My Biggest EV Trade Of The Year Explained In Simple Terms

Nano One Materials Corp. (NNOCF) — has been one of my biggest winners in the EV battery space this year, and it’s a great example of how I research stocks for my subscribers.

I had known Chairman Paul Matysek for ten years and CEO John Lando for thirty years. I had watched the stock trade since its IPO date, and once they announced a big financing $1.15, I could smell a big run coming in the stock as this sector became red hot. Readers and I loaded up on that financing, and it has paid off (We actually added at the recent $2.72 financing).

I think the IP here has incredible potential. The company has a battery technology that is attracting global attention in the EV supply chain — because their IP can potentially:

- Greatly reduce costs (estimated 15-30%) for cathode materials.

- Use a much more environmentally-friendly process.

- Charge a car battery in 12 minutes.

- Provide 1000 charges (1 charge = 1 tank of gas) — at a tank of gas a week, that would be the equivalent of an almost 20-year battery life.

I say "potentially" because it’s all still at a lab or pilot/demonstration scale. But they already have announced collaboration deals in Europe, China, and an unnamed Asian company. They now have $28 million in the bank -- including some big non-dilutive financing from governments. That’s at least a five-year runway.

Besides the stellar IP, the stock has benefited from the growing bubble in EV battery stocks — from Tesla (TSLA) all the way down to lithium miners, this sector has been one of the top places to be for retail investors. Investors are due for a correction in this space, but I think the EV trade has years to run.

Now that the stock has almost tripled for my readers, I want to give you a simple explanation of how this little company in a suburb of Vancouver, Canada could have one of the most heralded technologies of the EV age.

I bought Nano One on a simple idea – that they are in the running to make the first million-mile battery. That is still a big part of the story. But there is more to it than just that. Nano One is a battery material company. Yes, they are figuring out ways to makes batteries last longer, but they are also hard at work making them cheaper, smaller, and greener – basically, the next-generation of battery.

Once the market catches on – that this small Canadian company could be on the cusp of developing the next-gen battery – I think the stock could see further gains.

A Focus on the Cathode

Nano One is tricky to understand – there are so many technical details. Investors can (and often do) get bogged down with the science. Thus, I’ll try to keep it simple. Start with the lithium-ion battery. There are main 4 parts: cathode, anode, electrolyte, and separator.

Nano One is focused on the cathode. The cathode is a good place to look for cost reduction. One quarter of the cost of a lithium-ion battery comes from the cathode. There are lots of different materials that are used as cathodes. Nano One is working with 3 cathode materials:

- Lithium-iron-phosphate (LFP).

- Nickel-manganese-cobalt oxide (NMC).

- Lithium-nickel-manganese (LNM) (which has a higher voltage than the other two).

The first two (LFP and NMC) are commonly used in batteries. Nano One is trying to make them better. Nano One has filed a patent on using LNM with some off-the-shelf products to allow for a very long battery life – this could be a game-changer.

The One-Pot Process

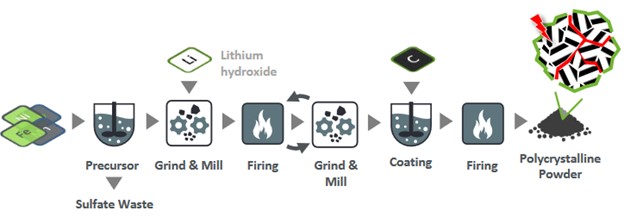

Nano One’s secret sauce is called the “One Pot” process. It is called One Pot because all the materials are mixed together in a single step. Fewer steps = lower cost. The standard process for making cathodes has 6 steps:

Source: Nano One Investor Presentation

One Pot has far fewer steps:

Source: Nano One Investor Presentation

But it is not just simpler. It creates a much better cathode. Cathodes are made of crystals. The standard process creates clusters of crystals. These clusters are then coated (top-half of diagram):

Source: Nano One Investor Presentation

The One Pot process is different. Each nano crystal is individually coated, not just each cluster (bottom-half of diagram). This has a number of advantages.

First, it’s a lot more durable; i.e. longer life battery. Charging a battery is hard on the material. Repeated charging causes coated clusters to break apart. The battery eventually stops working. With One Pot that doesn’t happen as fast. You have a longer-life battery. And that's not just more charges, but faster charges. Normally it’s either/or, but with Nano One, it’s a blend of both.

Second, the process produces a lot less waste. Consider the NMC battery. Today’s process is shown on the left in the diagram below. You can’t just go from raw metal to cathode. There is an intermediate step, called the “precursor." It involves a bunch of dirty chemicals like nickel sulphate, sodium hydroxide, and sulfuric acid.

Source: Nano One Investor Presentation

That sodium and sulfur come out the other end as waste. There is 5 times more waste than battery material produced. Not only is this much worse environmentally – producers have to pay to get rid of all that waste. As of now, there is no commercial use for that. So that waste is a large but unknown cost.

The One Pot process gets rid of the “precursor." You can go straight from raw metal to cathode. No sulfide, no sodium, and less waste. We don’t know how much that waste costs, but it will be a lot. This is a game changer on its own for the global EV battery industry. It means:

- Less energy consumed.

- Less material cost.

- More friendly to the environment.

This summer, Elon Musk made the request for green nickel. Removing this waste from the process is a step in that direction.

Lower Input Cost

There is another big advantage of removing the precursor step. The One Pot process can take the cost of raw materials way down. Raw materials make up somewhere between 70 and 80% of the cost of the cathode. One Pot can reduce that by 15-30%.

