New Oriental Education: Strong Growth, Rising Profitability, And Attractive Valuation

New Oriental Education (EDU) is one of the leading players in private educational services in China. Education plays a central role in the Chinese culture, and the company is benefiting from strong demand tailwinds in the years ahead.

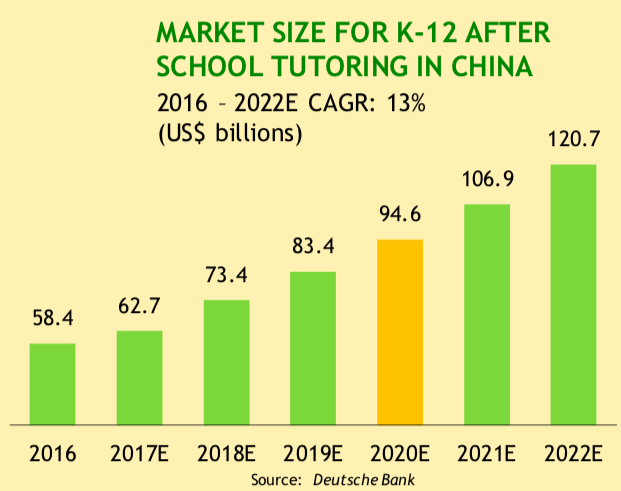

Source: New Oriental Education with data from Deutsche Bank

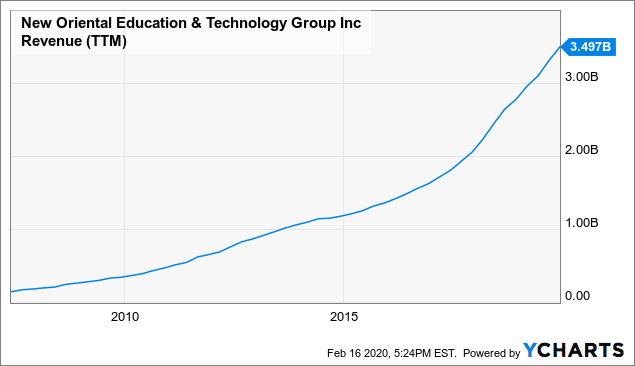

Competitor Tal Education (TAL) has been growing at a faster rate in recent years, and it has a stronger focus on K-12 after school tutoring services. But New Oriental is more diversified into different segments, and it has a slightly bigger revenue base, with $3.5 billion in revenue for New Oriental versus $3.2 billion in revenue for Tal over the past 12 months.

Market leadership and scale are major sources of competitive advantage for New Oriental. Brand recognition, reputation, and geographical coverage attract students in different categories, and the company has the resources to bring in the most talented professors and also to create industry-leading content and online capabilities.

By leveraging these advantages, New Oriental has been able to deliver outstanding revenue growth in the long term, both via organic revenue increases and through acquisitions.

Data by YCharts

There is no slowdown at sight looking at the most recent earnings report.

- Total net revenue increased by 31.5% to US$785.2 million for the second quarter of the fiscal year 2020.

- Total student enrollments increased by 63.3% year-over-year to approximately 3,789,200. This higher-than-normal increase in student enrollments is primarily due to the division of the autumn semester into two parts, meaning that the student enrollments are reported separately and fall into separate quarters.

- Non-GAAP operating margin rose by an impressive 720 basis points.

- Non-GAAP earnings per share came in at $0.34 beating expectations by $0.13 per share.

Management has identified several main drivers behind the big increase in profitability last quarter. The new facilities built in the last two fiscal years are being ramped up more efficiently than before, and higher utilization of the facilities provides better leverage in classroom rental and related operating expenses.

New Oriental has also built a systemized operating process driving big increases in operational efficiencies, and the company is getting more leverage on the selling, marketing, and G&A expenses. Importantly, revenue growth is accelerating versus recent quarters as New Oriental keeps gaining market share versus smaller players in the market.

The company is making big investments in its purely online subsidiary Koolearn.com, and these investments will have a negative impact on margins over the middle term. But even considering this factor, management is expecting widening profit margins in the next two quarters and even through 2021.

With revenue growing rapidly, a consistent increase in profit margins could provide a double boost to earnings in the future, since New Oriental could benefit from both growing revenue and a larger share of revenue being retained as earnings over the middle term.

Attractive Valuation

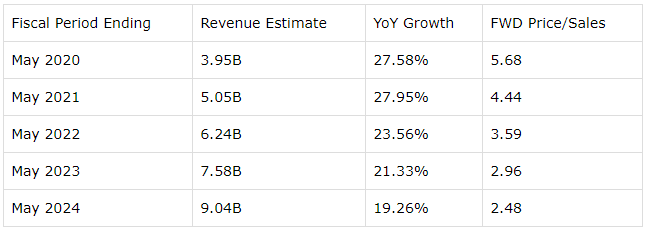

The table below shows the average revenue estimate for the company over the next 5 fiscal years, the year over year expected growth rate in revenue and the price to sales ratio implied by those numbers.

