Noble Energy Just Struck Gaseous Gold

We have all heard the expression “liquid gold” before, AKA oil, but what I’m talking about is Natural Gas. Noble Energy has found two major natural gas fields off the coast of Israel that will be very lucrative. The first, and most recent, is the Leviathan Gas Fields which is approximately worth $95 Billion and suppose to be the largest gas discovery in the last 10 years. Amazingly, it seems to overshadow another huge discovery that Noble made which at the time was the largest gas discovery in that region, the Tamar gas field. Noble Energy (NBL) has been refining the Tamar gas for years, and now stands to have rigs up in both valuable gas fields bringing in billions of dollars in new revenue.

There was a slight scare that the Leviathan project was not going to be approved as the Israeli Supreme Court originally struck down the project. However, after persuasion from PM Benjamin Netanyahu and outcry from the oil and gas industry the Supreme Court was able to renegotiate the deal to terms they liked and approved the project.

Fundamentals:

1Q16 EPS of ($0.53) beat Street consensus of ($0.58). Production of 415.5 was 3% above the mid-point of guidance (395 - 405 MBoe/d), and implies a decline of 2% q/q and an increase of 32% y/y (12% excluding ROSE).

NBL raised 2016 production guidance 4% to 405 MBoe/d, which implies annual growth of 15%. The company also expects to spend less than its 2016 budget of $1.5B but did not provide a specific target (we assume $1.4B). The changes cause us to raise our 2016 CFPS estimates 5%.

SRL Niobrara well costs in Wells Ranch declined to $2.7MM from $3.0MM despite higher sand loadings as productivity/ft is up 30% y/y.

Noble has a very solid balance sheer. Liquidity of ~$5B consists of an undrawn credit facility with a $4B borrowing base plus cash of $953MM. I expect project cash flow to exceed capex this year by ~$330MM (~$1.1B including divestitures).

Technicals:

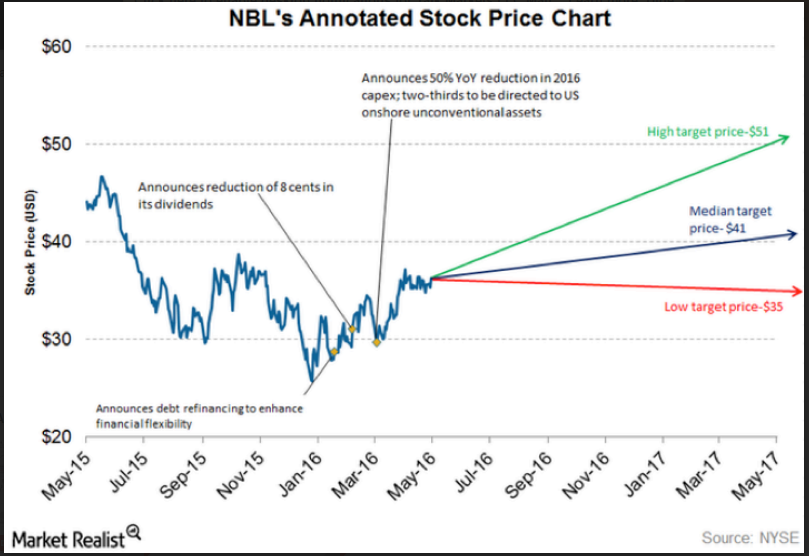

After the January plunge, it has traded nicely in an uptrend. There have been some bullish occurrences, which make the stock look interesting to me. The last two times the stock corrected (in mid April and June) it bounced off of its 50 day moving average to the upside. What also appeals to me is that in early May we saw the beginning of a “Golden Cross” where the 50 day moving average (blue) crosses above the 200 day moving average (red).

After announcing several capex reductions and based on current trading patterns the stock looks like it continues to head towards its median price target of $41 per share.

However, any positive news on early drilling or gas production may propel the stock rapidly higher towards its high price target.

Alternatively, another way to play this may be through the iShares MSCI Israel Capped ETF (EIS). Israel’s economy should benefit from this, as they now become a major gas player in the Middle East.

Conclusion:

Noble Energy looks like a buy, especially if it can hold the $36 level, which it tried hard to do in mid 2015. It trades at a 16% discount to its peers and has new profitable projects underway. Lastly, it has hedged 40% of its forecast oil volumes and 28% of its US natural gas volumes, which should help protect it from violent swings in the commodities market.

Estimates suggest that the Leviathan gas plant will become operational as soon as 2019 but that's assuming the Israeli Government can come up with over $5bn in funds to get the gas field up and running p. With so much at stake for Noble and over 40% invested in the development of the largest gas field of the decade one wonders whether Noble will see itself investing even more money to get the gas project up and running. 40% is already a lot of eggs in one basket, I wonder if the risk will pay off? I would yes, its a win win for Noble and Israel.

With all the wars and terrorism that #Israel faces, are the gas fields in any danger? If they are worth $95 billion, I would think they would be a very tempting target. Isn't this a danger to $NBL?