Nasdaq 100 May Start A Catch-Up Rally As Inflation Pressure Eases

NASDAQ 100 FUNDAMENTAL FORECAST: BULLISH

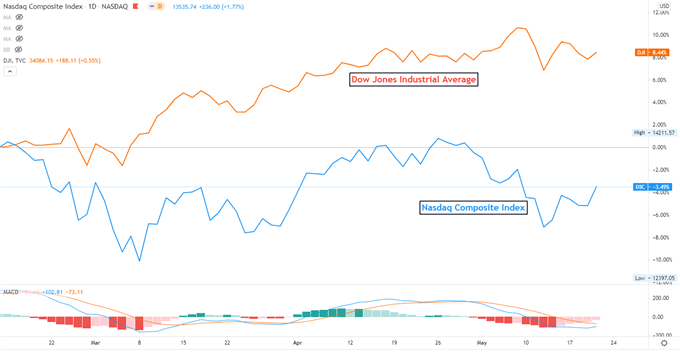

- The Nasdaq Composite fell 3.5% while the Dow Jones gained 8.4% since mid-February

- The gap could narrow as a pullback in commodity prices cools inflation expectations

- Weekly jobless claims hit a fresh pandemic low, underpinning economic strength

The technology sector extended higher towards the end of the week as investors cheered a decent jobless claims report and cooling inflationary pressure. US weekly jobless claims hit a pandemic low of 444k for the week ending May 14th, underscoring a smooth recovery in the labor market.

Meanwhile, commodity prices retreated further, alleviating concerns about inflation. Prices of copper, iron ore, nickel, crude oil and natural gas have all pulled back from their recent highs, dragging the energy and material sectors lower. On the other hand, the technology sector has benefited from falling price levels as concerns surrounding rising longer-dated rates eased. The benchmark 10-year Treasury yield was hovering at around 1.60% for most of April and May, pausing a rally that stoked drastic selling in technology stocks seen earlier this year.

This may pave the way for a catch-up rally in the Nasdaq 100 index after months of underperformance. The Dow Jones Industrial Average rallied 8.4% since mid-February while the Nasdaq 100 index lost 3.4% during the same period (chart below). The gap could narrow if inflation expectations start to cool off.

DOW JONES VS. NASDAQ 100 – PAST 3 MONTHS

Chart created with TradingView

Inflation fears appeared to have dented consumer spending as prices of goods and services become more unaffordable. US retail sales stalled in April, and the University of Michigan consumer sentiment gauge unexpectedly tumbled to 82.8. Rising raw material prices may also put pressure on the manufacturing sector, squeezing factories’ profit margins.

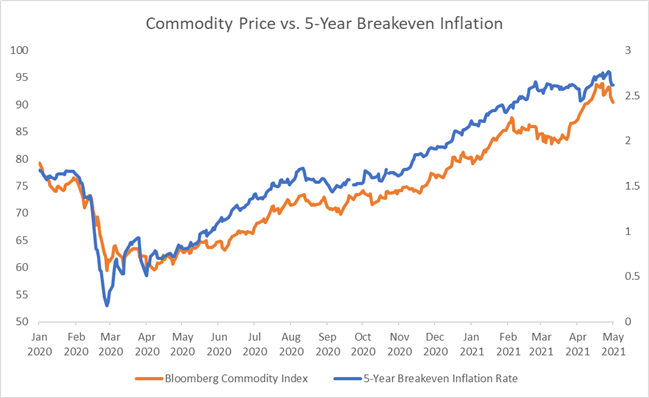

Earlier this month, reflation hopes and pent-up demand sent commodity prices to their highest level since 2011, according to an index compiled by Bloomberg. The gauge comprises a wide range of energy, metal and agricultural products. The 5-year breakeven rate, a proxy of bond traders’ inflation expectations, surged to 2.76% - a level not seen since 2008 – on May 17th (chart below). The rate has fallen to 2.61% towards the end of last week, suggesting that inflation expectations cooled as commodity prices retreated.

COMMODITY PRICES VS. 5-YEAR BREAKEVEN INFLATION

Source: Bloomberg, DailyFX

Disclosure: See the full disclosure for DailyFX here.