For the fiscal year ending in May of 2021, New Oriental is expected to generate revenue growth of almost 28%, and the stock would be trading at a very reasonable forward price to sales ratio of 4.4 based on current market prices. This is hardly excessive for a business with abundant growth prospects.

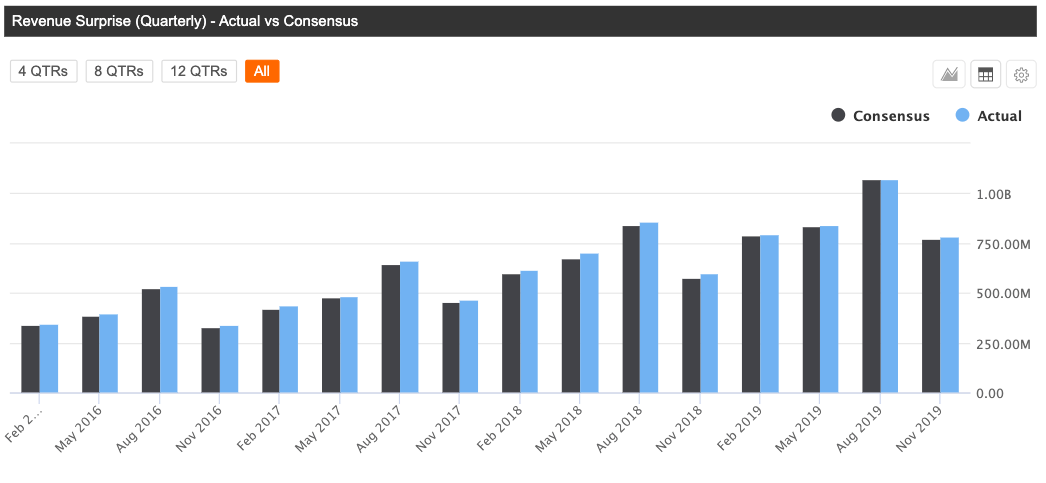

(Click on image to enlarge)

Source: Seeking Alpha

Importantly, New Oriental has delivered revenue figures above analysts' expectations in each of the past 16 quarters in a row. If past history is any valid guide for the future, it shouldn't be much of a surprise to see New Oriental beating expectations in the years ahead too.

In such a scenario, if revenues are going to be higher than currently expected, the stock would be even cheaper than what current valuation ratios are implying.

Source: Seeking Alpha

Based on free cash flow estimates for fiscal 2020 and fiscal 2021, New Oriental is trading at a forward price to free cash flow ratios of 21 and 16, which sounds more than attractive for such a strong business.

Valuation should be interpreted in the proper context, and investors should always incorporate other return drivers into the equation. A company that generates strong profitability and above-average growth rates obviously deserves to trade at a higher valuation than a business with below-average profitability and mediocre growth rates.

However, it is not easy to incorporate multiple factors into the analysis and quantify them in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative algorithm that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

New Oriental has a PowerFactors ranking above 88, so the stock is solidly in the top quintile based on financial quality, valuation, fundamental momentum, and relative strength together.

Backtested performance data for quantitative algorithms should always be taken with a grain of salt. The backtested data shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the long term, but this does not tell us much about how a specific company such as New Oriental is going to perform in a particular year.

In other words, the main strength of the algorithm is that it provides a quantifiable approach based on hard data to make investment decisions supported by evidence as opposed to opinions. However, the main weakness is that the algorithm does not consider the particular characteristics and the fundamental risks of different businesses when analyzing the numbers.

Those limitations being acknowledged, it is good to know that New Oriental still offers attractive upside potential from current levels if the company can continue meeting and ideally exceeding analysts' expectations.

Risk And Reward Moving Forward

The potential impact of the coronavirus is perhaps on the top investors' minds right now, but management considers that this is not much of an issue for New Oriental. Revenue from Wuhan is nearly 4% of the total, and the company already has plans to reschedule physical classes to the online format if it needs to do so in different cities.

It is practically impossible to tell for how long the coronavirus problems will last and what kind of economic effect they will have over the middle term. But New Oriental has the resources to successfully adapt to a changing landscape, and any kind of impact should be rather modest and only transitory.

More strict regulations in after-school training have benefited a well-established market leader such as New Oriental and, according to management, the company keeps getting market share from small players "almost every day".

This is a major positive for the company in the middle term, but it also shows that the competitive landscape is fluid, and changing regulations can always be a relevant source of uncertainty for investors.

Chinese students studying in the US have always been a major demand engine for New Oriental. Even if the company has widely diversified its offerings in recent years, visa restrictions and similar policies against immigration can be an important headwind.

In spite of these uncertainty drivers, the big-picture investment thesis in New Oriental looks clearly strong. The company is a market leader in an industry with abundant potential for growth in the years ahead. Revenue is growing vigorously and profit margins are expanding. At current prices, the stock even looks attractively priced. The risk and reward trade-off in New Oriental looks quite convenient over the long term.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EDU over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more