Netflix Jumps After Blowing Away Expectations, Guides To A Whopper Q4

Recent earnings reports from streaming giant Netflix have been a mixed bag: the stock tumbled five quarters ago when the company reported earnings for its first full "post-Corona" quarter and warned that "growth is slowing", before again plunging four quarters ago when the company reported a huge miss in both EPS and new subs, which at 2.2 million was tied for the worst quarter in the past five years, while also reporting a worse than expected outlook for the current quarter. This reversed three quarters ago when Netflix reported a blowout subscriber beat and projected it would soon be cash flow positive, sending its stock soaring to an all-time high - if only briefly before again reversing and then tumbling two quarters ago when Netflix again disappointed when it reported a huge subscriber miss and giving dismal guidance, leading to the second quarter when Netflix slumped again after the company missed estimates and guided lower.

Which brings us to today, when investors are on edge today to find out not whether the company would justify the impressive stock price surge in the past two months sparked by fresh hopes that Netflix would not only beat conservative expectations of 3.72 million new subs added in Q3 but also project a burst of new subscribers in the year's fourth quarter, courtesy of a refreshed release lineup in no small part driven by such hits as Squid Games. As a reference, consensus expects a whopping 8.32 million paid subs to come in the 4th quarter.

Among the things investors will be focusing on will be:

- Netflix’s third-quarter subscriber figures after a couple disappointing prior periods -- as well its subscriber forecast for the fourth quarter

- The regional breakdown. In particular, how did Netflix fare in Asia and Europe? (Those regions produced the company’s two biggest hits last quarter)

- Any new commentary on its expansion into video game

So with all that in mind, was Q3 the quarter that would justify the recent surge in the stock price? It looks like the answer is yes because moments ago the company not only beat on the top and bottom line but smashed on both current subs and also projected a far stronger Q4 streaming number (full letter to shareholders).

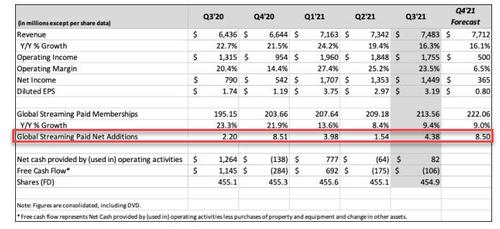

First, the historical data news:

- Q3 revenue $7.48B, in line with Est. $7.48B

- Q3 EPS $3.19 beating est. of $2.53, and almost double from 1.74 a year ago.

- Q3 Streaming Paid subs +4.38, beating the estimate of +3.72M;

- Total streaming subs rose to 213.6MM, beating the 212.9MM exp.

- Q3 Operating income $1.76 billion, beating the estimate $1.56 billion, and up +33% y/y,

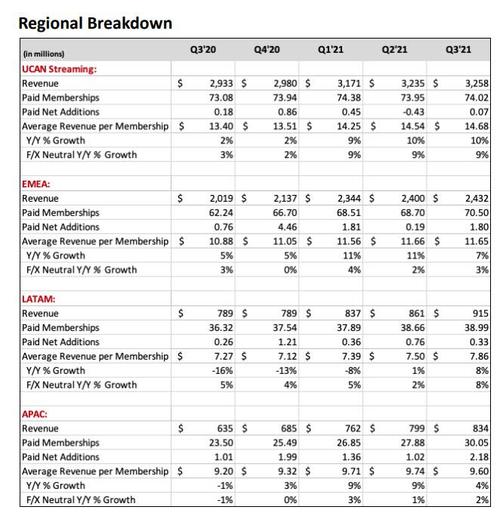

Here is the breakdown of Q3 subs which saw a miss in the US/CAN and EMEA subs which rose less than expected, offset by a jump in EMEA and APAC:

- UCAN streaming paid net change +70,000, -61% y/y, below the estimate +310,504

- EMEA streaming paid net change +1.80 million vs. +760,000 y/y, below the estimate +1.10 million

- LATAM streaming paid net change +330,000, +27% y/y, beating estimate +787,877

- APAC streaming paid net change +2.18 million vs. +1.01 million y/y, beating estimate +1.43 million

Summarized:

Commenting on its net adds for the quarter (4.4m actual vs. the company's 3.5m projection), the company said that it "under-forecasted" while ending paid memberships of 214m was within 0.4% of the company's forecast.

