Neuronetics Could Feel The Heat When Lock-Up Expires

The 180-day lock-up period for Neuronetics Inc. (STIM) ends on December 25, 2018. When this period ends, the company's pre-IPO shareholders may opt to sell their shares in the secondary market. More than 11 million shares are subject to lock-up agreements and just 5.5 million shares are trading pursuant to the IPO. When these 11 million shares become eligible for trading on December 26, there could potentially be a surge of share volume traded in the secondary market. This flood of shares could cause a sharp, short-term downturn in share price.

(Click on image to enlarge)

Trading in STIM has been mixed during this six-month period and the stock currently has a return from IPO of 13.4%. The stock was priced at $17 and closed on its first day of trading at $27.78, for an increase of 63.4%. The shares climbed to a high of $37.54 on September 10. Currently, the stock trades between $19 and $20.

Business Overview: Medical Technology Company That Develops and Markets Treatment for Major Depressive Disorder

Neuronetics developed and designed its treatment for patients with psychiatric disorders, specifically major depressive disorder (MDD). The company is at the commercial stage with its product, the NeuroStar Advanced Therapy System. This non-invasive office-based treatment delivers transcranial magnetic stimulation (TMS) which results in a pulsed MRI-strength magnetic field. This field generates electrical currents to stimulate the brain regions associated with mood.

(Source: Neuronetics website)

In its SEC filings, Neuronetics noted that it has 781 active NeuroStar Advanced Therapy Systems in use in approximately 615 psychiatry offices. The company estimated that 50,000 patients have been treated with their system.

Typically, treatment options for MDD are antidepressant medications, and many patients receive these prescriptions from the primary care physician. Neuronetics believes that medications have two limitations: side effects and limited effectiveness.

These limitations contribute to the failure to achieve full relief from symptoms because patients may not adhere to their prescribed therapies. TMS offers an alternative for treating MDD who may not experience a satisfactory improvement from psychiatric medications. The efficacy of TMS relies upon precise delivery of the treatment, and Neuronetics believes its product is superior to other TMS systems that may have significant limitations.

Neuronetics estimates that a psychiatry office can recoup their investment in the NeuroStar system by delivering a standard course of treatment for 12 patients. Each course of treatment is expected to generate $7,500 to $10,000 in revenue for each patient. They sell their product through a direct sales force and customer service team. They focus on close to 15,100 psychiatrists across 3,600 psychiatric practices. Approximately 33 percent of MDD patients in the U.S. have insurance, and Medicare and most commercial insurers cover treatment with NeuroStar Advanced Therapy System.

Neuronetics generates most of its revenue from initial capital sales of the NeuroStar system. The company was incorporated in 2003, has 167 employees, and maintains its headquarters in Malvern, Pennsylvania.

Company information sourced from the firm's S-1/A and company website.

Financial Highlights

Neuronetics Inc. reported the following highlights for the end of the third quarter for fiscal 2018 ended September 30, 2018:

- Revenue was $13.7 million for an increase of 31 percent over last year. U.S. revenue was $13.5 million for a 30 percent increase.

- Through the end of September, the number of installed NeuroStar systems was 858 for an increase of 133 systems versus the same period of last year.

- Gross margin for the third quarter was 77.9 percent versus the third quarter of 2017 gross margin of 74.9%.

- Operating expenses were $15.0 million for an increase of $4.4 million. The increase came from an expansion of its sales force and marketing campaigns as well as general and administrative expenses resulting from becoming a public company.

Financial highlights were sourced from the company's website.

Management Team

CEO and President Christopher Thatcher has served in his position since December 2014. His previous experience comes from serving at Integra LifeScience Holdings, Ametek, Allergan, and Bausch and Lomb. He holds a Bachelor's Degree from Lafayette College, and he has completed executive programs at Columbia University and Trinity College in Dublin, Ireland.

CFO Peter Donato has extensive experience as a senior financial officer. He has held positions at Assurex Health, Bovie Medical Corporation, Catasys, LivaNova, Environmental Service Professionals, Iris Diagnostics, Cyberonics, and Ernst & Young. He holds an MBA from the University of Akron (Ohio) and he is a CPA.

Management biographical information was sourced from the company's website.

Competition: Magstim, CloudTMS, and Others

Other companies that market TMS therapy include Magventure, CloudTMS, Nexstim, Magstim, and Brainsway. In addition, Neuronetics faces significant competition from companies that market antidepressant medication such as Eli Lilly (LLY) and Pfizer (PFE).

Early Market Performance

The underwriters for Neuronetics priced its IPO at $17, above its expected price range of $14 to $16 per share. The stock has had a mixed performance. It reached a high of $37.54 on September 10 and has a return from IPO of 13.4%.

