New Technologies And Manufacturing Lead Will Drive Intel Stock Higher

At the Intel Corporation's (INTC) Technology & Manufacturing Day which took place in San Francisco on March 28, the company demonstrated its manufacturing lead. What's more, Intel highlighted important new technologies that could allow the company to address a vast array of product types, markets, and customers. According to the company, it continues to advance Moore’s Law which gives it a significant product and cost benefits. Also, the company claims that it has three year lead over the rest of the industry on 14-nanometer semiconductor device fabrication node, which is, in my opinion, a significant competitive advantage, as Intel is building a foundry franchise.

As I see it, Intel is well positioned to return to sustainable growth. The traditional CPUs for PCs and servers remain the company's primary business, and this market has recovered strongly. The Data Center Group which accounted for 29% of the company's revenues in 2016, is poised to benefit from the Altera and Nervana additions and should help Intel developing a next-generation architecture for the hyper-scale data center. Internet of Things (IoT) is also an important growth driver for the company. In fact, the IoT net revenue of $2.6 billion in 2016 grew 15% year over year. Although IoT revenue accounted for only 4.4% of the company's total net revenue in 2016, that clearly indicated a growing trend.

The $15 billion acquisition of Mobileye, will position Intel in the new fast growing market of autonomous driving. According to Intel, the total available market for autonomous driving and advanced driver assistance systems could reach about $70 billion by 2030. In my opinion, the combination of Intel's computing strength and Mobileye's strong position in the advanced driver assistance systems market and autonomous driving development will give the company a high market share in these markets.

What To Expect From Intel's Next Earnings Report

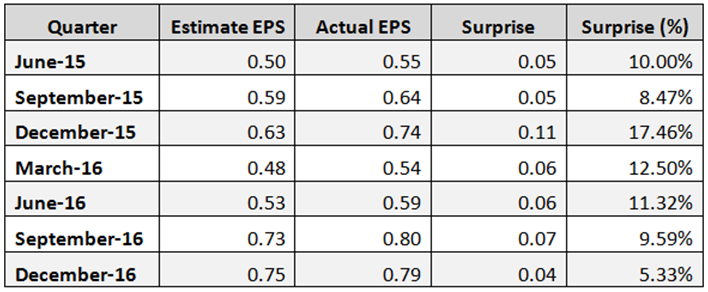

Intel is scheduled to report its first quarter 2017 financial results on Thursday, April 27, after market close. According to 30 analysts' average estimate, Intel is expected to post a profit of $0.65 a share, a 20.4% increase from the year-ago quarter. The highest estimate is for a profit of $0.65 a share while the lowest is for a profit of $0.64 a share, not a big difference. Revenue for the second quarter is expected to grow 7.3% year over year to $14.81 billion, according to 32 analysts' average estimate. There was one up earnings per share revision during the last thirty days. Since Intel has delivered significant earnings per share surprises in all its last seven quarters, as shown in the table below, there is a good chance that the company will beat estimates in the next quarter as well.

Intel Stock Performance

Intel has underperformed the market in the last few years. Year to date, INTC's stock is down 0.6% while the S&P 500 index has increased 5.5%, and the Nasdaq Composite Index has gained 9.8%. Moreover, since the beginning of 2012, INTC's stock has gained only 48.7%. In this period, the S&P 500 Index has increased 87.9%, and the Nasdaq Composite Index has risen 126.9%. According to TipRanks, the average target price of the top analysts is at $41.37, which indicates an upside of 14.7% from its March 31, close price of $36.07, however, in my opinion, shares could go even higher.

Intel Daily Chart

Intel Weekly Chart

Chart: TradeStation Group, Inc.

Valuation

According to its valuation multiples, INTC's stock is not expensive, the trailing P/E is at 17.01, and the forward P/E is very low at 12.31. Furthermore, its price to cash flow ratio is low at 9.72, the Enterprise Value/EBITDA ratio is very low at 7.81, and the PEG ratio is at 1.56.

Dividend and Shares Repurchase

In its latest quarter, the company generated about $8.2 billion in cash from operations, repurchased $533 million in stock, and paid $1.2 billion in dividends. Intel has been paying uninterrupted dividends since 1993. The forward annual dividend yield is pretty high at 3.02% and the payout ratio is only 47.7%. The annual rate of dividend growth over the past three years was at 4.9%, over the past five years was at 5.9%, and over the last ten years was high at 10%.

Ranking

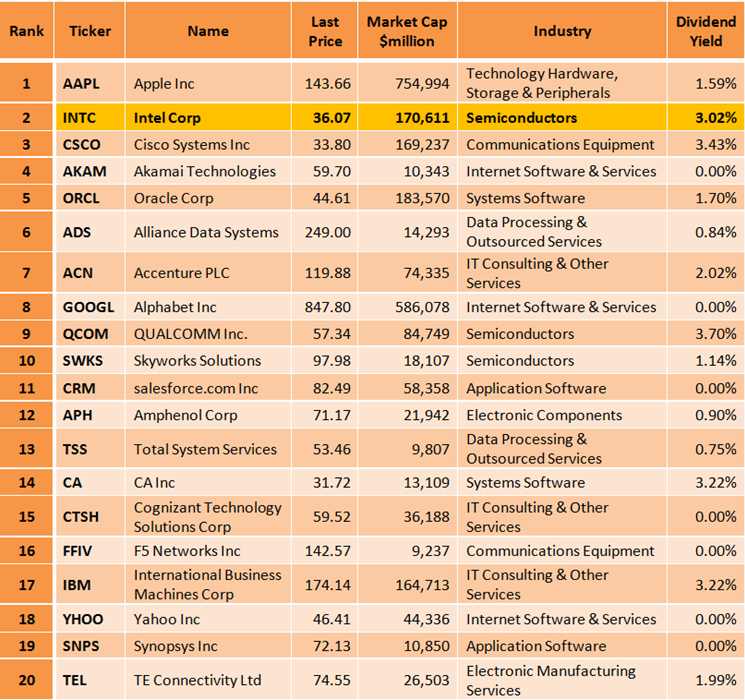

According to Portfolio123’s "All-Stars: Buffett" ranking system, INTC's stock is ranked second among all 66 S&P 500 technology companies, only Apple Inc. (AAPL) is ranked higher. The ranking system is based on investing principles of the well-known investor Warren Buffett. The 20 top-ranked tech companies according to the ranking system are shown in the table below:

The ranking system is quite complex, and it takes into account many factors like book value growth, operational P/E, price-to-book value, trailing P/E, price-to-tangible book value, price-to-cash flow and EPS stability. Back-testing over eighteen years has proved that this ranking system is very useful.

Conclusion

As I see it, Intel is well positioned to return to sustainable growth. The company continues to advance Moore’s Law which gives it a significant product and cost benefits. Intel has three year lead over the rest of the industry on 14-nanometer semiconductor device fabrication node, which is, in my opinion, a significant competitive advantage, as Intel is building a foundry franchise. The combination of Intel's computing strength and Mobileye's strong position in the advanced driver assistance systems market and autonomous driving development will give the company a high market share in these fast-growing markets. The average target price of the top analysts is at $41.37, which indicates an upside of 14.7% from its March 31, close price of $36.07, however, in my opinion, shares could go even higher.

Disclosure: I am long INTC AAPL stocks.