Novocure: A Disruptive Growth Play In Cancer Treatments

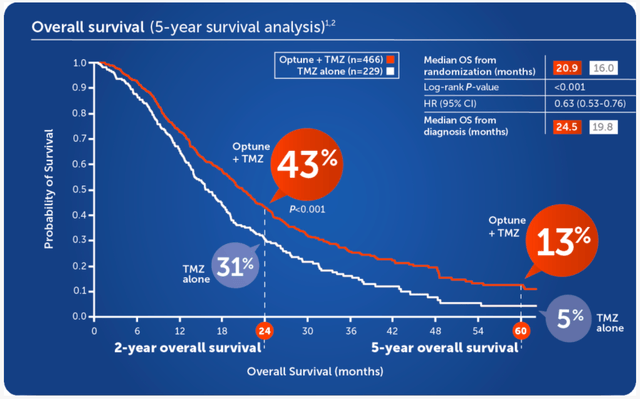

Novocure (NVCR) is the company behind the Tumor Treating Fields - TTF, a technology that uses electric fields to stop the replication of cancer cells. Novocure's Optune device is a leading-edge treatment for glioblastoma multiform - GMB, a very serious form of brain cancer.

Tumor Treating Fields therapy selectively targets the electrical properties of proteins involved in cancer cell division with electric fields tuned to specific frequencies to disrupt the process of cell division - mitosis. By stopping the process of cell division, not completely but to a large degree, those cells are often damaged and ultimately die spontaneously, which materially stops the replication of cancer.

According to research data, Optune has proven to increase survival rates and also to produce much lower side effects in comparison to chemotherapy or radiation.

Source: Novocure

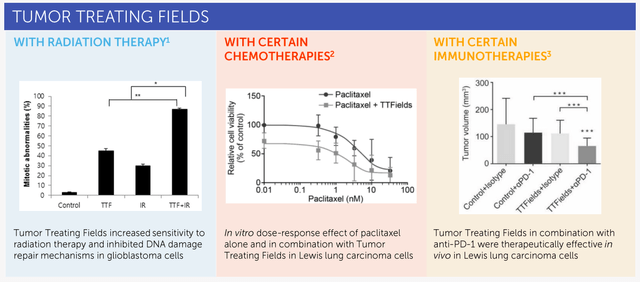

There's a growing body of research indicating that TTF can significantly increase the health outcome when used in combination with radiation therapy, chemotherapies, and certain inmunotherapies.

Source: Novocure

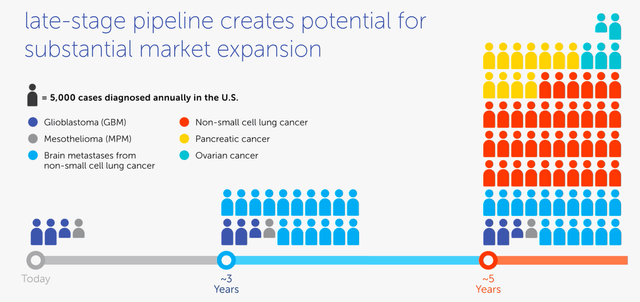

Last year the company received FDA approval via the Humanitarian Device Exemption (HDE) pathway for the treatment of adults with malignant pleural mesothelioma, the company's first FDA-approved torso indication. Novocure also has established a partnership with Zai Lab in China, opening the door to compelling growth opportunities in the years ahead.

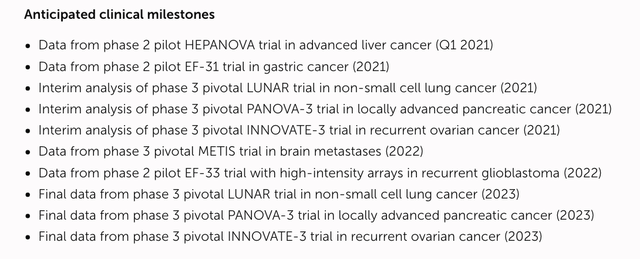

The company has enormous potential for growth in areas such as brain metastases from small-lung cancer, non-small cell lung cancer, pancreatic cancer, and ovarian cancer. There are obviously substantial risks in these developments, but these markets are also exponentially larger than GBM, so the growth opportunities are more than attractive if things work out well.

Source: Novocure

Moving forward, management is focused on three key drivers for the company: Strengthening the commercial business in glioblastoma or mesothelioma, advancing clinical trials across multiple tumor indications, and improving the TTF delivery system.

Novovuore has ongoing Phase II pilot studies in gastric cancer and in recurring GBM, testing a new high-intensity array system which was launched last quarter. The company also is working on the TRIDENT trial, a randomized post-marketing study in newly diagnosed GBM to study the potential survival benefit of initiating Tumor Treating Fields therapy concurrent with radiation therapy.

Through its partnership with Zai Lab, Novocure expects to begin opening new trial sites in China to drive enrollment in Phase III trials beginning in 2021.

In July the company completed enrollment of the HEPANOVA trial, a Phase II pilot trial in liver cancer, and management is expecting final data from this study in the first quarter of next year.

