Nordson: A High-Growth Dividend King

Nordson Corporation (NDSN) has a dividend track record that few companies can rival. The company has increased its cash dividend for 54 consecutive years, making it one of just 14 such entities in the entire market with a dividend increase streak of that length.

That puts Nordson among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years.

Dividend Kings have the longest track records when it comes to rewarding shareholders with cash and this article will discuss Nordson’s dividend and valuation outlook.

Business Overview

Nordson was founded back in 1954 in Amherst, Ohio, but the company can trace its roots much further back to 1909 to the US Automatic Company. That enterprise specialized in making screw machine parts for the fledgling automotive industry but in the 1930’s, the company shifted to making more high-precision parts you’d probably associate with the Nordson of today.

Then in 1954, Nordson was started as a division of the US Automatic Company via the acquisition of patents covering the “hot airless” method of spraying paint and other coating materials. The rest, as they say, is history as Nordson has grown to $2B+ in annual revenue with its 7,500 employees all over the world.

Nordson engineers, manufactures and markets unique products used to dispense, apply and control adhesives, sealants, polymers, coatings and other fluids to test for quality as well as to treat and cure surfaces. The company’s products are found all over the world – sold primarily by a direct, global sales force – and offer custom solutions to their customers’ engineering problems. Nordson has built a reputation over the past five decades of quality and value with its wide range of solutions.

Source: Q1 earnings slides, page 19

Nordson is split into three business segments: Adhesive Dispensing Systems, Advanced Technology Systems and Industrial Coating Systems. Adhesive Dispensing Systems delivers proprietary precision dispensing and processing products for applications that reduce material consumption as well as increase line efficiency and enhance product durability. This segment primarily serves the consumer non-durable market.

Advanced Technology Systems serves the needs of electronics, medical and high-tech customers by integrating product technology found in the various stages of a production process such as dispensing of material, surface treatment, optical inspection and x-ray testing to ensure quality.

The Industrial Coating Systems segment provides standard and customized equipment used primarily for applying coatings, sealants, paint and other finishes as well as for curing and drying of dispensed material. Industrial Coating Systems primarily focuses on the consumer durable market.

Nordson’s revenue mix is highly diversified as only 30% of it comes from the US. The remainder is from a wide variety of global customers, offering Nordson not only a diverse customer base, but also diversity when it comes to the currencies it operates in. The US is Nordson’s largest in terms of geographic presence but Asia-Pacific and Europe aren’t far behind; Nordson is a truly global company.

Adhesive Dispensing Systems and Advanced Technology Systems both accounted for 44% of revenue in 2017 with Industrial Coating Systems producing the balance of 12%. Within these segments exists a diverse group of customers – no customer makes up more than 10% of total revenue – as well as a wide variety of product types and end markets. The mix of revenue in terms of customers, products and geographies is very strong and offers Nordson benefits when it comes to exposure to downturns in certain economies, industries and currencies.

Growth Prospects

The company’s recent Q1 report showed tremendous growth over the prior year’s comparable quarter, although the company tends to see its heavier volume later in the year as customers nail down what they can spend in terms of capex, somewhat diminishing the importance of the first quarter. Still, Q1 saw sales increase 35% while profit measures such as EBITDA, operating margin dollars and adjusted diluted EPS rose 50% or better.

Nordson is a serial acquirer and has been basically from the beginning when it was started with the acquisition of patents covering the hot airless method of spraying. That allows for some very strong growth numbers at times, like in this year’s Q1, but guidance for Q2 revenue growth is tamer at 9% to 13%.

Source: Company acquisition summary presentation, page 3

Above is a look at the companies that Nordson purchased in FY2017 as an example of how frequently it performs acquisitions. Nordson’s track record when it comes to acquisitions is a good one as it looks for companies that give it some sort of competitive advantage it does not already possess with high percentages of recurring revenue and expense synergies. Growth-by-acquisition is a difficult thing at which to succeed but Nordson has proven the ability to do so over the long term. This is a key differentiator for Nordson and should not be overlooked by investors.

(Click on image to enlarge)

Source: Q1 earnings slides, page 29

However, Nordson isn’t just an acquirer; this company produces organic growth as well. Above is a snapshot of the past 11 years in terms of what Nordson has been able to do with both organic volume growth and acquisitions. Nordson’s average annual growth from 2007 to 2017 just from acquisitions is 4.4%, providing a nice tailwind to revenue. Organic growth has been strong as well as every single year in this dataset produced flat or positive organic revenue except for 2009.

