Nasdaq 100 At An Extreme Level

Thursday’s sentiment indexes were very confusing. The NAAIM exposure index spiked again as fund managers bought the 7% correction. It’s no surprise people bought the dip because the market recovered. This index spiked from 77.48 which is a modestly high reading to 88.25 which is almost extreme. It’s slightly below the peak of 91.6 two weeks ago which is about in line with the stock market which is below its recent high. This index increased a tad bit more than the market.

We could see a reading in the mid-90s if stocks rally in the next week. We don’t need this indicator to be in the 90s to be bearish, but it certainly doesn’t hurt the case. The 90 threshold is my own estimate. Being slightly below it doesn’t suddenly mean you should go buy stocks.

AAII sentiment index was bizarrely bearish. It's shocking how negative it was because of how high the stock market is. Specifically, the percentage of bulls fell 9.9 points to 24.4% which is way below the average of 38%. This dramatically counters the spike in retail trading activity. Data on retail trading is real. Robinhood already confirmed it added 3 million accounts in Q1. Judging by anecdotal evidence and Google search data, it’s likely the number of new accounts in Q2 was much larger.

Remember, we also have the data that says many people put their stimulus checks into the market because they couldn’t spend it. In the AAII survey, the percentage of bears rose 9.7 points to 47.8% which is above the average of 30.5%. It’s getting close to the peak in March. That’s shocking.

However, I reject the notion that investors are negative which means stocks must move higher. The stock market can’t go higher without people buying it. Retail investors are bearish, but long stocks just like how hedge funds think the market is expensive and don’t see a V-shape recovery, yet are very long.

Keep in mind that it's unlikely this market is more expensive than it was in the late 1990's; neither do fund managers. It’s simply that slightly more fund managers think the market is expensive than then.

Tech Stocks Have Gone Bonkers

Speaking of the late 1990's, let’s talk about tech. In the past few years, many have strongly disagreed that we were in a tech bubble because of the solid fundamentals of the big tech firms. That's changed as we are likely in a tech bubble. We shouldn't expect the Nasdaq to fall 80%, but it will likely fall much more than 15% once the peak is in. Apple is very expensive along with the cloud stocks and the electric auto firms which are Tesla and Nikola.

As you can see from the chart below, the Nasdaq 100 is 15% above its 200 day moving average which has been a bad sign for the index in the past few years. The fact that the stock market was overvalued and overbought right before the COVID-19 crisis was partially why stocks fell so much. The market was overdue for a 10% correction anyway.

This is why it's unlikely the S&P 500 will make a new record high soon. Why should the market get back to an expensive level when the economy is in a recession? It remains surprising that the 7% correction did nothing to change sentiment.

This is a cloud stock bubble. ServiceNow has a price to sales multiple of 21 which is almost its highest ever and higher than any multiple Salesforce has had in its history. Microsoft got into the 30's in the tech bubble. The CLOU cloud ETF was up 1.69% on Thursday which means it’s now up 12.11% in the past month. That’s an unsustainable course. It’s up 31.05% year to date.

Keep in mind, that's calling for the cloud stocks to fall sharply and not recover quickly. Investors in these names think they will just ride out the decline. They don’t care about a potential 20% decline because they think it will just rebound quickly.

As you can see from the chart below, when the Z-score of the tech sector is above 2 standard deviations, it has been bad for returns. This is already the third longest period it has been overbought in the past nine quarters.

Another key point of this prediction is the tech sector will lead the market lower in the next correction. If the market falls 15% from its peak in June, the tech sector can fall 20% to 25%. That would be a massive decline for tech because the sector is only 1.11% off its June high now.

In my opinion, Shopify is the face of this bubble because it is up so much and has no profits along with declining revenue growth. Its stock was up 5.65% on Thursday which puts it up 167.95% from its March bottom. A recent 12% correction is not the type of decline this is calling for. It will likely be larger and there won’t be a recovery in three weeks.

Shopify’s market cap is $101.23 billion which makes it temporarily the largest firm in Canada. Spotify was up 12.74% on Thursday and is up 21.46% in the past 2 days. Speculators love that it has paid millions of dollars for exclusive podcasts.

Nikola was up 5.73% despite a negative article on Bloomberg this week calling its CEO’s ethics into question. It has no revenues. It fell 24% off its high in two days, but now it’s only down 15%. Beyond Meat stock is up 192.85% since its March low. Investors love money losing companies with no moat.

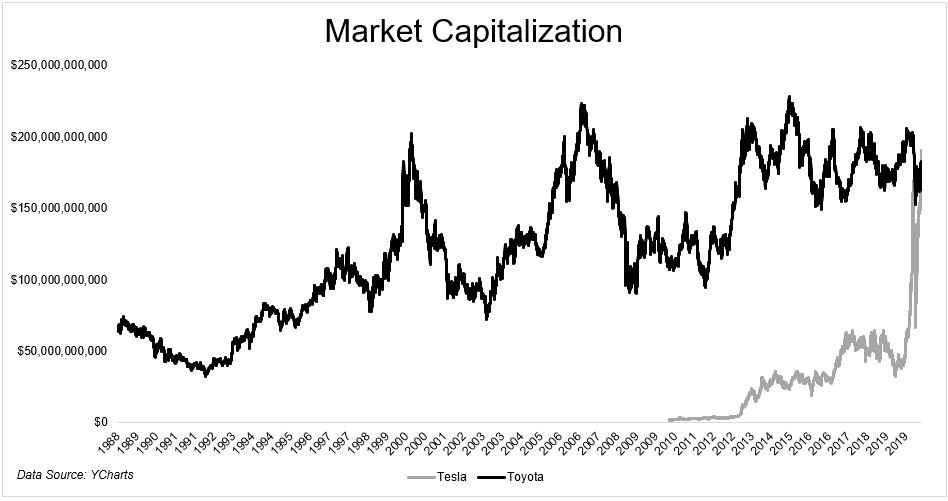

Finally, Tesla was up 1.23% to $1,003.96. It fell almost 9% in the correction, but has recovered almost all its losses. As you can see from the chart below, Tesla now has a larger market cap than Toyota. It took Toyota decades to be this large. Most of Tesla’s gains have come in the past year.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more