New Stocks On Most Attractive And Most Dangerous Lists: July 2015

Photo Credit: GotCredit (Flickr)

Recap from June Picks

Our Most Attractive Stocks (0.2%) outperformed the S&P 500 (-2.4%) last month. Most Attractive Large Cap stock HCA Holdings (HCA) gained 12% and Most Attractive Small Cap stock First Bancorp (FNLC) was up 12% as well. Overall, 23 out of the 40 Most Attractive stocks outperformed the S&P 500 in June.

Our Most Dangerous Stocks (-0.2%) underperformed the S&P 500 (-2.4%) last month. Most Dangerous Large Cap stock Groupon Inc. (GRPN) fell by 18% and Most Dangerous Small Cap Stock A.H. Belo Corp (AHC) fell by 5%. Overall, 13 out of the 40 Most Dangerous stocks outperformed the S&P 500 in June.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

8 new stocks make our Most Attractive list this month and 8 new stocks fall onto the Most Dangerous list this month. July’s Most Attractive and Most Dangerous stocks were made available to members on July 2.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for July: Check Point Software Technologies (CHKP: $80/share)

Check Point Software Technologies (CHKP), a worldwide leader in firewall equipment, is one of the additions to our Most Attractive stocks for July and was our Stock Pick of the Week in early June.

Check Point’s leading position in the firewall market has allowed it to build a highly profitable SaaS business. Over the past decade, after-tax profit (NOPAT) has grown by 14% compounded annually. Business strength has remained solid with NOPAT margins upwards of 40% every year since 2010.

Check Point earns an ROIC of 180%, up from 37% in 2008, and the company has generated over $2 billion in free cash flow since 2011. This high return provides a great advantage over competitors who generate much lower ROICs. With more profitability, Check Point enjoys better pricing power and the flexibility to invest in new products and solutions.

CHKP is only up 2% on the year as many investors fear that new entrants threaten Check Point’s foothold within the industry. These fears are unwarranted as Check Point is leveraging its superior cash flow to strengthen its existing offerings and find new services that could drive future profit growth. The good news for investors is that this pessimism has left CHKP undervalued. At its current price of $80/share, Check Point has a price to economic book value (PEBV) ratio of 1.3.

This ratio implies the market expects Check Point to only grow NOPAT by 30% over the remaining life of the company. 30% profit growth is no small task, but after a decade of growing profits by 14% compounded annually Check Point is well positioned to exceed such low market expectations.

If Check Point can grow NOPAT by 9% compounded annually for the next decade, the stock is worth $110/share today – a 38% upside.

Most Dangerous Stock Feature for July: Tyco International Ltd. (TYC: ~$38/share)

Tyco International Ltd. (TYC), a provider of security solutions and fire protection, is one of the additions to our Most Dangerous Stocks for July. The stock’s valuation has reached dangerous heights when taking into account the business’ declining fundamentals.

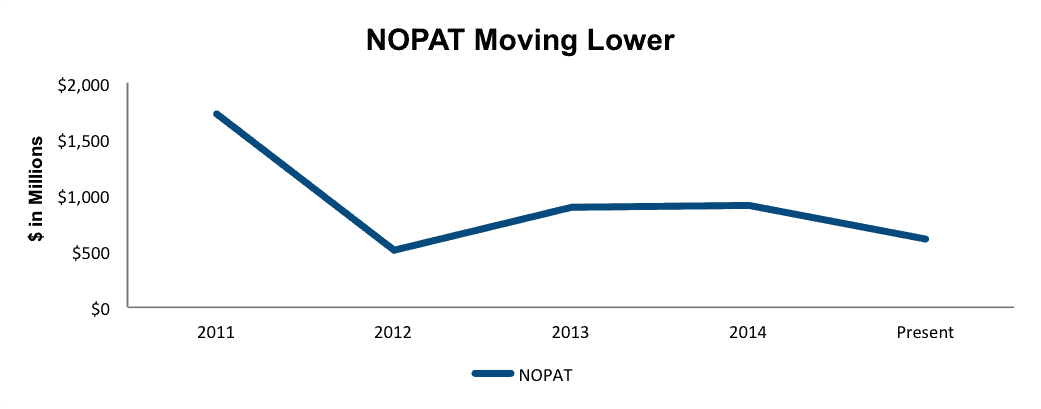

For fiscal years 2011-2014, the company’s NOPAT fell by 19% compounded annually. The decline continues for 2015’s 1Q and 2Q results as trailing-twelve month (TTM) NOPAT fell to $600 million from $900 million in fiscal year 2014.

Figure 1: Profits on the Decline

Sources: New Constructs, LLC and company filings

The company earns a bottom quintile ROIC of 2%, half of the 4% earned in 2011 and well below the 10% generated in the early 2000’s. In addition, for every year since 1999 Tyco has generated negative economic earnings, which highlights management’s inability to create true shareholder value.

Forensic Accounting Reveals Overstated EPS

TYC, down 13% YTD, would be even lower if it weren’t for Tyco’s earnings misleading investors. There were 28 adjustments made to Tyco’s 2014 income statement for a net impact of $937 million. The largest adjustment is the removal of $1 billion (57% of net income) in income from discontinued operations. After removal of these items we have found that NOPAT is $901 million, only half of the reported GAAP net income of $1.8 billion. Without forensic accounting to find and make these crucial corrections, many investors risk pouring money into companies whose profits cannot justify the valuation of their stock.

Overvalued and Very Dangerous

Tyco earns our Very Dangerous rating not only because of its misleading earnings but also due to its lofty valuation. To justify its current price of ~$38/share, Tyco must grow NOPAT by 9% compounded annually for the next 14 years. This optimistic expectation contrasts strongly with the decline in NOPAT over the past four years. With better investment alternatives, such as CHKP detailed above, investors would be wise to avoid TYC.

Disclosure: more