More Than A Pretty Face

The realization, that the longest bull market in history is more than simply a monetary liquidity phenomenon, struck me while I was looking for correlations between various ratios (in this case, the tech:financial ratio) and the SPX.

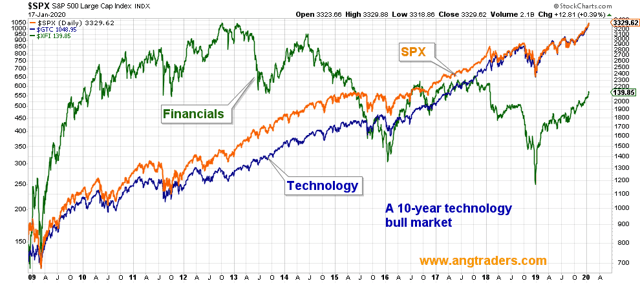

... notice in the chart below how closely technology has tracked the SPX, while financials have done their own thing for most of the bull market. This makes us consider the possibility that this 10-year (so far) bull market has not been just about monetary policy. It has been about investors making bets on the future of our economy; technological knowledge. It supports what Alvin Toffler predicted more than 40-years ago, that the knowledge economy, not manufacturing, would be the future economy of the 1st world.

As long as liquidity is available, investors will continue to fund the growing knowledge economy, and as long as that is happening, the bull market has fundamental reasons to keep going.

(Click on image to enlarge)

Now we need infrastructure spending on ...education, healthcare, communication, etc....so the populace can participate in, and help grow the new knowledge economy.