Mystery Trader Shocks Market With Giant VIX Put Trades

While everyone is familiar with the exploits of the notorious vol trader Ruffer LLP, better known in the market as "50 cent" for his penchant for buying deep OTM VIX calls which while usually expiring worthless, occasionally make a killing, such as the $2.6 billion the fund made during the March crash when VIX soared, a new and heretofore unknown player has emerged in the vol space. And because this particular trader's bet appears to be on a reduction in volatility Perhaps we can call him minus 50 cent?

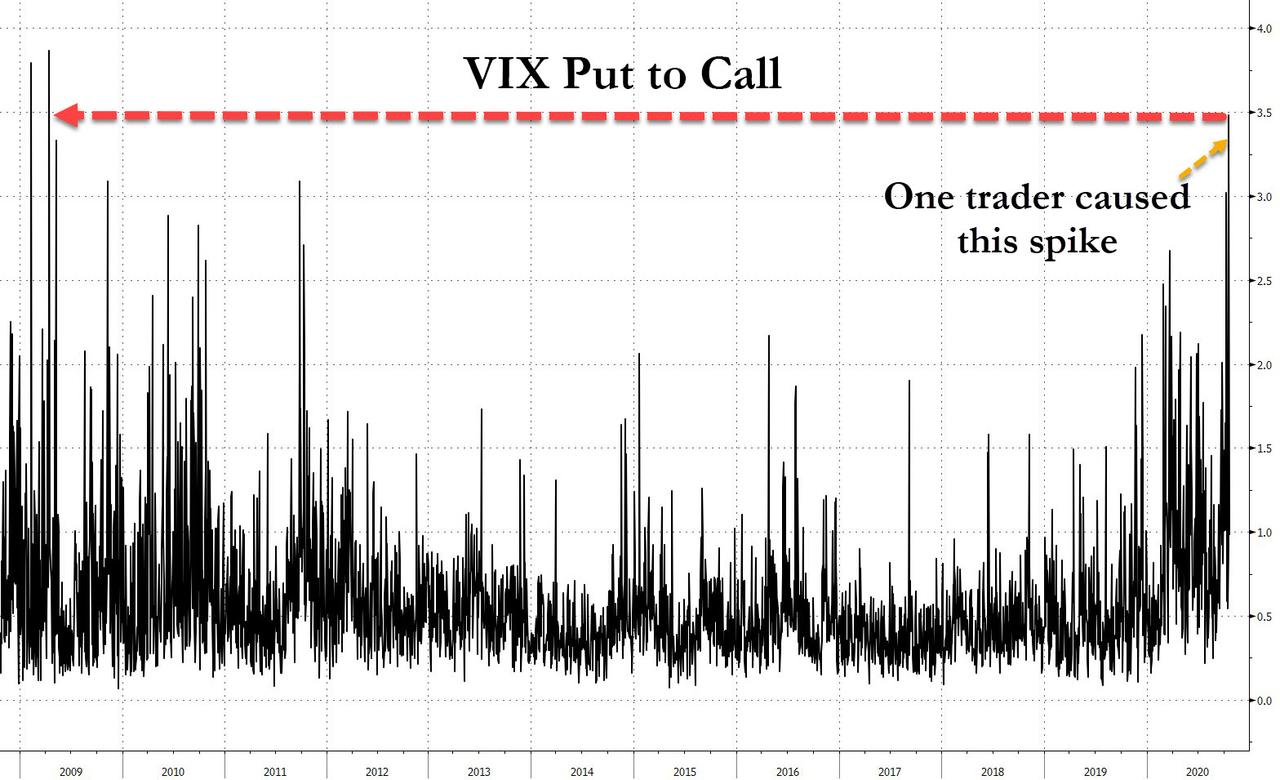

According to Bloomberg, which first reported the mystery trader's exploits, so large were the fund's block trades that it moved the market's entire Put to Call ratio from near-record lows to the highest in a decade!

The fund was most likely buying a giant put spread in a massive bet that the VIX which is currently at 29 will tumble to 17 by February, or just after the inauguration date. According to Bloomberg, the unknown trader bought and sold some 360,000 put options, sending volume in those contracts soaring and moving the broader put-to-call measure, which has been declining in recent months, to 3.5, the highest level since 2009. And all that from one trade.

(Click on image to enlarge)

Just as notable, as fast as the trader appeared, his disappearance was just as fast, and it was all gone by Monday, as put volumes tumbled; the put-to-call ratio on the VIX Index was back to 0.98 on Monday, near its average for this year.

