Monthly Dividend Stock In Focus: Permian Basin Royalty Trust

Income investors often find high-yielding stocks to be attractive, due to the income that these investments can produce. But sometimes the need for income can blind investors to the issues with the company itself. If this is the case, then investors can be blindsided when the company cuts its dividend.

The same can be said for monthly dividend-paying companies. Investors might overlook weak fundamentals with a company in order to obtain monthly dividend payments. Monthly dividend stocks can be appealing as they create more regular cash flow for investors.

But investors shouldn’t buy a high yield monthly dividend-paying stock simply because of its monthly payments. This is particularly true when it comes to oil and gas royalty trusts.

Permian Basin Royalty Trust (PBT) fits the description of a high yield monthly dividend stock that should be avoided. Even after multiple dividend cuts this year, the stock offers a nearly 6% yield, but this doesn’t make up for a 34% decrease in share price over the last year.

This article will look at Permian Basin’s business, growth prospects and dividend to show why investors should avoid this stock.

Business Overview

Permian Basin holds an overriding royalty interest in several oil and gas properties in the United States. The trust is a small-cap stock that trades with a market capitalization of less than $154 million. The trust has oil and gas producing properties in Texas.

The trust was established in 1980 and has a 75% net profit royalty interest in the Waddell Ranch properties. These properties consist of 332 net productive oil wells, 106 net producing gas wells, and 120 net injection wells.

Permian Basin also holds a 95% net profit royalty interest in the Texas Royalty Properties, which consist of approximately 125 separate royalty interests across 33 counties in Texas covering 51,000 net producing acres.

As of January 1st, 2020, the trust had approximately 4.0 million barrels of proven oil reserves and 5.4 billion cubic feet of proven natural gas reserves remaining. Permian Basin estimates that the trust has a life span of 9 to 11 years remaining.

Growth Prospects

As an oil and gas trust, it goes without saying that Permian Basin will perform in direct relation to oil and natural gas prices. Investments like Permian Basin are designed as income vehicles. Higher energy prices will likely lead to higher royalty payments, driving up demand for units. The same, however, is also true. Lower energy prices will lead to lower dividend payments.

Distributions are based on the price of natural gas and crude oil. Permian Basin is impacted in two ways when the price of either declines. First, distributable income from royalties is reduced, lowering dividend payments. In addition, plans for exploration and development may delayed or canceled, which could lead to future dividend cuts.

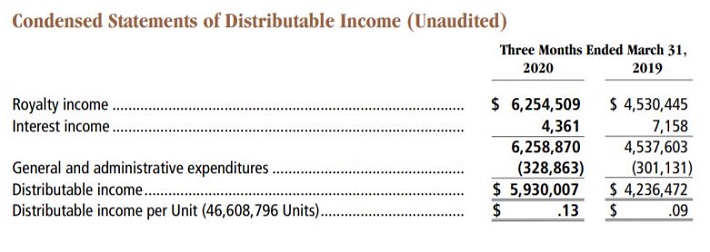

Permian Basin reported first-quarter results recently.

(Click on image to enlarge)

Source: First Quarter Report

Permian Basin received $6.25 million in royalty income during the first quarter of 2020, a 38% increase from the first quarter of the previous year. This growth was primarily attributed to higher oil prices. The average oil price was $58.13 compared to $44.47 in the previous year.

Offsetting this was a 0.5% reduction in oil production declined. Natural gas prices declined 53% to $1.60 Mcf. Given the steep decline in pricing, it is not surprising that gas production fell nearly 10%.

Dividend Analysis

Royalty trusts are usually owned for their dividends. These investments are not likely to have multiple decades of dividend growth like the more well-known dividend-paying companies like Johnson & Johnson (JNJ) or Procter & Gamble (PG). That is because trusts like Permian Basin depend entirely on the price of oil and gas to determine dividend payments.

Listed below are the trust’s dividends per share over the last seven years:

- 2013 dividends per share: $0.87

- 2014 dividends per share: $1.02 (17% increase)

- 2015 dividends per share: $0.34 (67% decline)

- 2016 dividends per share: $0.42 (24% increase)

- 2017 dividends per share: $0.63 (50% increase)

- 2018 dividends per share: $0.66 (4.8% increase)

- 2019 dividends per share: $0.42 (36% decline)

Dividends come directly from royalties, so higher oil and gas prices will likely lead to distribution growth. Given this, it shouldn’t come as a surprise that shareholders of Permian Basin saw a significant decline in dividends during the 2014 to 2016 oil market downturn.

As oil prices stabilized following this downturn, the dividends returned to growth again. And, as you can see, the dividend growth was extremely high as energy prices improved. Still, dividends haven’t returned to their 2014 level following the last decline in energy prices.

Permian Basin has reduced its dividend four times so far in 2020. While each dividend cut was a double-digit percentage, none was worse that the 89% decrease that took place for the July payment. To be fair, the dividend was higher by 217% the very next month. This helps to illustrate the extreme volatility of the dividend payments.

Permian Basin has distributed or announced a total of $0.1714 of dividends through August. Assuming no change from the August payment through the end of the year, total dividends will be $0.197 per share, which would be a 59% decline from total dividends last year.

This expected dividend per share equates to a yield of 5.8% based on the August 11th closing price of $3.37 per share. This yield looks even better when compared to the 1.8% average yield of the S&P 500 and the 0.64% yield on the 10-year Treasury bond. Shares of Permian Basin offer a yield more than 3 times that of the S&P 500 and 9 times that of the 10-year U.S. Treasury bond.

Final Thoughts

Monthly dividend-paying stocks can help investors even out cash flows compared with stocks that follow the traditional quarterly payments. Monthly payments can also help investors compound income at a faster rate as well.

High yield stocks can provide investors more income, something that is important to those investors living off dividends in retirement. Permian Basin does offer a yield that is considerably higher than that of the market index and Treasury securities.

Investors with a higher appetite for risk might feel that the large dividend increases and nearly 6% yield are a solid trade-off for steep declines that occur when energy prices fall.

That said, Sure Dividend believes that the risk is not worth the reward when it comes to royalty trusts. Permian Basin does offer a monthly high yield but doesn’t provide certainty of what the payment may look like. The dividend payments rely totally on the price of oil and gas. When one or both are down, so are dividend payments. Investors who need steady, reliable income are strongly encouraged to invest elsewhere.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more