Nike, Inc.- Excellent Company

Nike, Inc. - Excellent Company

Nike continues to be one of the leading Dow 30 - Industrials composite Companies. It is on a Strong Hold, but my Indicators are breaking down.

My previously written articles on NKE (just click) provide you with the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics.

My previously written articles on NKE (just click) provide you with the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics.

A Special Note for Seniors & Retired Investors - Dividend Yield: 1.27%

This week's commentary on Nike covers all of my indicators, both fundamentally for valuations and technically for momentum. Despite its relatively low dividend it can be a very safe and productive company for Income Investors.

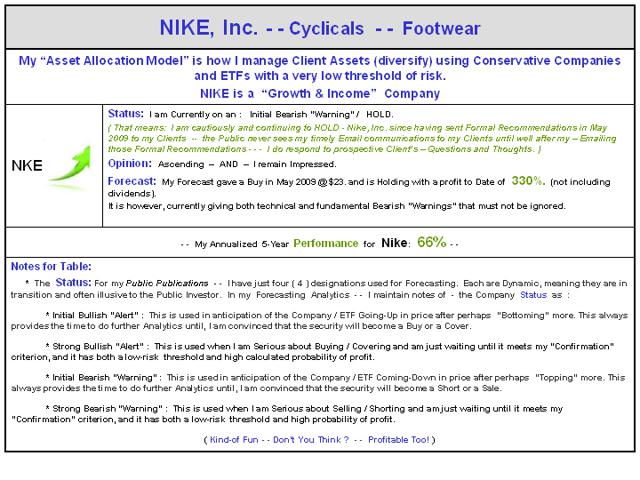

Forecast w/ 5 Year Performance

Nike, Inc. and other Footwear Companies are tracking the marketplace well. The rally since mid 2012 is getting quite long in the tooth.

Note: The below Table is for your review, questions and perhaps thoughts.

My Current Forecast is not as bright as you may think! If you own or are considering owning footwear companies, the securities are becoming a mixed bag. Nike is currently relatively strong technically, but I have reservations about my fundamental valuation; however, it is on my Initial Bearish Forecast - "Warning."

My Current Opinion is to Hold in anticipation of taking profits. This may be at even higher prices, but there will be an end and time to sell, but that is not currently in my forecast. That is a balancing of my below three(weighted) pillars of research.

Fundamentally - ( weighting - - 40% ): My Analytics for my fundamental valuation play a vital role in profitable managing money. Earnings continue to be strong.

Technically - ( weighting - - 35%): Within this outstanding company, my indicators remain strong. It is only slightly off its highs of $80, is selling for $76.

Consensus Opinion - ( weighting - - 25% ): My third pillar of research is one that is always distorted to the positive by most all financial analysts. That's because they are afraid of being bearish. I am not! My articles on "reality" are supportive of the below 20 year Chart.

A Twenty Year Perspective of Nike, Inc.

Nike has taken some big hits over the years!

URL for (20-years of -(NKE): http://stockcharts.com/h-sc/ui?s=NKE&p=W&yr=20&mn=0&dy=0&id=p22103550174&a=330115421

"Selectivity" is what I preach (along with discipline and patience) and is what separates the average investor and mutual funds from the profits that come with long-hours / hard work and "selectivity."

Smile, Have Fun, "Investing Wisely,"

None.