 8%, from $410.4 million a year ago. However, this again points to the volatile nature of the company, and is not in our opinion reflective of any problems in the business overall. This was addressed on the conference call:

"Net new bookings in the quarter were down 8% compared to the prior year. We've said previously that net new bookings will vary quarter-to-quarter, driven by the timing of large multi-year arrangements and we urge shareholders to look at our performance on an annual basis. Bookings in the first half of 2018 were up 1% year-over-year. And based on the strength of our sales pipeline, we are reiterating our fiscal 2018 net new bookings guidance of 5% to 7% growth."

Still, with higher investment expenses, and slow revenue growth, adjusted net income was down to $79.1 million, or $0.27 per diluted share, compared to $92.8 million, or $0.32 per diluted share, in the second quarter of fiscal year 2017. Is the growth over? We think it has stalled, thanks to the changes being made to streamline the business. As such, at a 52 week low, with guidance reduced, now is the time to take other investors' BAD BEATS, and profit from a trade. CEO Mark Benjamin stated:

"I want to again reiterate that the team and I remain confident in our fundamentals and prospects of the business. As we continue through this period of transition, we are going to be prudent with providing our longer-term outlook. Given everything we have underway and the ongoing transformation of the business, we will provide 2019 guidance when we announce fourth quarter results in November."

This is another mean reversion play. The fundamentals are a bit shaky but from a technical perspective this trade looks to set up nicely.

Disclosure: No current position

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the material and want to see ...

more