For the second consecutive quarter, the APAC region was our largest contributor to membership growth with 2.2m paid net adds (half of total paid net adds) as we are continuing to improve our service in this region. In EMEA, paid net adds of 1.8m improved sequentially vs. the 188k in Q2 as several titles had a particularly strong impact. The UCAN and LATAM regions grew paid memberships more slowly. These regions have higher penetration of broadband homes although we believe we still have ample runway for growth as we continue to improve our service.

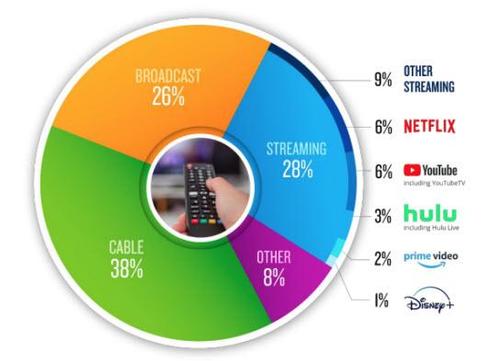

The company had a bit of a humblebrag to describe its performance: “We are still quite small, with a lot of opportunity for growth; in our largest and most penetrated market, according to Nielsen, we are still less than 10% of U.S. television screen time.” Translation: NFLX expects to keep growing as if there is no competition.

But it was the company's projections that everyone was looking for, and sure enough, projecting ahead, the company forecast a stronger than expected top line offset by a small miss on EPS:

- Q4 revenue $7.71BN, beating exp. $7.68BN

- Q4 EPS 80c, exp. $1.10

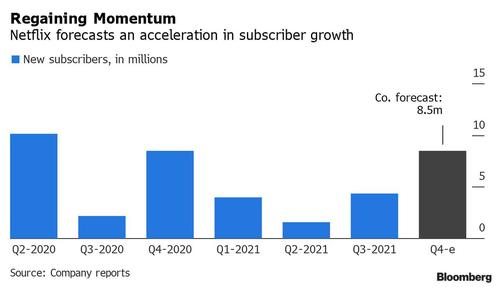

But most importantly, the company projected a stronger than expected number of subscribers in Q4, when it now sees +8.5MM paid subs, beating the 8.32MM consensus expectation.

And visually:

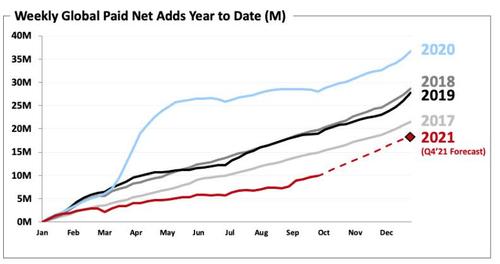

Looking at just the subscribe growth, NFLX appears to be regaining its momentum:

As NFLX says in its letter, for Q4’21, NFLX forecasts paid net adds of 8.5m, consistent with Q4’20 paid net additions. For the full year 2021, it forecast an operating margin of 20% or slightly better. This means that Q4’21 operating margin will be approximately 6.5% compared with 14% in Q4’20: "The year over year decline in operating margin is due mostly to our backloaded big content releaseschedule in this Q4, which will result in a roughly 19% year over year increase in content amortization for Q4’21 (compared with ~8% growth year to date)."

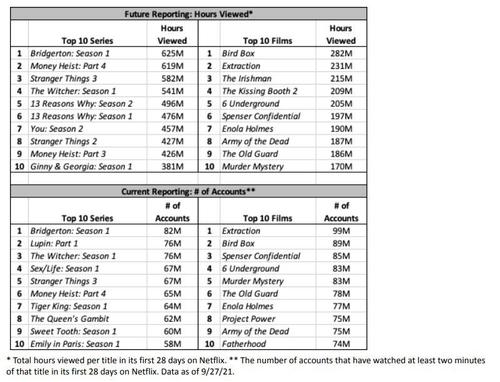

One thing to note is that a big change is coming in how Netflix reports viewer data. Later in 2021, the company will shift to reporting hours viewed rather than households.

