National Oilwell Varco - Head For The Hills

The free fall in oil prices and oil & gas E&P has taken a toll on oilfield services firms. I previously assumed that the lesser-capitalized firms would get hit the hardest. However, larger firms like National Oilwell Varco NOV have been ravaged and the carnage may not abate any time soon. NOV is down 30% Y/Y versus a flat return for the S&P 500 SPY; the stock is 20% above its 52-week low of $25 but will likely retest those lows by the first half of 2016.

Rig Systems Refuses To Cooperate

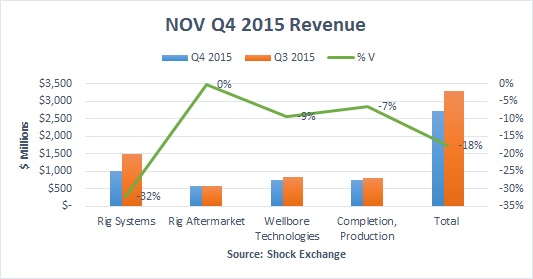

The company's largest operating segment, Rig Systems, sells land rigs, offshore drilling equipment and components. The segment has been hit hard by falling oil prices; in particular, its offshore equipment has experienced a dearth of new orders. Revenue was off 32% sequentially; this followed a 22% decline in Q3.

As an accommodation to clients, National Oilwell is allowing customers to delay acceptance of uncontracted newbuilds; this allows customers to slow their Capex amid falling day rates. For 2016 management expects revenue out of backlog to be about $2.1 billion. Any additions would have to come from new orders which plummeted 76% during the quarter to $89 million. To give a sense of how bad 2016 could be, Rig Systems had 2015 revenue of nearly $7 billion. 2015 results could be less than half that.

EBITDA Will Likely Plummet For Here

National Oilwell's Q4 EBITDA fell 39% sequentially as margins declined from 16% in Q3 to 12% in Q4. The lion's share of the company's EBITDA comes from Rig Systems and Rig Aftermarket. While total revenue fell 17% sequentially, revenue from these two segments were off 23%. It could worsen; analysts expect Q1 2016 revenue to fall by 12% Q/Q to $2.4 billion. If margins continue to deteriorate then EBITDA could free fall.

Deteriorating Backlog Remains A Concern

A big selling point amid the oil price rout was National Oilwell's prodigious backlog; that backlog is deteriorating and is now a source of concern. The company's backlog fell over 20% from $9 billion in Q3 to $7 billion in Q4. Part of the decline was due to a $1.1 billion write-off related of the Petrobras PBR drill ships package. About $1.8 billion of the remaining backlog remains for 15 rigs related to the package.

Sete Brasil, the shipyard contracted to build the drill ships, is having funding troubles. Rumors also suggest that Petrobras may consider abandoning the drill ships project altogether. That puts the remaining Petrobras-related backlog in serious jeopardy. A $1.8 hit to the backlog in addition to the normal quarterly attrition could cause the year-end backlog to fall below $4 billion. Ultimately, shrinking new orders and a deteriorating backlog could cause NOV to sink this year. Investors should head for the hills.