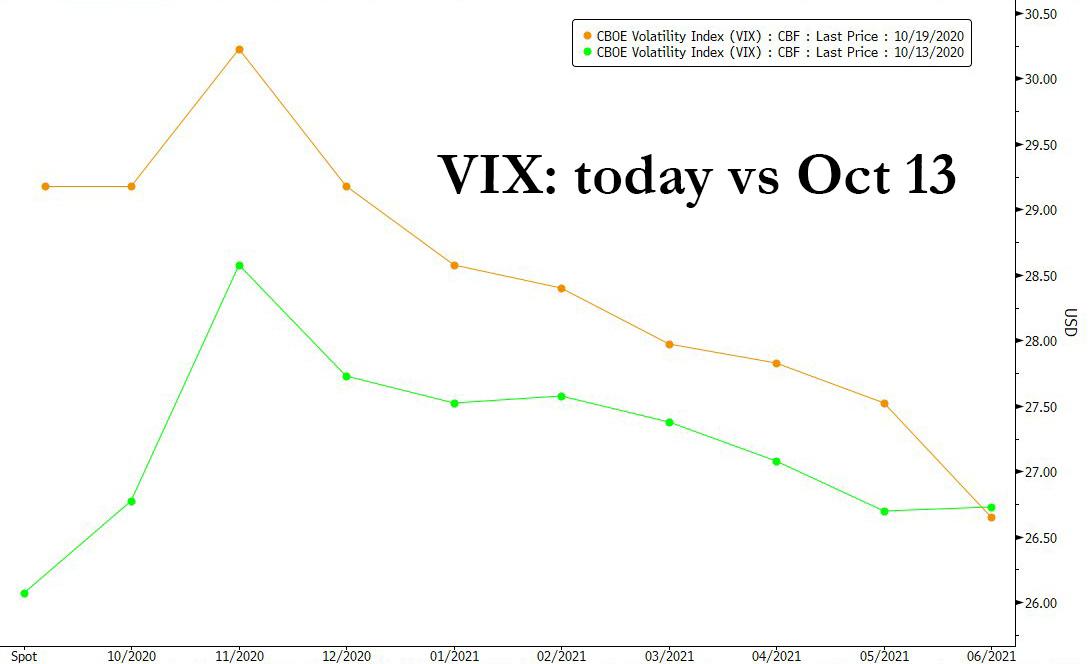

(Click on image to enlarge)

How do we know this was just one trader? According to Susquehanna Financial’s co-head of derivatives strategy Chris Murphy, trades accounting for 68% of Friday’s put volume came from one investor making block trades. As part of the put spread, the unidentified investor bought 60,000 VIX 21 put contracts that expire in February on a bet that the index will decline, while selling 120,000 February 17 puts to offset his cost basis, and with the assumption that volatility won’t drop much below that level. He made a similar trade for VIX options expiring in March. Of course, if the VIX fails to drop or rises, both trades will expire worthless.

"I believe this investor is positioning for (or hedging against) lower volatility in the 1Q21, likely due to a combination of the election being over, vaccine success and continued Fed support,” Murphy told Bloomberg. "This has a huge impact not only on VIX put/call ratio but on put/call ratio for all index products,” he added, noting a Friday spike in the Cboe Index put-to-call ratio.

Incidentally this is effectively a trade is a bet that the market is pricing in far too much risk from a contested election, and is betting that the VIX term structure will flatten and decline, which incidentally is the trade we recommended on Sept 30 in "Contested Election" It Is: Here Is How To Trade It."

Yet while the rationale behind the trade is clear, it’s hard to say who’s behind the trade. Separately, Friday’s expiration of options had likely little to do with the trades so far out next year, according to Interactive Brokers LLC’s Steve Sosnick, unless the customer had a similarly large expiring position, which is impossible to track down using public data.

Whoever’s behind the bet that volatility will subside post-election they’re not alone, with the shape of the VIX curve showing a gradual easing in volatility beginning in December, although the curve has certainly moved higher over the past week amid renewed stimulus and covid risks.

(Click on image to enlarge)

The VIX Index -- a gauge of the 30-day implied volatility of U.S. stocks also known as the “fear gauge” -- closed above 29 on Monday as the S&P 500 slid 1.6% amid renewed concerns a stimulus package won’t be agreed on before the election. Futures on the S&P 500 Index are trading 0.4% higher, following an up day in Asia and Europe.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more