Norway's $1 Trillion Wealth Fund Doubled Down On US Stocks During March Market Rout

Jeff Gundlach, Kyle Bass and - from the looks of it - Warren Buffett sat out last month's market turbulence. Gundlach and Bass apparently cashed in their shorts and have repositioned for another pullback.

But at least one massive player in the "permanent capital" space apparently went all in. Amid a scandal that has rocked the Norwegian financial elite, the fund expanded its holdings of US stocks, something it has been planning to do for months, though - fortunately for the Norwegians - waited to execute.

Interestingly enough, the fund, which is still being managed by veteran CEO Yngve Slyngstad, added to stakes in some of the worst-hit companies listed in the US, including Royal Dutch Shell (despite the fund's decision to cut back on some oil stocks) and Carnival Corp. Apparently, Norway believes now is a good time to buy energy assets, an opinion that is shared by almost nobody.

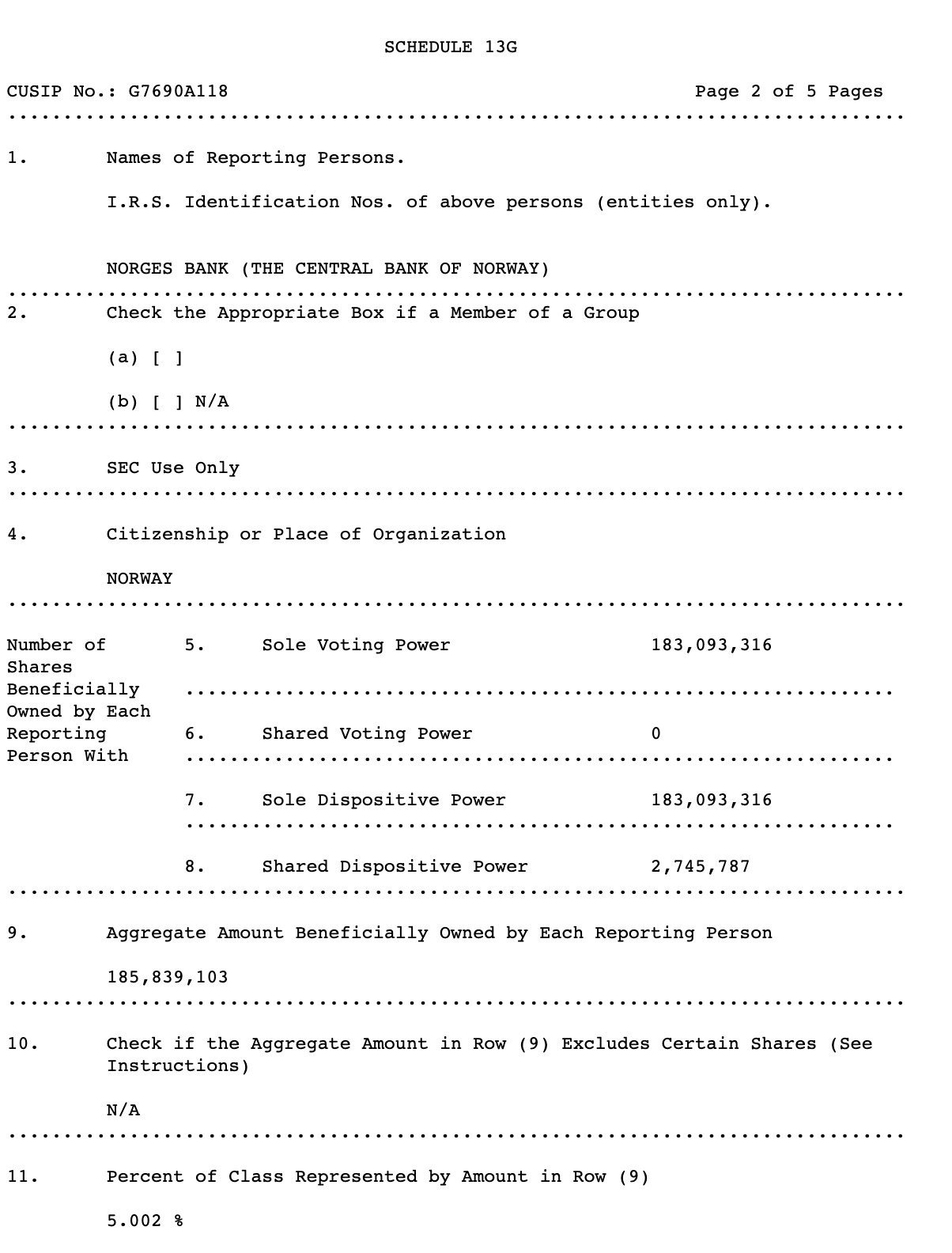

According to filings by Oslo-based Norges Bank seen by Bloomberg, the list of companies where the fund acquired a stake of 5% or more includes seven US-listed firms, including the aforementioned two, along with Australian mining giant BHP Group and Liberty Broadband.

The fund doubled its holdings in Shell.

The Norwegians aren't the only oil money investing in Carnival (a symbiosis that we find oddly satisfying): Saudi Arabia’s $320 billion Public Investment Fund also built up a sizable stake in the troubled cruise line, which is facing a torrent of international outrage and a criminal investigation in Australia.

The chairman of some energy advisory firm quoted by Bloomberg defended the fund's investment in Shell, arguing that the oil giant is "positioning themselves for a cleaner energy future."

"There has been a lot of volatility in the last three or four months, but Norges Bank thinks long term," said Peter Fusaro, the chairman of Global Change Associates, a New York-based energy advisory firm. "Shell is actually not only looking at oil and gas assets, but positioning themselves for a cleaner energy future."

The Norwegian fund’s stake in Shell Class B shares reached 5.1% on March 24, according to a filing with the SEC, up from the 2.55% at the end of last year.

While Shell’s Class B ADRs have rebounded from a low of $19.58 on March 18, they’re still well below an early January price of almost $62.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more