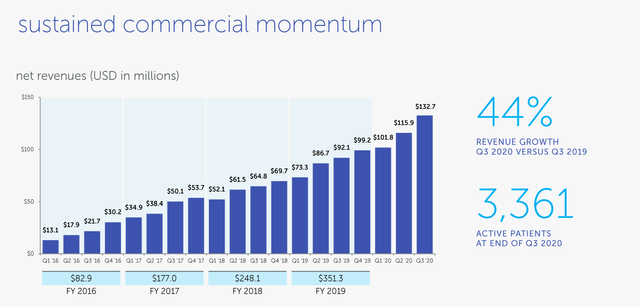

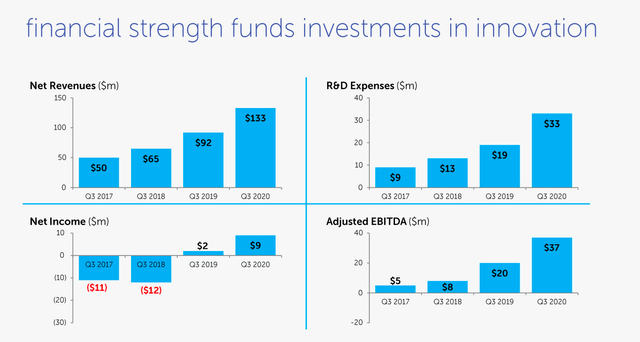

Solid Financial Performance

Novocure reported both sales and earnings above Wall Street expectations in the third quarter of 2020. Total revenue reached $132.7 million, an increase of 44% vs. the same quarter in the prior year.

Source: Novocure

Geographical distribution and growth rates are as follows:

- In the United States, net revenues totaled $92.6 million, growing by 51% versus the third quarter in 2019.

- In Germany and other EMEA markets revenue reached $28.2 million, a 15% increase.

- Net revenues in Japan totaled $7.5 million, growing by 57%.

- In Greater China, net revenues totaled $4.3 a 205% increase compared to the same period the prior year.

Looking at expenses, it's interesting to note that Novocure is aggressively investing in research, development, and clinical trials but the company is still producing expanding profit margins due to leverage in the cost of revenues and fixed expenses.

Research, development, and clinical trial expenses amounted to $32.8 million, a big increase of 75% year over year. This was driven by an increase in expenses for Novocure's phase 3 pivotal and post-marketing trials, as well as expenses to support product development programs and investments in preclinical research and medical affairs activities.

On the other hand, the gross margin increased to 79% of revenue in the third quarter of 2020 vs. 75% of sales in the same quarter a year ago. Sales and marketing expenses grew 23% and sales and administrative expenses grew 19% year over year, both items substantially below the 44% increase in revenue during the period and having a positive impact on profitability.

Source: Novocure

Being such a dynamic growth business, investors in Novocure need to be willing to accept that profit margins are going to fluctuate substantially over time. However, it's good to see the company delivering vigorous revenue growth, expanding margins, and positive earnings numbers.

Moving forward, growing revenue and expanding earnings as a percentage of revenue could provide a double boost to earnings per share, which would be a major catalyst for the stock price.

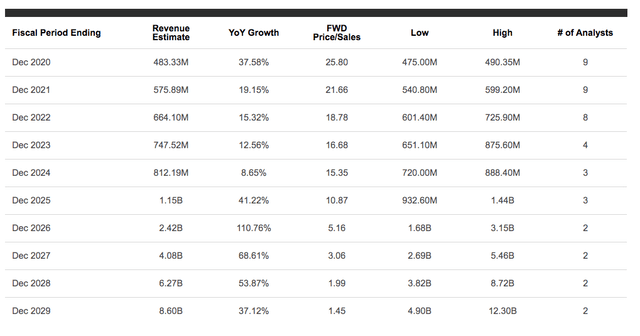

Valuation And Price Action

Novocure stock is trading at a price to sales ratio of 21.66 times revenue estimates for 2021. This is certainly not cheap based on current numbers, but it provides ample room for appreciation if the company manages to expand beyond GMB in the years ahead.

In other words, you can't justify the current valuation based on the GMB market alone, but the stock also could deliver big gains if the company successfully enters different markets that are multiple times bigger than its current market.

Both the upside potential and the downside risks are very large in Novocure, and the main driver will be the company's growth into other kinds of tumors over the years to come.

Looking at revenue estimates for Novocure, we can see that there's a huge degree of dispersion among the high and low revenue estimates for the company. This is understandable considering the uncertainty, and it also can be a source of opportunity for investors. If you believe that Novocure is on the path to success, then the revenue growth rate will be strong enough to propel the stock price higher from current valuation levels.

Source: Seeking Alpha

Novocure stock is in a healthy uptrend, prices pulled back substantially in the second half of October, and the stock then found support near the 50-day moving average around $110 on Nov. 3. The uptrend remains intact, and the stock is still well below its highs of the year at around $140.

Source: StockCharts.com

On Nov. 11, the company got a green light for NovoTTF-100L in the European Union and Switzerland. This is not so much about the financial impact of the approval, but rather about the importance of confirming that the technology also produces results when used in other parts of the body beyond the head, which provides further validation to Novocure's growth plans. The news could attract some attention to the stock in the short term.

Risk And Reward Going Forward

Make no mistake, due to the nature of the business, Novocure is a particularly risky stock. Both the downside risk and the upside potential are quite large depending on the company's ability to successfully enter other markets evolves. Novocure will be announcing lots of data from important studies in 2021 and beyond, and these announcements will probably have a large impact on the stock price, for better or for worse.

Source: Novocure

Investing in a company that's working to provide better treatments for cancer is certainly exciting, and it's only natural for investors to want Novocure to succeed. The company's achievements so far are promising, and there's not much competition in the same kinds of developments.

It's important to fully acknowledge the risks and uncertainties that come with a company that's driving new technologies in an industry with plenty of regulatory intricacies. Novocure is certainly not the right stock for investors who want stable and predictable outcomes.

That being said, Novocure is executing well, both medically and financially, and growth opportunities are enormous. For investors who can tolerate the risk, the long-term upside potential may well be worth the short-term uncertainty.

Disclosure: I am/we are long NVCR.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more