Monthly Dividend Stock In Focus: Grupo Aval Acciones Y Valores

Grupo Aval Acciones y Valores (AVAL) is a financial services company that operates in Colombia and Central America. The stock also offers a dividend yield of more than 7% at the present moment.

This makes Grupo Aval a member of the high dividend stocks list.

Grupo Aval also pays a monthly dividend, which allows shareholders to receive income on a more frequent basis than the traditional quarterly schedule.

Shares of Grupo Aval have declined nearly 47% from the beginning of the year, which has caused the dividend yield to rise to its current level. But a crashing share price and a soaring yield can often be a warning sign about the underlying company’s business.

This article will discuss Grupo Aval’s business model, its prospects for growth, and whether the dividend is sustainable.

Business Overview

Founded in 1994, Grupo Aval offers a wide variety of financial services and products to both public and private sector customers in Colombia and Central America. The bank has a market capitalization of just over $5.1 billion. The Colombia-based bank provides checking and savings accounts, time deposits, cashier checks, and collection services.

Grupo Aval also provides commercial loans, including general purpose loans and leases, and consumer loans, including payroll, personal and auto loans. The bank also offers pension services, document storage, and payment and collection services. Lastly, Grupo Aval provides customers with investment fund advice and private banking.

Grupo Aval has a heavy presence in Colombia.

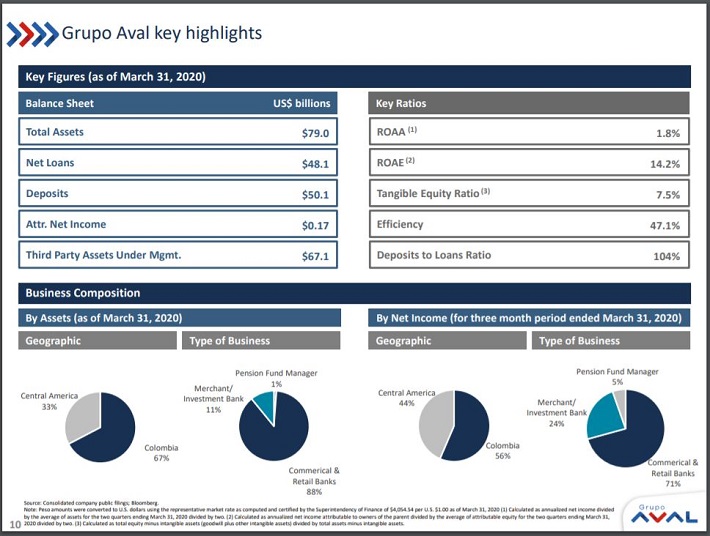

Source: June 2020 Investor Presentation, slide 10.

Two-thirds of assets and 56% of net income came from Colombia in the first quarter of 2020. This means that Grupo Aval’s business will almost always be directly tied to the health of its Colombia segment. A downturn in the nation’s economy would have a material impact on financial results. Fortunately, Grupo Aval has several areas of strength within the regions where it operates.

Growth Prospects

With nearly USD$80 billion in total assets, Grupo Aval is a leading financial institution in the regions it has a presence. The bank has 1,341 branches, 3,535 ATMs and 69 payment collection centers in Colombia and has 762 branches, 2,136 ATMs and 8,860 points of service throughout the rest of Central America.

Grupo Aval has the top market position in nearly every banking category in Colombia and Central America.

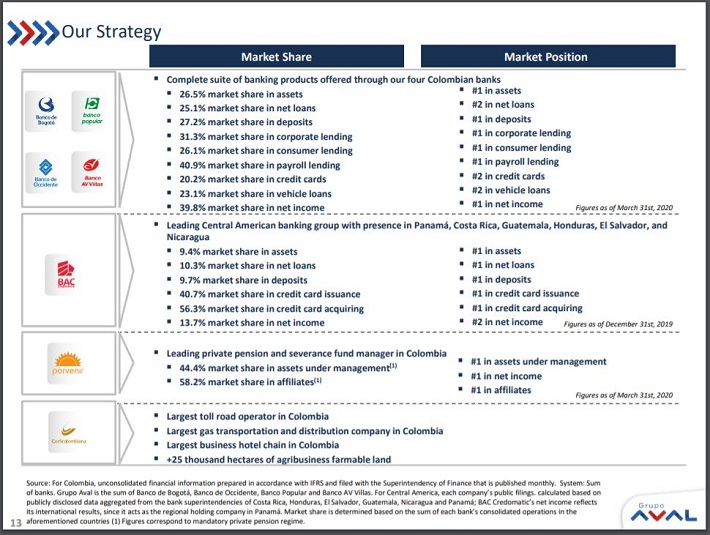

Source: June 2020 Investor Presentation, slide 13.

