NIO Stock Price Is On Fire – Will The Run Continue?

2020 is a year that is mostly defined by the COVID-19 pandemic and the historically crucial presidential election. From an investor standpoint, there’s one more thing you can add to that list: the growth of the electric vehicle (EV) market.

Not only have several new EV companies come on to the scene, but existing players continue to see huge buying interest. In particular, Tesla (TSLA) is up 425% year-to-date and has even undergone a 5-to-1 stock split. At a market cap of over $400 billion, TSLA is currently the twelfth-largest listed stock overall (on US exchanges).

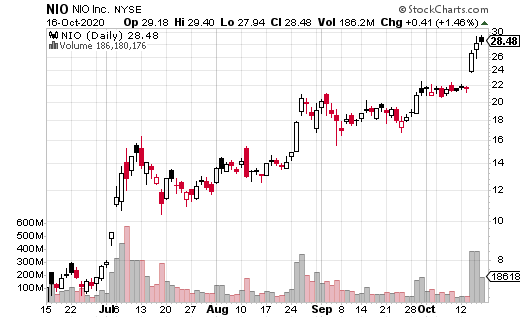

But, TSLA isn’t the only high flier. Several other EV stocks have taken off. One of them, often considered the Tesla of China, is NIO (NIO). Like TSLA, NIO shares have been flying off the shelf, with the stock up over 600% year-to-date.

Unlike some of the other up-and-coming EV stocks, which haven’t started selling products, NIO already has over a billion dollars in sales. This has translated into a rather rich market cap of around $40 billion. Nevertheless, there is certainly a light at the end of the tunnel for NIO, as it stands now.

Some major banks have already upgraded NIO to a buy rating recently. One analyst even put the price target at $33 (with the stock at $28.48 as of this writing). That’s certainly good news for optimistic investors who may have been concerned about the company’s lofty valuation.

NIO seems to have a robust backlog of orders, which is a big deal in the EV industry. You may remember TSLA locking in thousands of preorders for its new vehicles and how the market reacted positively in each of those cases.

Options traders also seem to have a bullish view on NIO. In fact, one trader even made a multi-million dollar bet that NIO will remain above $20 through January 2022. Keep in mind, EV stocks tend to be extremely volatile…so in the realm of EV companies, that’s a very, very long time for the duration of an options trade.

This trader sold 3,650 January 2022 20 strike puts for $6.00. That means the breakeven for this trade is $14 at expiration, and the max loss is if the stock goes to zero. Technically, that would be about $5 million risked, although the stock going to zero doesn’t seem likely at this stage.

Meanwhile, if NIO remains above $20 by January of 2022, the trader will keep the $2.2 million from the put sale. That’s a decent chunk of change. Clearly, whoever made this trade believes there’s a floor on how far the stock could potentially drop. Assuming that NIO continues to increase its order backlog and sales, this actually seems like a relatively safe bet… at least in the crazy world of EV stocks!

Disclosure: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more