How? First, the nickel. Right now, nickel is refined into nickel sulphate before it can be used in battery production. One Pot can use nickel metal as an input. Wood Mackenzie Research Director Andrew Mitchell estimates the cost of producing nickel sulphate from nickel metal is US$3,500 per ton Ni. Removing that cost drives down overall cathode costs by 15%.

The same applies to manganese and cobalt. Pure metal can go straight into the process. There is no need for refining the metal to sulphate and the costs associated with it. This would be a big disruption to the existing cost centers that have sulphate production built into their process. It could be a disruptor for new entries that can compete on lower material costs without the need to build out the refining capacity.

Next, the lithium. The One Pot process is agnostic to the form of lithium that is used. Lithium carbonate, lithium hydroxide, it doesn’t matter. With existing technology, some cathode materials require that lithium carbonate be used as a raw material while others require lithium hydroxide. High-nickel content cathodes, which tend to be more expensive, need lithium hydroxide.

Carbonate can be as much as $2,000 per ton cheaper than lithium hydroxide. Shifting to lithium carbonate could take another 5% out of costs for nickel-based cathodes.

Go-to-Market

Nano-One has created a better way of making a battery cathode. Now they have to take it to market. They can do it in two ways. First, they can use their process on existing materials–making those materials better, cheaper, and cleaner. This is what they are doing with LFP and NMC. Both are already standard cathode materials.

LFP is the lowest cost battery type. It is durable and stable over a long period. But it can only handle low voltages and has a low energy density (meaning it takes up more space). NMC has better energy density than LFP, but also has a shorter life span and costs more to make. The One Pot process improves both.

For NMC, it can increase the cathode life by 4 times compared to an uncoated cathode. And it brings down the cost:

Source: Nano One Investor Presentation

For LFP, Nano One can make the cathode cheaper and last even longer. Nano One has a partnership with a Chinese company called Pulead Technology Industry, a large supplier of LFP cathodes for e-buses and grid storage. The partnership is focused on improving the manufacturing to take out costs.

One Pot can do a lot for existing battery materials. But Nano One has another way of making an even bigger splash – by creating a better cathode. The company thinks they have done just that – In January, Nano One patented a new cathode material: lithium nickel manganese oxide (LNM). This material is also referred to as “high voltage spinel” (HVS) because it can operate at a whole volt higher than existing cathode materials – up to 4.7 volts.

One volt is actually a big deal. Battery makers have been trying to create a higher voltage battery out of LNM for years. But they run up against a wall – at higher voltages the material degrades faster and battery life plummets. But Nano One has overcome that. By using the One Pot process to create an LNM cathode, together with an off-the-shelf electrolyte and anode, Nano One has found a combination that works. And now Nano One has patented the process.

Nano One has shown that their LNM battery can last up to a thousand fast charge cycles. Think of one charge cycle = one tank of gas refill. So if you fill up the gas tank in your car once a week, that’s an EV battery equivalent of lasting 19.23 years. Now, that’s my math; I’m pretty sure the company would not phrase it in such a way — they’re quick to say “Lots more testing to do before we can say that.” But that is what it really means.

And let’s talk about “Fast." Right now, a gentle charge is ten hours. A more aggressive charge is one hour. But there’s the possibility that the new Nano One spinal can charge in 12 minutes with limited degradation of battery life (This is still just lab scale, so it may end up being a bit longer). If you tried that on an existing lithium battery you would damage it.

LNM (or HVS) is also cobalt free. Cobalt is a big problem for battery manufacturing because it comes from countries that use child labor. The Democratic Republic of the Congo (DRC) is now tracked by both industry and NGOs and they want it stopped. Sourcing cobalt outside of these countries is expensive. Nano One has the first lab scale battery with no cobalt. Problem solved.

All this, and a higher voltage, too – which has big implications of its own. Consider that a power drill operates at 18 volts. With existing batteries, you need 5 cells to run that drill. With the LNM battery, you will need 4. Translate that to a car or a bus – 4 cells instead of 5 — and you’ve just reduced the battery footprint by 20%. Smaller, lighter, and cheaper.

Nano One’s LNM cathode is a brand-new material. Nano One announced the patent in January. Evaluations with EV OEMs (Original Equipment Manufacturers) and battery supply chain companies are taking place now. Those evaluations will take time. But the pay-off could be huge. We are talking about a candidate to be the next generation of batteries: a battery that lasts longer, charges faster, and operates at a higher voltage.

Patents and Partners

All of this is patented. The One Pot process is patented. The LNM material is patented. The LNM battery design using the off-the-shelf anode and electrolyte is patented. The company has 16 patents right now, and more applications pending. There is the partnership with Pulead. There is a partnership with Volkswagen (VWAGY) – focused on improving the durability of the cathode.

There is a partnership with Saint-Gobain (CODYY), a French multinational. And there is a recent Joint Development Agreement deal with the (as of yet unnamed) multi-billion-dollar Asian cathode material producer.

Nano One has described the JDA as “developing and evaluating cathode materials." That language suggests the target here is a new material, like LNM, where a deal would be a game-changer.

CONCLUSION

I hope I’ve made this simple; I’ve tried to explain the features of the NNO technologies. The benefits don’t need explaining, yet deserve reiterating:

- Much longer-lasting battery.

- Much faster charge times.

- Much lower cost battery.

- Much more environmentally-friendly.

I couldn’t see all of this back in January, but I could see enough to know this stock could become a major player in one of the three largest trends of 2020 (EVs, gold and COVID-19 trade). And it has worked well so far.

With $28 million cash, they get to decide their own destiny–unless one of a dozen automakers, major OEMs, parts companies, or nickel miners decides to buy them out first.

Disclaimer: Under no circumstances should any material