Novartis Looks Undervalued

Like many other companies in the drug manufacturing industry, Novartis (NVS) is being affected by rising competition and increased regulatory uncertainty weighing on the sector. However, the company is still producing a solid performance in a challenging environment, future growth prospects look strong, and the stock is attractively valued.

At current prices, Novartis stock looks like an attractive proposition in terms of risk and potential reward over the long term.

The Fundamentals Are Solid

Novartis has a broad and well-diversified portfolio of drugs, with a big presence in oncology, neuroscience, ophthalmology, and generics. Exclusive patents, scale, brand recognition, and a massive distribution network provide key sources of competitive strength for the company.

Novartis has gone through a reorganization in the past several years. In 2015, Novartis acquired Oncology products from Glaxo for $16 billion. At the same time, GlaxoSmithKline (NYSE: GSK) purchased Novartis' non-influenza vaccines business for $7.1 billion. In 2015, Novartis also sold its Animal Health Division to Eli Lilly (NYSE: LLY) for approximately $5.4 billion. Among several other similar transactions, Novartis made a spin-off of its Alcon business into a separate company in April of this year.

These initiatives have made Novartis a much more focused and profitable business, and the numbers from the most recent earnings report confirm that the company keeps firing on all cylinders as of the second quarter of 2019. Novartis reported both revenue and earnings numbers above Wall Street expectations, even more important, management also raised forward-looking guidance on both revenue and operating income.

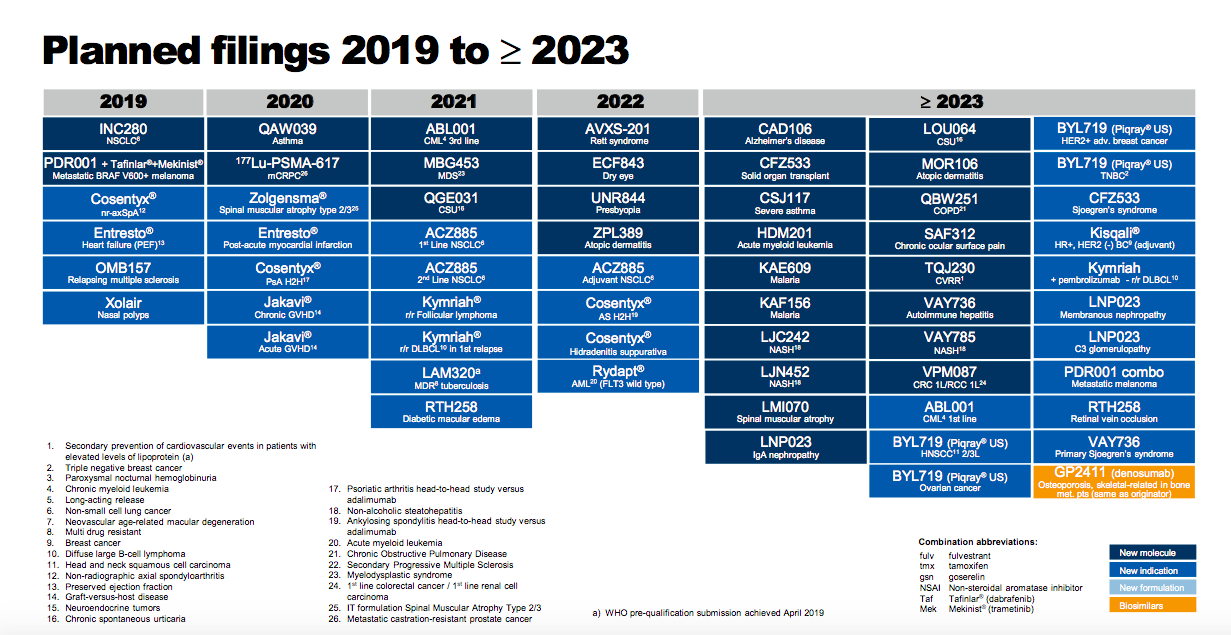

Revenue from continuing operation jumped 8% year over year, with core operating income increasing 20% and operating profit margin expanding by 3.2% during the period. Novartis is benefitting from strong revenue growth across its key innovative products, and this bodes well in terms of analyzing the company's ability to sustain performance going forward.

