Nasdaq Hits Fresh Highs While Wall Street Eyes Stimulus

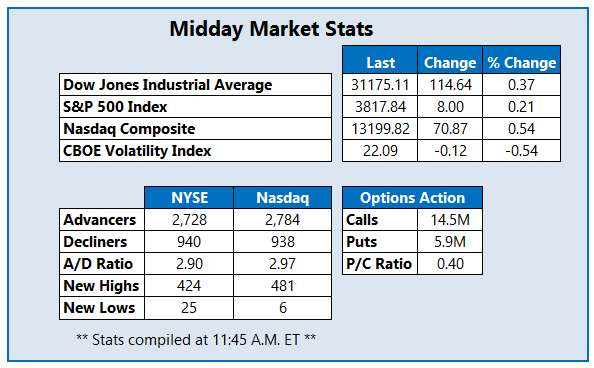

Stocks are getting a boost this afternoon, as investors anxiously await the unveiling of President-elect Joe Biden's promising stimulus package, and celebrate the efficacy of Johnson & Johnson's (JNJ) one-dose coronavirus vaccine. In response, the Dow Jones Industrial Average (DJI) is up roughly 114 points at midday, and the S&P 500 Index (SPX) is registering modest gains. Meanwhile, the Nasdaq Composite (IXIC) hit a record high.

Traders have largely brushed off this morning's dismal jobless claims update, which came in higher-than-expected. In other news, President Donald Trump became the first president to be impeached twice, after he was charged with incitement of insurrection.

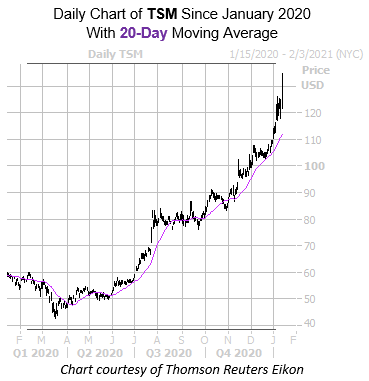

One stock seeing notable options activity today is Taiwan Semiconductor Mfg. Co. Ltd. (NYSE: TSM), last seen up 11.8% to trade at a record high of $133.46, after the chip concern reported a 23% rise in fourth-quarter profits, thanks to higher demand during the pandemic. So far, 196,000 calls and 59,000 puts have crossed the tape, which is six times the intraday average. Most popular is the January 2021 130-strike call, followed by the 135-strike call in the same series, with new position currently being opened at both. The security has experienced tremendous growth over the past year, with support from the 20-day moving average. Year-over-year, TSM sports an impressive 125.8% lead.

Near the top of the New York Stock Exchange (NYSE), today is space-travel concern Virgin Galactic Holdings Inc (NYSE: SPCE), up 20.8% at $33.28 at last check. The positive price action came after ARK Investment Management filed to launch a space exploration exchange-traded fund (ETF), focusing on companies that either lead, enable, or benefit from "products and/or services that occur beyond the surface of the Earth." On the charts, the security has had a volatile run over the past year, following a Feb. 20 record of $42.49. Year-over-year, though, SPCE remains up a significant 124.6%.

Near the bottom of the NYSE, today is Lemonade Inc (NYSE: LMND), last seen down 5% to trade at $167.79 after the company announced the underwritten public offering of over 4 million shares of its common stock for $165 -- or a 6.6% discount to last night's close. The direct-to-consumer (DTC) insurance firm said the proceeds will be used for general purposes. On the charts, Lemonade stock is coming off a Jan. 12 record of $188, with support from the 20-day moving average. In the last six months, LMND added 111.1%.