Monthly Dividend Stock In Focus: Oxford Square Capital Corporation

Investors looking for high yields might consider buying shares of Business Development Companies or BDCs for short. These stocks frequently have a higher dividend yield that the broader stock market average.

Some BDCs even pay monthly dividends.

Oxford Square Capital Corporation (OXSQ) is a BDC that pays a monthly dividend. Oxford Square is also a very high yielding stock, with a yield of more than 23% based on expected dividends for 2020. This is nearly 13 times the average yield of the S&P 500.

However, investors should always keep in mind that the sustainability of a dividend is just as important (or more important) than the yield itself.

BDCs often provide high levels of income, but there are few that pay as high a yield today as Oxford Square. This article will examine the company’s business, growth prospects, and evaluate the safety of the dividend.

Business Overview

As a BDC, Oxford Square provides funding to smaller companies. The company usually targets companies with annual revenues below $200 million and have a market capitalization or an enterprise value of less than $300 million. Oxford Square typically invest $5 million to $30 million per transaction.

Oxford Square operates as a closed-end, non-diversified investment company. The company is a private equity and mezzanine firm. This means that Oxford Square provides debt and equity financing that gives it the right to convert an equity interest in the company in case of default. This usually takes place after venture capital companies and other senior lenders are paid.

As a closed-end fund, Oxford Square trades much like any typical equity. The share price rises and falls during the trading day, but Oxford Square will not issue additional shares or repurchase existing shares.

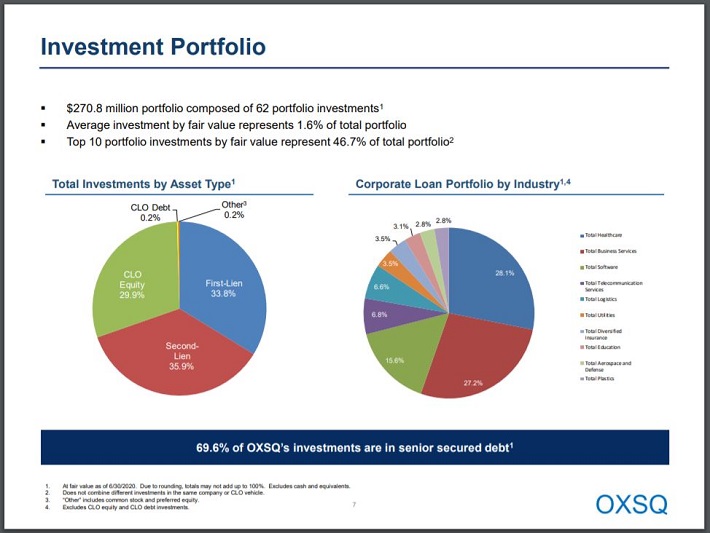

Oxford Square currently has $270.8 million invested across 62 different companies. The company trades with a market capitalization of $130 million today.

Oxford Square’s asset investments are split fairly evenly between three different types.

Source: Investor Presentation, slide 5

Slightly more than one-third of Oxford Square’s investment portfolio is in first-lien assets. This means that the company will be the first to be paid if a borrower defaults.

Second-lien investments make up the largest portion of Oxford Square, accounting for 35.9% of the investment portfolio. Second lien debt is borrowing that takes place after a first lien is already in place. The second lien is second in line to be repaid in case of borrower default with first liens being repaid first.

Just under 30% of the company’s investment portfolio is comprised of junior-debt tranches of collateralized loan obligations or CLOs. CLOs are pooled collection of securities, usually debt instruments that are organized by risk or other characteristics and then marketed to investors. The top three asset types account for 99.6% of the entire investment portfolio.

Growth Prospects

A rather well-balanced portfolio is one of Oxford Square’s most important growth levers. The company isn’t over-reliant on any one type of investment.

It is also positive that first and second lien investments make up two-thirds of the portfolio. These debts have a higher chance of being repaid in the case of a default. Oxford Square has also increased its exposure to first-lien secured debts over the past 12 months. First liens represented 25% of the investment portfolio at the end of June 2019 compared to 34% at the end of this past June.

On the other hand, CLOs are incredibly risky. Most CLO issues have a junk credit rating, which are those rated BBB and below by Standard & Poor’s. The lower the credit rating, the higher likelihood of default.

Fortunately, Oxford Square has taken measures to reduce exposure to this risky asset. At the end of the second quarter of 2019, CLOs accounted for 30% of the investment portfolio at the end of the second quarter compared to 36% of the investment portfolio a year ago.

Increasing exposure to more secure investments while reducing the percentage of investments in the riskier asset is a prudent move for Oxford Square in our opinion.

Also, a good sign for the future is Oxford Square diversified corporate loan portfolio. The company currently has investments in 11 different industries. The top three holdings are healthcare, business services and software, but investments are also made in telecommunication services, utilities, education and insurance. The top three industries make up just under 71% of the total portfolio. Top 10 individual holdings represent almost 47% of the total portfolio.

With investment across a wide breadth of different industries, Oxford Square has a fairly balanced portfolio. The company's top three industries do make up most of the portfolio, but they are in different areas of the economy. This adds some protection in case of a downturn in one industry.

Dividend Analysis

Oxford Square only recently began paying a monthly dividend, with the first being distributed in April 2019. Total dividends paid over the past few years are listed below:

- 2015 dividends: $1.14

- 2016 dividends: $1.16 (1.8% increase)

- 2017 dividends: $0.80 (31% decrease)

- 2018 dividends: $0.80 (no increase)

- 2019 dividends: $0.80 (no increase)

Shareholders have received one small increase and one massive decrease over the past five years. That streak will likely continue for the current year. After maintaining the same dividend through the June payment, Oxford Square announced the third-quarter monthly dividends will be $0.035 per share. This is a 48% decrease from the second quarter monthly distributions.

Shareholders would receive $0.612 in dividends per share in 2020 if the new dividend payment remains constant through the end of the year. This would be a 24% decrease from dividends distributed last year.

While the dividend cut is large, the dividend yield remains very high. This is due in part to a nearly 52% decrease in share price. Using the expected dividend payment for the whole year, Oxford Square offers a dividend yield of 23.3% using the current share price of $2.63.

Final Thoughts

Oxford Square has a solid business model, with diversification across investment asset and industry. The company has also taken steps to build up its less risker asset position while decreasing its reliance on riskier CLOs.

That said, Sure Dividend recommends that risk-averse investors avoid Oxford Square. We believe that this yield is likely unsustainable. The company has shown a history of cutting its dividend in previous years and an addition cut could occur. Extremely high yields above 20% are often a precursor to a cut, as it is a clear signal that the market does not believe the payout is sustainable. We echo these concerns and rate Oxford Square a sell.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more