Monthly Dividend Stock In Focus: Shaw Communications

Shaw Communications (SJR) is a rare stock. It is based in Canada and is the only telecom stock with a monthly dividend. The stock is listed in both New York and Toronto, and we’ll be using the latter throughout this article unless otherwise noted.

While the U.S. telecoms like Verizon (VZ) and AT&T (T) pay quarterly dividends, Shaw’s monthly payouts allow investors to compound their dividend growth more quickly.

Indeed, Shaw is one of just 41 stocks that pay monthly dividends.

The other advantage for Shaw is it is outside the highly-competitive U.S. wireless market.

Shaw is growing subscribers and revenue, which fuels its 4.3% dividend yield. In addition, its impressive growth leaves the possibility for dividend increases moving forward.

This article will discuss Shaw’s business model and why the stock could be an attractive option for income investors.

Business Overview

Shaw is a diversified telecommunications company. The company recently consolidated its four prior reporting segments into just two. Shaw no longer breaks out its services by customer type, but rather into just Wireline and Wireless services.

(Click on image to enlarge)

Source: Investor Overview Presentation, page 3

In terms of service revenue, Shaw’s segment breakdown is as follows:

- Wireless (18% of revenue)

- Wireline (82% of revenue)

Shaw provides customers with a wide variety of services, including satellite video, fiber-coax network connectivity, and mobile phone services, among others. The company serves consumers and small to medium businesses in its service area, which includes much of Canada. The bulk of the company’s revenue is from consumers.

Shaw has struggled a bit in recent years to grow earnings as it has undergone a strategic transformation.

(Click on image to enlarge)

Source: Investor Overview Presentation, page 6

Shaw, in the past three years, has acquired Freedom Mobile, divested its former media business, acquired wireless spectrum licenses from Quebecor, and divested its ViaWest business. These changes have left the company more focused on its long-term goals of sustainable growth.

Going forward, we believe there is still plenty of growth potential for the company.

Growth Prospects

The company’s Q1 earnings report was released on 1/14/19 and results were strong. Revenue was up nearly 9% and normalized operating income rose 13.5%.

Wireline revenue was essentially flat with the comparable year-ago period, but strong growth in the wireless business offset that lack of growth. Cost reductions in the wireline business are bearing some fruit, and margins are improving as a result.

Earnings-per-share came in at 36 cents in Q1 against 23 cents in last year’s Q1. Our estimate for 2019 earnings-per-share remains unchanged at $1.40 after what was a strong Q1 report that shows Shaw is on track with its growth plans.

(Click on image to enlarge)

Source: Investor Overview Presentation, page 12

Management provided the above guidance for fiscal 2019, which is largely unchanged from our prior assumptions. The good news is that free cash flow should grow substantially, helped in part by lower capital expenditures.

In addition, continued revenue growth and margin expansion should help drive earnings higher, marking a year of recovery after just $1.01 in earnings-per-share in fiscal 2018.

