New Low For Bullish Sentiment

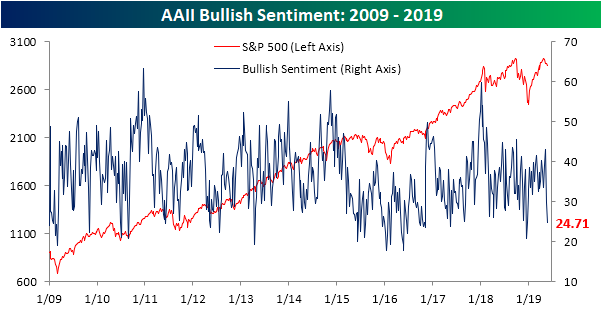

Trade headlines have continued to have a negative impact on stock prices, and in turn sentiment levels, over the past week. The AAII investor sentiment survey saw bullish sentiment decline sharply once again this week falling to 24.71% compared to 29.82% last week. To think that just two weeks ago bullish sentiment was at 43.12%, which was the highest reading of the year. Falling 18.41% from this recent high, the current decline is the largest two-week drop in bullish sentiment since 6/6/13 when it fell 19.5% over the two previous weeks.

(Click on image to enlarge)

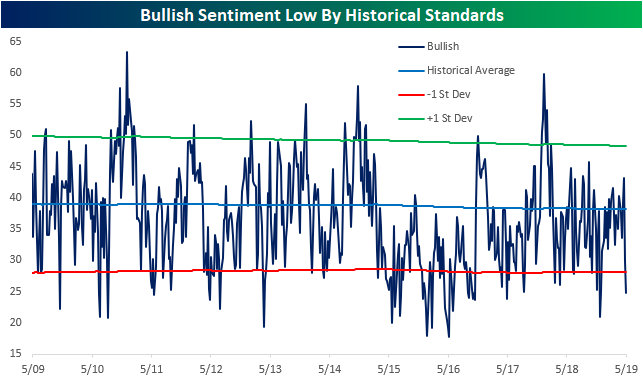

But this is not necessarily all bad news from a contrarian perspective. As shown in the chart below, this week’s reading of 24.71% is well below the historical average of 38.21%. In fact, it is over 1 standard deviation below it, something that can be considered a bit extreme and raising expectations for some type of mean reversion. When bullish sentiment reaches an extreme low by historical standards, forward equity market performance has typically been stronger than average. The last time survey respondents showed this little optimism was in late December of last year; right around the time of the market bottom.

(Click on image to enlarge)

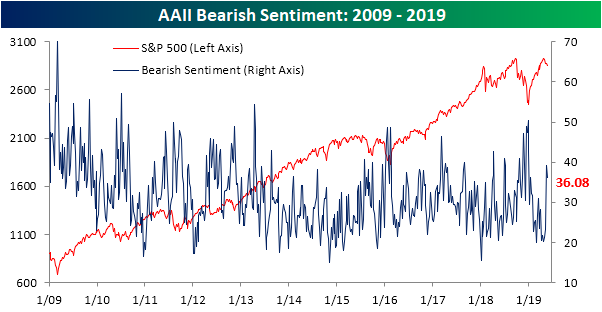

Surprisingly, while there was this development in bullish sentiment, bearish sentiment actually fell to 36.08% versus 39.3% last week. So while still elevated from where it has been for much of this year as the market has rallied, bearish sentiment is not reaching new highs. It is also still above its historical average but not to an extreme degree.

(Click on image to enlarge)

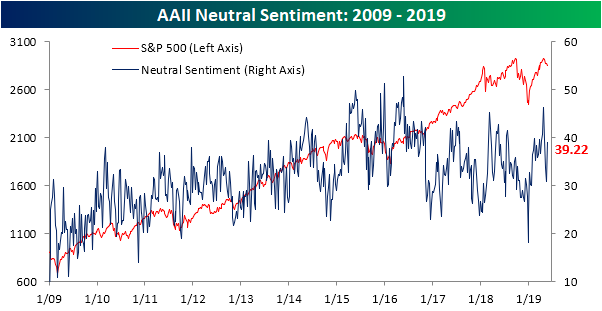

Neutral sentiment took from the losses in the bullish and bearish camps as it rose to 39.22%. While this sounds high, there was actually a slightly higher reading at the beginning of the month and this brings the neutral reading off of its recent lows and more in line with what has been observed for most of this year.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more