However, the rebound in 2010 was swift and strong, basically erasing the downturn in revenue the prior year. The point here is that while Nordson’s growth may be a bit lumpy – beholden to acquisition rates as well as companies’ willingness to spend their capex budgets on Nordson’s products – this company’s long term track record of growth is a good one.

How is Nordson doing this? The combination of acquisitions, organic growth and focus on continuous improvement drives not only top line expansion but margin gains as well. Organic revenue growth is driven by continually introducing new products and technology. Nordson only spends ~3% of its revenue on R&D but manages to produce ~50 new patents each year in the US. This steady stream of new ideas turns into new products and drives organic revenue growth.

In addition to that, Nordson’s focus on emerging markets has helped it grow and will continue to do so in the future. The company’s emerging markets have produced low double-digit revenue growth on average in the past ten years, outpacing Nordson’s core markets of the US and Europe. The growing middle classes of these emerging markets should allow Nordson to continue to see impressive rates of organic revenue growth as well as opening up the opportunity for continued, targeted acquisitions in those markets.

Nordson, through its decades of strong growth, also has a large installed customer base. That is tremendously valuable when it comes to upgrade and replacement cycles as its customers offer Nordson recurring revenue on a regular basis and even more when it is time to upgrade. This virtuous cycle is how Nordson makes its living and it is very good at it; this should not be overlooked as an avenue for steady, continuous growth moving forward and as Nordson grows, so does its installed customer base.

Finally, Nordson has been in the process of improving its efficiency through what it calls the Nordson Business System. Basically, this is a set of tools and best practices Nordson has collected over the years that is rooted in Lean Six Sigma principles and is applied throughout the company in all business units. Nordson closely monitors and measures results against benchmarks and this focus on efficiency is a growth driver via margins.

Nordson has improved its operating margins by more than 200 basis points since the end of 2015 through the use of these methods and this will continue to be a key growth driver going forward. Growth isn’t just about revenue expansion and Nordson knows this; the focus on margins will be key for investors going forward and Nordson is in good shape in terms of ensuring it is continuously improving.

Competitive Advantages & Recession Performance

Nordson’s competitive advantages are varied and when combined, they paint a pretty rosy picture of the company’s position. First, Nordson has an impressive global infrastructure that puts it in a place of not only having a diverse customer base, but diverse groups of talent as well.

In addition to that, its facilities are where the customers are in the world, meaning it can react more quickly to product needs and get them to market more quickly. This also affords Nordson an advantage when service is needed as it has people near its customers wherever they are. This is the sort of thing that drives long term relationships that are Nordson’s bread and butter.

That brings us to our next point, which is Nordson’s R&D and patents. Nordson only spends about 3% of its revenue on R&D but it makes the most of it, filing for dozens of patents each year. In addition to that, it buys patents and businesses with critical products it can use to supplement its existing lines.

Third, Nordson’s large installed customer base means that not only does it have a large amount of recurring revenue, but it makes it that much more challenging for competitors to take customers away. Switching costs are high for the kinds of things Nordson sells and thus, the incumbent in any given space has a huge advantage. Nordson’s installed base has many advantages and is a primary reason why the company has remained so successful.

Finally, Nordson’s geographic diversification works for the reasons I’ve mentioned in addition to providing a long and diverse mix of customers. Further, Nordson does the vast majority of its revenue outside of the US, meaning it derives revenue mostly in non-dollar terms. That provides additional risk and exposure to currency markets but Nordson has certainly made it work.

Nordson’s many competitive advantages allow it to hold up fairly well in recessionary environments; the company’s earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $1.33

- 2008 earnings-per-share of $1.77 (increase of 33%)

- 2009 earnings-per-share of $1.20 (decrease of 32%)

- 2010 earnings-per-share of $2.24 (increase of 87%)

Earnings were volatile during the recession, but on the whole, Nordson performed very well. There aren’t many companies with EPS figures that look like this during and after the Great Recession and in particular, ones that manufacture for a living. Keep in mind that a lot of Nordson’s products require capex from its customers so when things like the Great Recession happen, those budgets tend to get slashed.

However, Nordson also sells things that are absolutely vital to many businesses and thus, when the smoke clears, those orders tend to materialize. Indeed, as the global recovery began to gain steam in 2010, Nordson’s revenue was up 27%; its recession-resistance is surprisingly good.