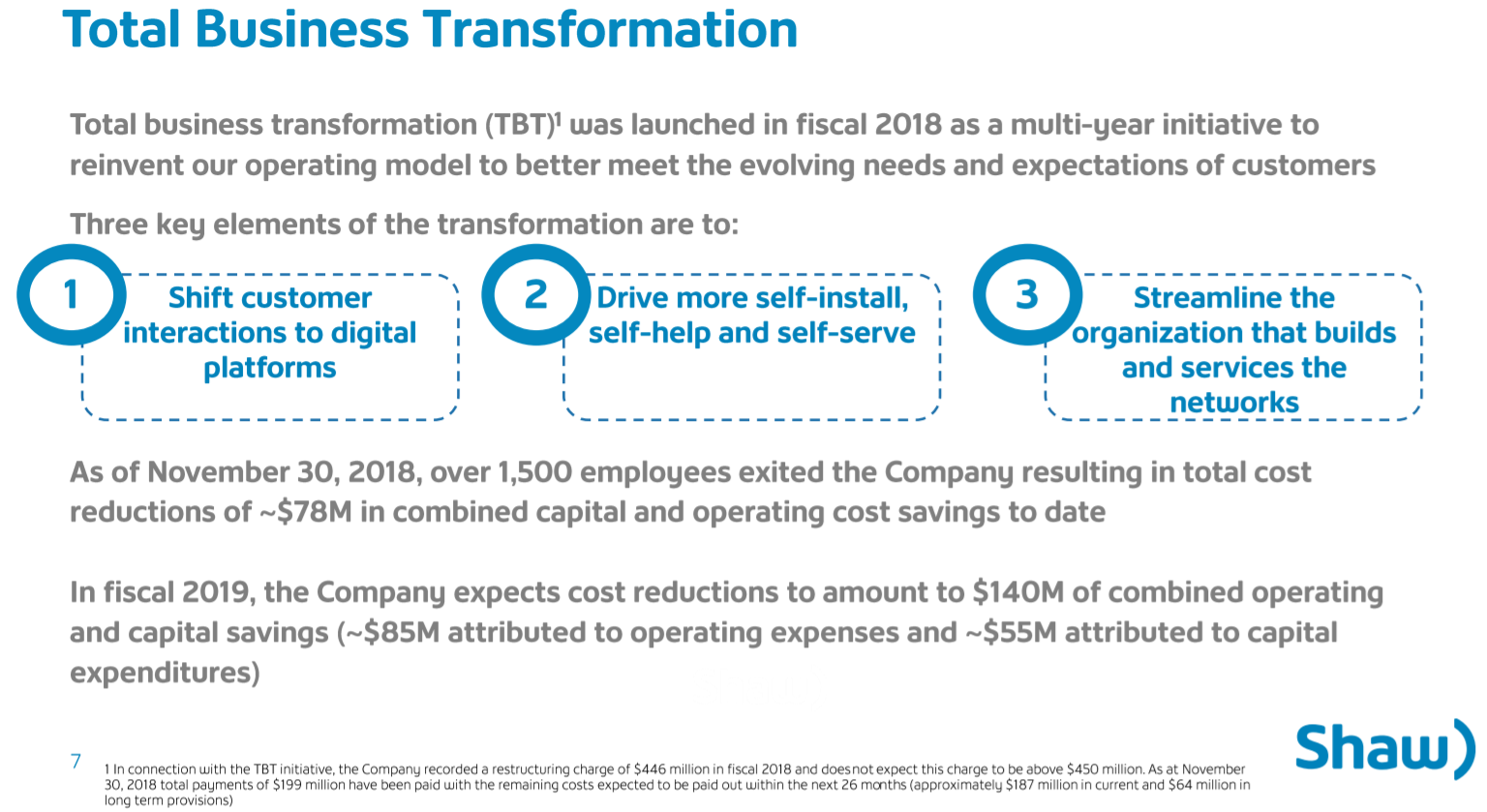

(Click on image to enlarge)

Source: Investor Overview Presentation, page 7

One way we think Shaw will continue to grow earnings, outside of its impressive top-line gains, is through its relatively recent strategy called Total Business Transformation. Essentially, Shaw is looking to reinvent its operating model in order to not only better meet the needs of customers but to reduce costs at the same time.

This will help drive customer engagement, which should hopefully lead to better retention rates, and it is already saving significant amounts of money from this program as well.

Savings should be $140 million or so in fiscal 2019 from this program, which is on top of the $78 million it saved last fiscal year. This will help improve not only earnings but free cash flow as well via lower capital expenditures.

In total, we see Shaw growing earnings at 7% annually for the foreseeable future through a mix of revenue growth and margin expansion. Fiscal 2019 is an important first step towards this growth and we are optimistic about the company’s prospects.

Dividend Analysis

Shaw’s current monthly dividend rate is approximately $0.098 per share in Canadian dollars. On an annualized basis, this comes out to roughly $1.19 per share and is consistent with its dividend rate for the past four years.

Of course, investors should consider that since Shaw is based outside the U.S., the dividend is exposed to currency risk as the dividend is declared in Canadian dollars.

The dividend rate is subject to change, once it is translated back into U.S. dollars. Based on prevailing exchange rates, Shaw’s dividend comes out to approximately $0.88 per share in U.S. dollars, which is also consistent with recent years.

Based on the stock’s current price of $27 Canadian dollars and $20 in the US, the dividend yield is 4.3%. That is lower than telecom giant AT&T and right on par with Verizon, but Shaw has the added advantage of monthly payouts. In that context, Shaw may be slightly more attractive than Verizon for some investors.

Another important consideration for investing in foreign companies is withholding taxes. Dividends received in Canadian dollars are typically subject to a 25% withholding tax. However, there is an exception for Canadian stocks – the withholding tax is waived for U.S. investors who hold the stock in a qualified retirement account, such as a 401(k) or IRA.

Shaw’s history of returning capital to shareholders is significant, even if it hasn’t raised the payout since 2016.

(Click on image to enlarge)

Source: Investor Overview Presentation, page 10

The dividend was raised briskly up until 2016, but Shaw’s lack of earnings growth has caused the company to pause on payout increases. Indeed, this pause was necessary given the deterioration in the company’s ability to finance the dividend.

Fiscal 2018 free cash flow, for instance, was $411 million, but the dividend cost $595 million. When we view the dividend of $1.19 per share in the context of earnings-per-share, which came in at just $1.01 last year, we see a similar picture.

We do not believe the dividend is in danger of being cut at this point. Shaw’s free cash flow guidance and earnings outlook have both improved significantly and we see the company growing its way out of the precariously financed dividend situation.

This year should be the last one that the company’s ability to pay the dividend is somewhat questionable, and we see dividend safety improving in 2020 and beyond as a result.

Certainly, investors would have liked dividend increases in the past few years, but Shaw simply couldn’t afford it. Now, we believe those days to be over and growth in the payout can resume at some point in the relatively near future.

Final Thoughts

When investors think of telecoms, they likely think of AT&T and Verizon. These are both very strong dividend stocks, but there may also be strong telecom stocks outside the U.S. that are worth considering.

Shaw has a strong business model, growth potential thanks to revenue increases and margin expansion, and its 4.3% yield is now safer than it has been in recent years. Plus, Shaw gives investors the added bonus of dividend payments each month.

Overall, we see Shaw as attractive for investors that want a relatively high yield that is also paid monthly, although there are certainly stronger choices for dividend growth potential.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more