Natixis Plunges After Its Ill-Named H20 Fund Sparks Panic Over Illiquid Holdings

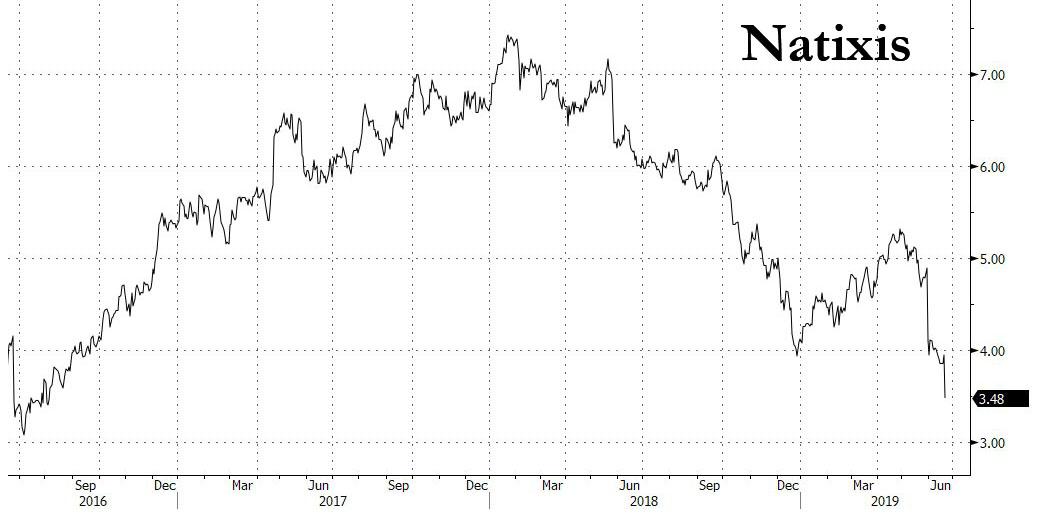

Step aside Neil Woodford (and your disastrous investments in illiquid assets), and make room for French bank Natixis NTXFY (and its own disastrous investments in illiquid assets), whose shares plunged 10% to the lowest in three years, after bond rating giant Morningstar suspended its rating on the woefully-named H2O Asset Management’s Allegro Fund yesterday, citing concerns over “the liquidity of certain bonds”.

"H20" fund... lack of liquidity... get it?

The questionable Natixis holdings are linked to debt issued by Lars Windhorst, "a flamboyant German entrepreneur with a history of legal troubles" according to the FT, which first flagged the Allegro fund's shady holdings.

Lars Windhorst

Some history: the London-based H20, which oversees about €30bn of assets, has been a subsidiary of Natixis Investment Managers since it was bought in July 2010. Executives sent a message to clients on Wednesday to reassure them about the liquidity of its investments and that its positions had been “fully disclosed to our clients and auditors”.

"The suspension raises concern about the quality of oversight by Natixis management of its network of asset managers," KBW analyst Jean-Pierre Lambert told the FT, adding that in the vein of the Woodford fiasco, the €250MM performance fee H20 pays Natixis could be affected, and questions should be raised about the French bank’s flurry of recent asset management acquisitions and stated ambition for more.

In response, Natixis said on Thursday that suspension of the rating has "absolutely no impact on the liquidity and performance of H2O’s funds. H2O will communicate shortly in detail to address all the questions raised by the publication of these elements.” The statement added that “the risk of a potential conflict of interest” raised by Morningstar was "groundless."

Of course, a few weeks ago, UK "investment legend" Neil Woodford said the same thing when a "fund run" on his assets resulted in an unprecedented gating of investors when the market is trading at all-time highs. Now, it's Natixis' turn to discover just why all those warnings written here and elsewhere about illiquid bond investments should have been taken seriously.

According to a previous report by FT Alphaville, H2O’s filings list investments in more than €1.4bn of illiquid bonds linked to Windhorst, across six funds that allow retail investors to withdraw their money on a daily basis.

H2O appears to be by far the biggest investor in many of these bonds. It often holds the majority of the outstanding amount across the firm, according to FT calculations based on each fund’s latest regulatory filings.

Windhorst, once seen as a teenage prodigy and poster boy for entrepreneurship in his native Germany, saw his reputation crater after he presides over several insolvencies, personal bankruptcy and received a suspended jail sentence in 2009. He relaunched his investment firm last month in an attempt to draw a line under several tricky years, which saw him and his company Sapinda engaged in legal battles involving at least €220m with several investors — including Ukraine-born billionaire Sir Len Blavatnik.

The plot thickened after H2O’s CEO, Bruno Crastes joined a new advisory board of Windhorst’s rebranded Tennor Holding last month, along with fund management heavyweights Martin Gilbert and Avenue's Marc Lasry, who is also vice-chairman of UK asset manager Standard Life Aberdeen. In all, across these investors, they own tens of billions in illiquid bonds and may well be engaging in marking-to-myth by occasionally "buying" each other's bonds at specifics prices just to give the impression of a liquid market across billions in illiquid bond holdings.

Potential collusion aside, Morningstar on Wednesday said that Crastes’s board seat posed “a possible conflict of interest”.

Not everyone was convinced that Natixis is the next Woodford: "In our view, the reaction is overdone as H2O overall represents only 5 to 6 percent of the group’s net income,” said Jefferies analyst Maxence Le Gouvello Du Timat.

“The structure of the fund has always been disclosed by H2O with 85 to 90% in government bonds and futures and 5 to 15 percent in illiquid assets."

Still, even if the "illiquid" H20 fund investments turn out to be a tempest in a teapot, Natixis has many other shady investment problems: the stock has plunged 36% in the past 12 months, even before today's 10% plunge.

(Click on image to enlarge)

In February the bank said its fourth-quarter earnings were cut in half after some Asian derivatives trades went bad, prompting questions about its risk appetite and management.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more