Valuation & Expected Returns

According to ValueLine analysts, Nordson is expected to generate earnings-per-share of $6.60 for 2018. As a result, the stock trades for a price-to-earnings ratio of 20.4. The stock does not look particularly cheap, since it has held an average price-to-earnings ratio of 17.6 over the past 10 years.

(Click on image to enlarge)

Source: ValueLine

Long term earnings growth estimates are in the low double digits, congruent with what Nordson has produced over the past few years. However, overvaluation could erode shareholder returns moving forward.

Nordson’s strong free cash flow and disciplined approach to acquisitions mean that the dividend is very well covered. It also happens to grow quickly. Nordson’s dividend has grown an average of 16% in the past five years and as I mentioned earlier, it has raised its dividend every year for more than 50 years. With the company’s continued prosperity, you can bet the dividend will continue to move higher over the next 50 years.

The only problem with the dividend is that the yield is less than 1%. However, with its Dividend King status the dividend payout should continue to grow.

Nordson’s approach to spending its cash is a bit different from other companies in that, depending upon the year, it may buy back a bunch of stock, make acquisitions, pay down debt or any number of other things.

(Click on image to enlarge)

Source: Q1 earnings slides, page 14

We can see here that just since 2012, Nordson has spent its cash in wildly different ways from one year to the next, including more than half of it over this time frame on acquisitions. There have been years of high levels of buybacks and years with none. The dividend is the only thing that has been fairly constant apart from the growth in the payout itself but as you can see, it represents less than 10% of Nordson’s spending since 2012.

All of this is to say that this management team has performed very well in the past by making opportunistic decisions in terms of how to spend its cash. That makes predicting buybacks, the dividend or anything else difficult, but you cannot argue with results. This adds to the attractiveness of the stock here on a valuation basis because Nordson has a long track record of prudent capital deployment.

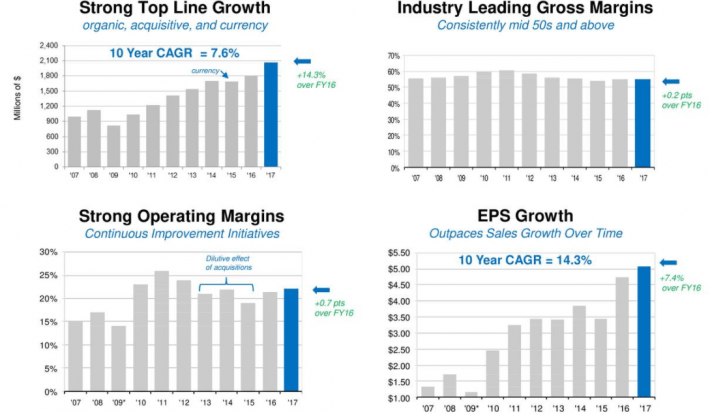

Speaking of results, this chart shows just how good Nordson has been in the past decade or so and why it deserves to be called a segment leader.

(Click on image to enlarge)

Source: Q1 earnings slides, page 12

Top line growth has been strong apart from a blip during the Great Recession and it has been able to maintain strong operating margins, leading to 14% average annualized EPS growth since 2007. Again, Nordson’s results can be lumpy but over time, it is tremendously successful in terms of producing growth.

Shareholder returns could exceed 10% annually from earnings growth and dividends. However, if the stock valuation declines toward its 10-year average, it will eat into those returns. Assuming the stock valuation falls back to a price-to-earnings ratio of 17-18, Nordson is currently overvalued by approximately 12%-17%. If it takes five years to reach this level, a declining valuation could reduce shareholder returns by ~3% annually.

As a result, if earnings growth and dividends provide 10% annual returns, but a declining valuation reduces those returns by 3% per year, total returns are likely to be near 7% annually moving forward. This is a satisfactory rate of return, but does not make Nordson a buy today.

Final Thoughts

Nordson isn’t a strong stock for high income. That is a bit strange to say given that it is a very rare Dividend King but the payout’s size simply isn’t the priority for management. The priority is growing the business and this company has done that exceedingly well, producing sector-leading total returns for shareholders. The dividend will continue to rise because Nordson has made it clear over the past 54 years that is something it intends to continue.

Nordson is a class leader in sectors where its high level of expertise and large installed base make it difficult for competitors to supplant. It is also recession-resistant and the management team has proven adept at managing its capital.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more