(Click on image to enlarge)

Source: Novartis.

The company will be facing significant patent losses and increased generic competition over the coming years. However, management has proven its ability to consistently deliver successful new products over the years, and Novartis has a strong pipeline of products with attractive potential in the long term.

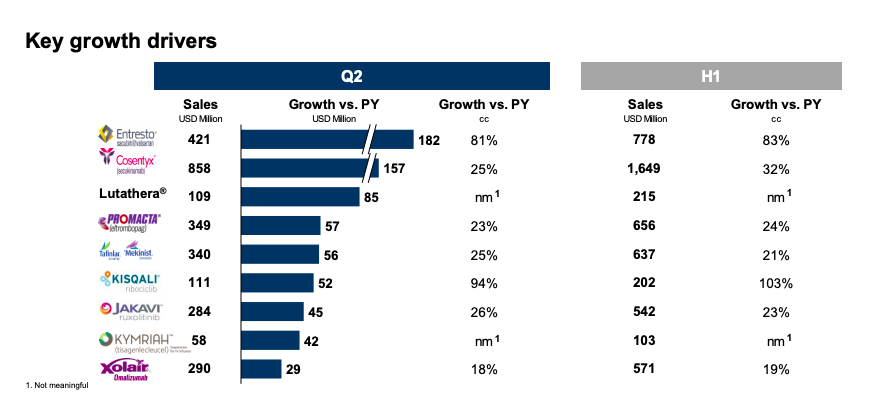

(Click on image to enlarge)

Source: Novartis

It's hard to know how each these developments could work on an individual basis. However, when seen as a diversified portfolio of products in different areas, the potential growth opportunities look quite compelling.

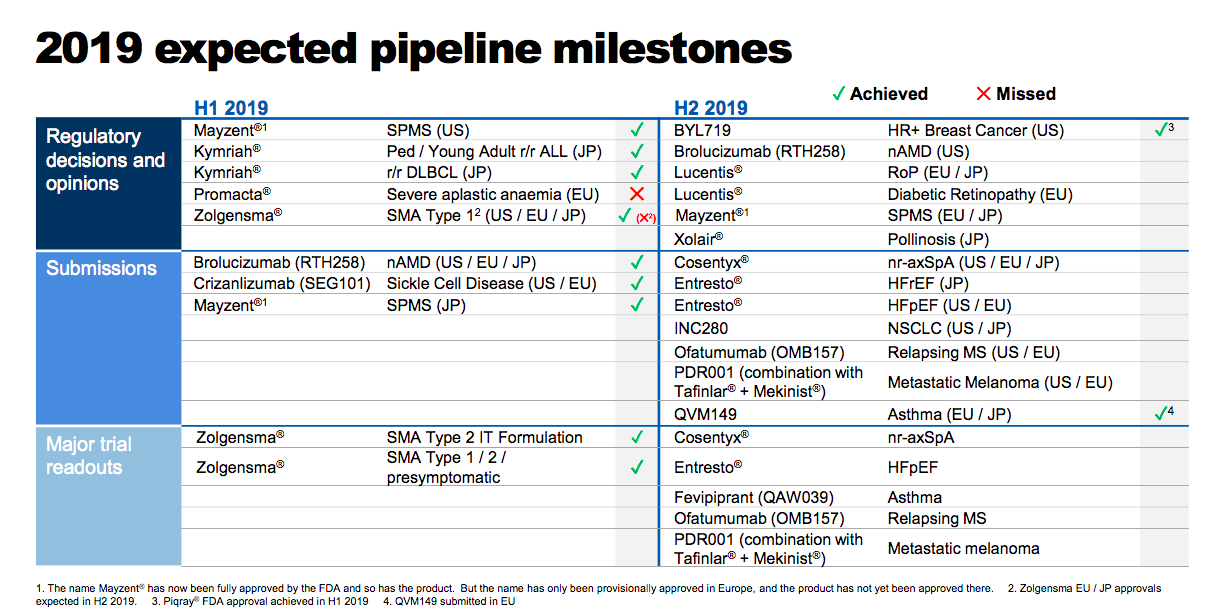

(Click on image to enlarge)