There is some difference in rankings, as you see below, but we think engagement as measured by hours viewed is a slightly better indicator of the overall success of our titles and member satisfaction. It also matches how outside services measure TV viewing and gives proper credit to rewatching. In addition, we will start to release title metrics more regularly outside of our earnings report so our members and the industry can better measure success in the streaming world.

Commenting on the Q3 results, NFLX said that revenue growth "was driven by a 9% and 7% increase in average paid streaming memberships and Average Revenue per Member, respectively." Operating margin for Q3 amounted to 23.5%, a three percentage point increase vs. the year-ago period. As the company notes, this was above its beginning of quarter forecast due to the timing of content spend, as well as lower than forecasted marketing spend. EPS of $3.19 vs. $1.74 a year ago included a $136m non-cash unrealized gain from FX remeasurement on our Euro-denominated debt.

In its shareholder letter, the company said that it expects 4Q to be its strongest yet for content -- “which shows up as bigger content expense and lower operating margins sequentially.”

This may be difficult to achieve without a sequel to Squid Game, speaking of which this is what NFLX had to say about the global Korean sensation which has been the company’s biggest show ever with 142 million households viewing:

a mind-boggling 142 million member households globally have chosen to watch the title in its first four weeks. The breadth of Squid Game’s popularity is truly amazing; this show has been ranked as our #1 program in 94 countries (including the U.S.). Like some of our other big hits, Squid Game has also pierced the cultural zeitgeist, spawning a Saturday Night Live skit and memes/clips on TikTok with more than 42 billion views. Demand for consumer products to celebrate the fandom for Squid Game is high and those items are on their way to retail now.

Squid Game aside, Netflix said “Money Heist” and “Sex Education” were two of its biggest returning shows with 69 million and 55 million households each viewing in the first four weeks.

Netflix also commented on its progress with games, writing that “we’ve begun testing our games offering in select countries. It remains very early days for this initiative and, like other content categories we’ve expanded into, we plan to try different types of games, learn from our members and improve our game library.”

Netflix shared tables showing how new viewer reporting will reflect some differences in terms of what’s a hit show. As Bloomberg notes, while some titles remain in the Top 10 -- like “Bridgerton” and “Money Heist” -- others, like “Emily in Paris,” may only see an audience tune in for the first few minutes, but viewers don’t stick around for hours and hours of watching.

NFLX devoted the usual commentary to competition, where one thing struck out: “on October 4, when Facebook experienced a global outage for several hours, our engagement saw a 14% increase during this time period."

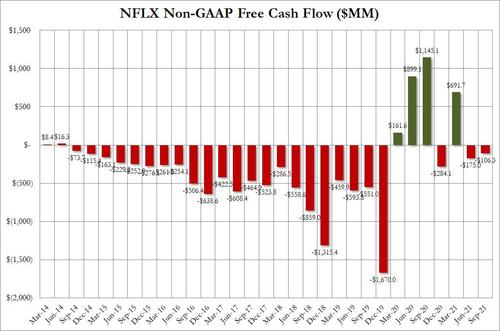

As usual, the company's cash burn was topical, as NFLX burned another $106 million in the quarter. This is what it disclosed in the letter:

Net cash generated by operating activities in Q3 was $82 million vs. $1.3 billion in the prior year period. Free cash flow (FCF) for the quarter was -$106 million vs. $1.1 billion in Q3‘20. FCF in last year’s Q3 was helped by COVID-related production shutdowns. Year to date FCF is $410m. With production volume ramping successfully and a lower operating margin in Q4, we anticipate Q4 ‘21 FCF to be negative. We continue to expect full year 2021 FCF to be approximately breakeven (plus or minus several hundred million dollars depending on the timing of production starts and related cash spending on content). We anticipate being FCF positive on an annual basis in 2022 and beyond.

And visually:

The company repeated that it no longer needs to raise external financing to fund its day-to-day operations, and added that it repurchased 0.2MM shares for $100 million, with the "slower buyback pace this quarter reflects the pick up in our M&A activity."

In kneejerk reaction, the stock is clearly happy, sending the price of NFLX higher in the after-hours session, although it has since retraced much of the gains.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more