Monthly Dividend Stock In Focus: Global Water Resources, Inc.

Utilities are very popular among income investors. Their steady revenue and earnings provide a stable base from which the companies can pay excess capital to shareholders. This tends to lead to reasonably high dividend yields and safe payouts, both of which are attractive for investors seeking current income.

Global Water Resources (GWRS) is a water utility based in Arizona that went public in 2016. It has a nearly 3% dividend yield, so it qualifies as a decent income stock when the broader market yields about 2%. In addition, Global Water pays its dividend monthly instead of quarterly.

Despite the solid yield and monthly payments, there are pressing issues that make the stock somewhat less appealing. The outlook for growth is challenged for Global Water, and given the current level of earnings, we are also concerned about payout safety.

Given this, we are cautious on Global Water’s prospects as an investment.

Business Overview

Global Water Resources is a water resource management company. It owns, operates, and manages water, wastewater and recycled water utilities in Phoenix, Arizona. The company’s strategy is called total water management, which simply means it wants to own the entire water cycle.

In essence, this is operating water, wastewater, and recycling facilities in the same geographic area to conserve water, but also maximize the economic value of water by owning the entire life cycle. The company focuses on communities where it expects population growth, but also where it expects water demand to exceed supply.

Global Water owns 12 water and wastewater utilities in Phoenix and has nearly 50,000 active service connections. The company believes it has capacity for hundreds of thousands of service connections, but its current scale is quite small.

Annual revenue is about $35 million, and the stock trades with a market capitalization of ~$230 million.

Source: Investor relations

The company reported first-quarter earnings in early May and results showed strong top-line growth, but earnings continue to be a problem. Revenue increased 6.6% to $8.2 million in Q1 thanks to organic connection growth, combined with an increase in rates charged to customers. Active connections were up 4.7% to 46,227 in Q1, so the company has continued to see meaningful contributions to growth from volume and pricing increases.

However, that hasn’t necessarily translated into profit growth. In Q1, operating expenses fell 1.4% to $6.4 million, thanks to lower general and administrative costs, which were partially offset by higher operations and maintenance costs. Maintenance costs have been a nearly-constant source of margin deterioration for Global Water as it has a highly complex network of assets that must be maintained and upgraded on regular occasions.

In addition, the company has an enormous amount of debt that requires servicing, wiping out much of what little profitability it has. At the end of Q1, the company had $232 million in long-term liabilities, with about half of that in traditional long-term debt and the balance in other non-current payables. This not only creates substantial leverage for the company, but it means that interest expense is sizable as well.

Indeed, operating income in Q1 was $1.8 million, but interest expense was $1.3 million, leaving just $560k in pre-tax income. In total, Q1 saw net income decline by nearly half year-over-year, to just two cents per share.

This high level of debt and interest expense means that Global Water, in our view, will struggle to produce earnings growth in the coming years.

Growth Prospects

The strategy behind Global Water’s asset base makes sense; areas with population growth and relatively scarce water supplies should see ever-rising demand for water. Global Water is positioned to do that, but the expense of doing so has proven too much.

In addition, it is present essentially in one metropolitan area in the southwest US, so geographic diversification is as poor as it can be. Even if Phoenix continues to see demand for water move higher, Global Water has proven that the expense of operating its utilities has generally kept pace with revenue growth, which has led to lackluster earnings.

The company has seen its total connections grow over time, but that growth has been fairly slow. Indeed, while connections have grown from 32k to 46k, that growth took 13 years, so we don’t believe organic growth will be a meaningful contributor to the top line moving forward. Global Water continues to see low-single-digit expansion in connections, but the expense required to build out the network and maintain it has proven quite costly.