Source: Novartis

Attractive Valuation

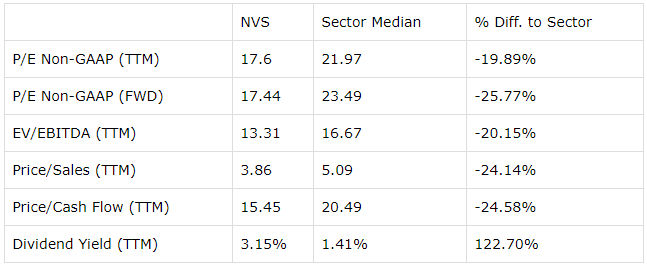

Drug manufacturing companies are trading at a discount versus the market averages due to the competitive and regulatory risks affecting the industry nowadays. However, even by industry standards, Novartis looks very attractively valued, especially when considering the company's financial performance.

The table below shows some key valuation ratios for Novartis versus the average company in the sector. Looking at metrics such as PE, forward PE, EV to EBITDA, price to sales, price to cash flow, and dividend yield, the stock is priced at a substantial discount to the sector median.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

The dividend yield stands at over 3%, which is not exceptionally high in comparison to the high dividend stocks universe, but it's still substantially above average, and it looks quite compelling in times of historically low interest rates all over the world.

On a trailing 12 months basis, Novartis produced $13.3 billion in operating cash flow, with capital expenditures absorbing only $1.8 billion of that money. This leaves Novartis with $11.5 billion in free cash flow during the period. Dividend payments amounted to $6.46 billion or 56% of free cash flow over the past twelve months, so the dividend is clearly sustainable going forward.

Valuation is not just about looking at the company's valuation ratios in isolation. Price is what you pay and value is what you get, so the price tag needs to be evaluated in the context of other quantitative return drivers such as financial performance and momentum.

The PowerFactors system is a quantitative algorithm available to members in The Data-Driven Investor. This algorithm ranks companies in the market according to a combination of quantitative factors that includes: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

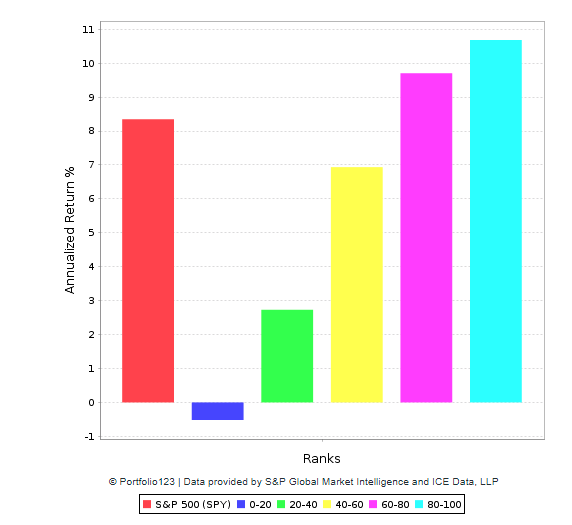

The algorithm has delivered market-beating performance over the long term. The chart below shows backtested performance numbers for companies in five different PowerFactors buckets over the years.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Stocks with higher rankings tend to outperform those in the lower rankings, which show that the system is consistent and robust. Besides, stocks in the strongest bucket materially outperform the market in the long term.

This has bullish implications for Novartis since the stock has a PowerFactors ranking of 95 as of the time of this writing. This means that Novartis is in the top 5% of companies in the US stock market based on a combination of quantitative return drivers as measured by the PowerFactors system.

The Bottom Line

Patent expirations, increased competition, and political pressure to reduce healthcare costs across the board are important risk factors to consider when evaluating a position in Novartis.

However, those risks are already well-known by the market and incorporated into the valuation. Considering the company's financial performance, growth prospects, and valuation, it looks like the market is actually being too pessimistic on Novartis. If management continues executing well, Novartis stock could deliver substantial gains from current valuation levels.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NVS over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more