No News Is Good News

It’s been a while since I looked at markets, as I am busily trying to finish the second chapter of my new demographics project—see here—but peering across my portfolio, I haven’t missed much. Granted, the straight-line rise in green and clean energy stocks—a theme that I am invested in—has petered out, but otherwise, most of what I own keep going up, and the number at the bottom of the column keeps getting bigger.

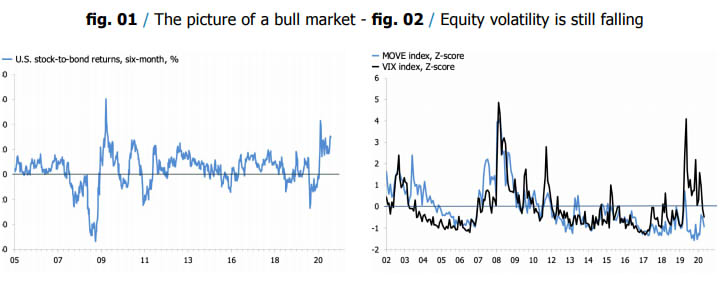

Investing in a pandemic-stricken world, it seems, isn’t too bad. When I haven’t looked at markets for a while, I tend to go back to the basics. The first chart below plots the six-month stock-to-bond return ratio in the US, which has been locked at +20% since the beginning of the fourth quarter. This is punchy, even unprecedented, but I am loathe to second guess this trend at the moment.

Sustained positive stock-to-bond returns tend to be associated with resilient bull markets, and let’s be honest; that’s what we have, for now. I worry, as I suspect does everyone else, that investors have bought too aggressively into the rumor of a post-virus recovery, implying that they will sell the fact. If that’s true, conditions will become more difficult over the summer, and in the second half of the year, though I am inclined to believe that any swoon will a familiar case of "BTFD."

In the meantime, the second chart below shows that equity volatility is still falling, a trend that I predicted earlier this year, upon realizing that a normalized VIX index was still elevated relative to a similar index of the MOVE. In level terms, the VIX has declined to just over 16 so far in April, and the question is why it shouldn’t drop further to the low teens, which has previously been the floor during previous periods of sustained gains in equities.

As the US and UK economies are hopefully about to provide the first glimpse of what post-virus pent-up demand looks like, investors are left contemplating whether reflation—and the associated shift in asset prices— is actually sustainable, or merely a temporary ruse. The numbers, as always, are inconclusive.

Inflation in energy, commodities, and manufacturing input prices is now advancing rapidly, as chart 03 shows, but policymakers, forecasters, and investors contend that this is a temporary affair, primarily driven by base effects. It’s difficult to deny the main thrust of this argument. Base effects currently are at an extreme, almost by definition suggesting that the leap in headline PPI and CPI inflation will be temporary.

That said, chart 04 shows that surveyed price expectations in services are also now rising, indicating that we should be at least a little wary that the flurry of inflation in commodities, manufacturing, and energy prices could filter into a sustained increase in core inflation. Elsewhere, the promised outperformance of commodities, value, and small-cap equities in a world gripped by reflation isn’t entirely clear.

Chart 05 below shows that while the ratio of the CRB commodities index to the MSCI World is now no longer falling, it isn’t exactly rising either. Chart 06 plots a similar disappointing picture for the performance of value and small-caps relative to the S&P 500. My index certainly bounced strongly towards the end of 2020 as the vaccine news brought the end of COVID-19 into view, but the change has been underwhelming relative to the move in long-term bond yields.

One possible conclusion from this is that reflation was never a sustainable theme in the first place, a version of the world in which investors will very soon be buying duration with both hands. That’s not necessarily a bad bet, cheap hedges always are worth considering, but another possibility is that reflation is still in its infancy. Maybe, for value investors, no news is good news.

Disclosure: None