Source: Investor relations

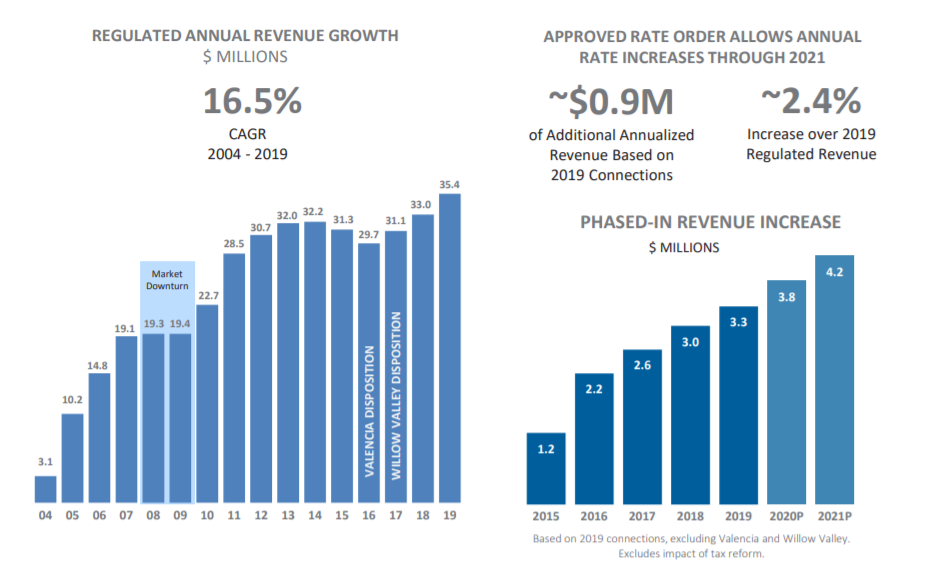

From 2004 to 2019, Global Water achieved a 16.5% compound annual growth rate in revenue, but that is somewhat deceiving. Most of that growth took place in the earliest years of this period, as illustrated by the fact that 2019 revenue was just $3.2 million higher than 2014’s revenue.

There were two dispositions in that period, but the total growth rate in revenue is unreasonable to expect moving forward, as the company is much larger now and will have a more difficult time coming close to that sort of revenue growth.

On the right side of the graphic, we can see organic growth contributions from rate increases, which amounts to another low-single-digit gain annually, on average. Like other utilities, Global Water is able to pass through approved pricing increases to its customers, which is a steady, long-term tailwind to revenue.

Putting all of this together, we see a path to mid-single-digit revenue growth, but with much of that offset by rising operating and maintenance costs, as well as the prodigious interest expense the company must pay to service its debt.

Dividend Analysis

Global Water has paid a monthly dividend since May of 2016, with a handful of raises in that time from the initial two cents per share monthly. The current payout is $0.0241 per share monthly, or $0.2892 per share annually, and is continuing to be paid through the current COVID-19 impacted environment.

This results in a current yield of 2.8%, which is respectable for a utility. However, we are concerned about dividend safety because Global Water’s earnings haven’t covered the dividend in recent years, or even gotten close.

Earnings for 2018 and 2019 came in at just $0.15 and $0.10, respectively, or about half and one-third, respectively, of what the company paid out in dividends for those years. In other words, depending upon the year, Global Water is paying out two or three times its net income in dividends. That means it has a significant shortfall and must fund the payout through other means, including debt and share issuances.

We expect about $0.10 in earnings-per-share for Global Water, and with the dividend still set at about three times that level, we are quite concerned about the company’s ability to continue to pay the current dividend for the long-term. It simply doesn’t make enough money to pay this level of dividend at the current level of earnings. If the company does not grow its earnings-per-share above the dividend, the payout will either need to be cut, or it will continue to fund the dividend with expensive sources of capital.

Final Thoughts

We think Global Water has a relatively tough road in front of it when it comes to earnings growth. We believe revenue growth is all but assured given the sources of organic growth the company possesses. However, we also see rising interest expense and maintenance costs as keeping a lid on margins, as it has for years.

With the dividend at nearly 300% of earnings and the yield at 2.8%, we see the risk of owning the stock as far outweighing the reward. Despite its attractive monthly payouts, we do not recommend the Global Water Resources stock.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more