Grupo Aval has market leadership positions in a number of important categories in Colombia, such as the top spot in assets, deposits, corporate, and consumer lending. Grupo Aval is also the leader in credit card issuance in the nation and no other financial institution in the country has more assets under management.

The bank’s dominance in its main market cannot be overstated. For example, Grupo Aval holds nearly one out of every four vehicle loans in Colombia. The bank also has more than a quarter of all the assets under management for the entire country.

In Central America, the bank has more than 40% of the credit card market and leads its peers in terms of assets, net loans and credit card issuance. And $1 out of every $10 of deposit for the region is in a Grupo Aval bank.

This market leadership has helped Grupo Aval to grow at a very high rate in recent years.

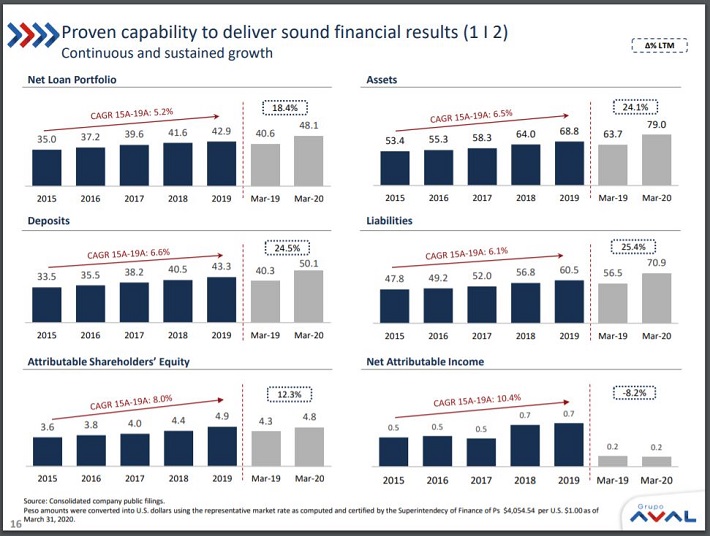

Source: June 2020 Investor Presentation, slide 16.

The bank’s net loan portfolio has increased with a compound annual growth rate of more than 5% from 2015 through 2019 while assets have increased at a rate of 6.5% over the same period of time. Deposits have increased 6.6% annually over the past five years.

This has allowed Grupo Aval to grow net income at rate of more than 10% annually since 2015. These growth rates show that Grupo Aval isn’t resting on previous success and is intent in securing more market share.

Grupo Aval’s balance sheet is strong.

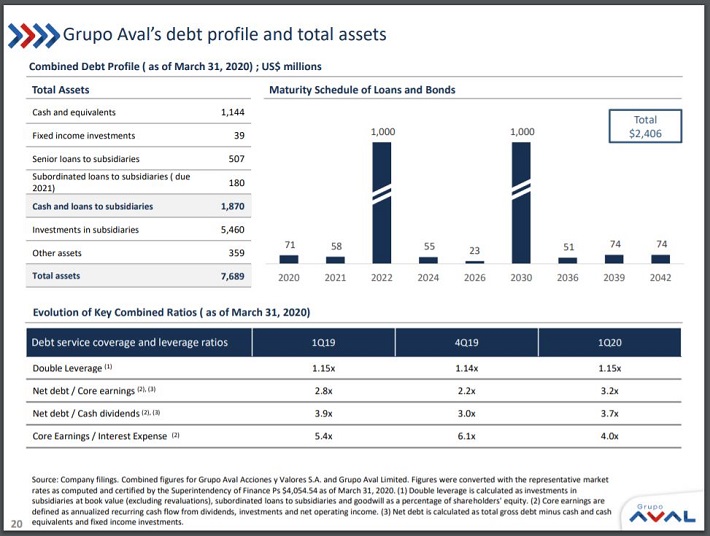

Source: June 2020 Investor Presentation, slide 20.

