New Lows Expanding For The Nasdaq 100

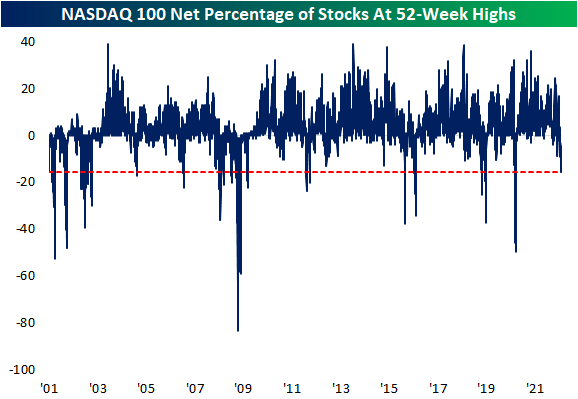

In an earlier post, we highlighted weak breadth for the S&P 500 Tech sector which now has just 9.2% of stocks above their 50-day moving averages. Pivoting over to the tech-heavy NASDAQ 100, another look at bad breadth is the new low in the net percentage of stocks setting new 52-week highs versus 52-week lows. As shown below, a net 15.68% of the NASDAQ 100 is at 52-week lows today which is the lowest reading since the COVID Crash in March 2020. At the lows during the COVID Crash, nearly half of the index hit 52-week lows. There have only been a few other times going back to the beginning of the data in early 2001 in which this reading got this low. The current reading is only in the 2nd percentile of the historical range.

The chart below shows the distance from a 52-week high for all of the Nasdaq 100’s members. There are currently only a dozen names that are currently within single-digit percentage points from their 52-week highs, while the average stock in the index is now 25.2% below its 52-week high.