Conclusion: STIM is a Short Before December 26th Trading Session

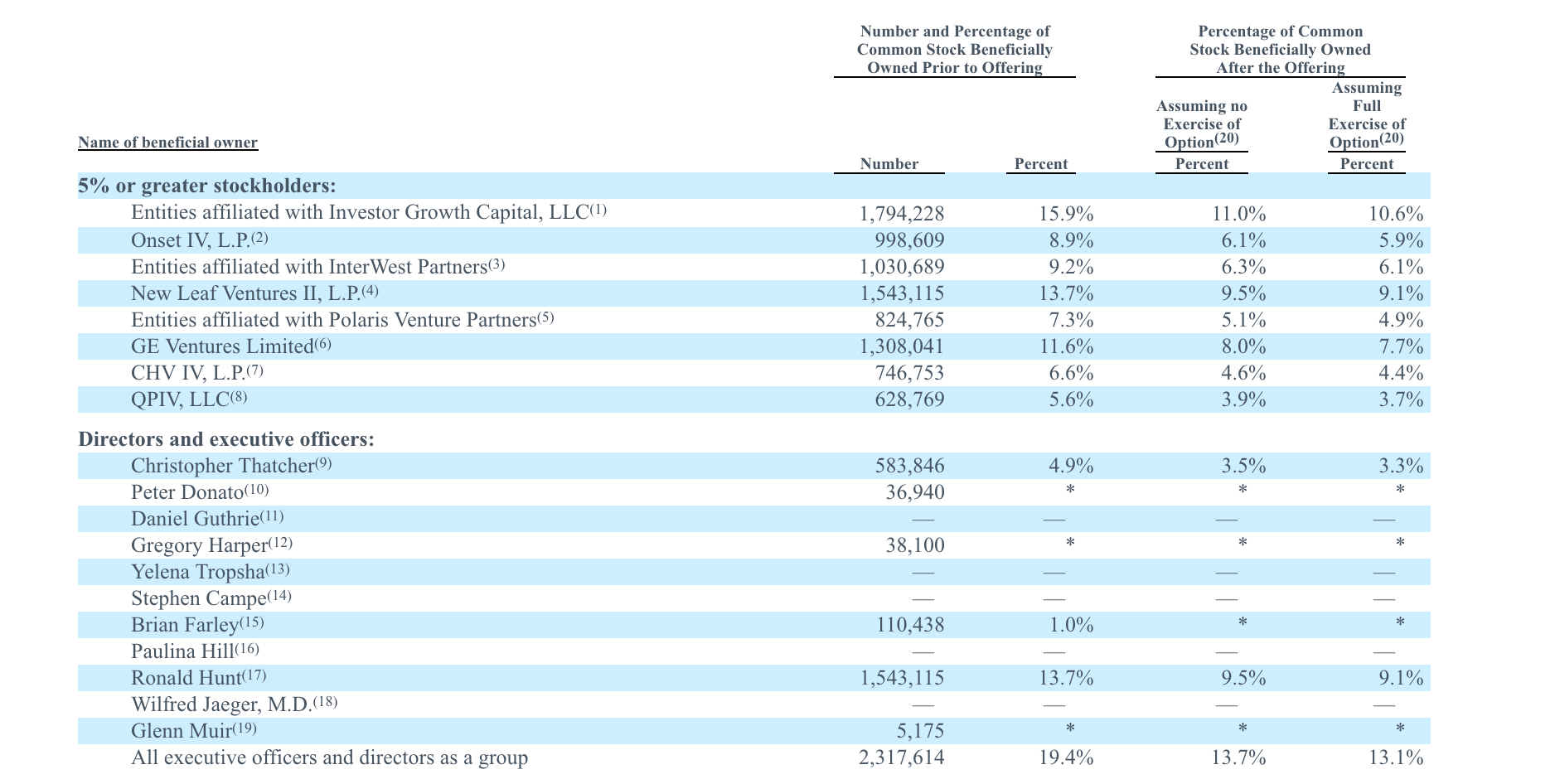

When the STIM IPO lock-up expires on December 25th, more than 11 million shares of the company's stock will be eligible for trading for the first time. Just 5.5 million shares of the company's stock are trading pursuant to the IPO, so the market could be flooded by any significant sales of these currently-restricted securities. These shares are owned by the company's pre-IPO shareholders and insiders - a group that includes 11 individuals and 8 corporate entities.

(Click on image to enlarge)

Aggressive, risk-tolerant investors should take advantage of this potential downswing by shorting shares of STIM ahead of the company's IPO lock-up expiration on December 25th. Interested investors should cover positions late in the trading session on December 26th or during the trading session on December 27th.

Disclosure: I am/we are short STIM.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more