The bank ended the most recent quarter with nearly $7.7 billion in total assets, including $1.1 billion in cash and equivalents. Grupo Aval has $2.4 billion in long-term debt, but just $129 million due over the next two years. The bank appears well-capitalized and unencumbered by debt.

Also helping Grupo Aval’s business is that the gross domestic product of Colombia has been solid over the years.

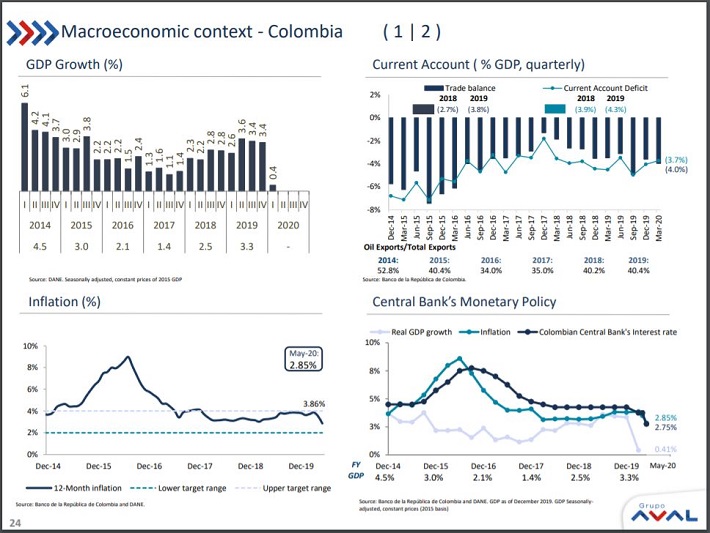

Source: June 2020 Investor Presentation, slide 24.

Up until the most recent quarter, GDP growth for Colombia had ranged from a low of 2.2% to a high of 3.6% over the past eight quarters. And this low growth rate is likely due to the negative impact of the COVID-19 pandemic.

Colombia has averaged GDP growth of 2.8% since 2014, which compares favorably to an average GDP of 2.7% for the U.S. over the same period of time. Many investors may not think of Colombia as a growing economy, but the data suggests otherwise.

Finally, Grupo Aval appears to be a cheap stock at the moment. This is likely due to it being a relatively unknown company operating in a part of the world that many investors might ignore. Only about 600,000 shares trade hands on an average day, suggesting a low level of trading volume.

Based on the current price and expected earnings-per-share for 2020, shares of Grupo Aval has a forward price-to-earnings ratio of just 7.9. Adding in a high dividend yield could make for a robust total return.

Dividend Analysis

Based on dividend payments through July, Grupo Aval is on pace to distribute a total of $0.33 dividends per share in 2020. Using the current share price of ~$4.66, the stock offers a 7.1% dividend yield. This compares quite favorably to the average yield of 1.9% that the S&P 500 currently offers.

The following are the bank’s dividends per share for the past five years.

- 2015 dividends per share: $0.4428

- 2016 dividends per share: $0.3844

- 2017 dividends per share: $0.3989

- 2018 dividends per share: $0.3615

- 2019 dividends per share: $0.3537

Grupo Aval’s dividend has fluctuated over the years, but much of this is due to currency exchange rates. We expect that dividends will continue to vary from year to year due to currency exchange.

That said, we believe it is likely that Grupo Aval will continue to pay a dividend going forward. Analysts expect that Grupo Aval will earn US$0.59 per share in 2020. This equates to a payout ratio of 58% when using expected dividends for the year, which should make the dividend safe from a cut barring a major reduction in earnings.

Final Thoughts

Grupo Aval is a rather unknown stock, but it a leading financial services company in the part of the world where it operates. The bank has the top leadership position in nearly every category of banking in Colombia and Central America.

Grupo Aval appears well managed and has very little debt coming due over the next few years. This should allow the bank to continue to build-outs its business in order to maintain its top ranking in the markets that it has operations.

The share price has been cut nearly in half since the beginning of the year and the bank’s monthly dividends have fluctuated over the years, but the yield is quite high. And the dividend looks safe using earnings estimates for the year.

Banking, in general, can be fraught with risks, especially banks outside the U.S., but Grupo Aval appears to be a solid investment for those with a higher tolerance for risk and a desire for monthly dividend income.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more