Monthly Dividend Stock In Focus: Exchange Income Corp.

The industrial aerospace industry is not well-known for high dividends or even dividend growth, both in the U.S. and Canada.

Exchange Income Corporation (EIF.TO) (EIFZF) is a unique Canadian business which acquires companies in the Aerospace & Aviation and Manufacturing sector.

The acquisition and growth strategy of EIC has allowed the company to reward shareholders with 13 annual dividend increases, with a growth rate of 5% annually over the past 15 years. Combined with EIC’s high dividend yield of 6.4%, this stock would pique the interest of any income investor.

With a yield more than three times the average dividend yield of the S&P 500, EIC is a member of the short list of publicly-traded securities with 5%+ dividend yields.

You can see the full list of ~400 stocks with 5%+ dividend yields here.

Beyond its high dividend yield, EIC is also quite unique because it pays monthly dividends, instead of the traditional quarterly distribution schedule.

Monthly dividend payments are highly superior for investors that need to budget around their dividend payments (such as retirees).

There are currently only 41 companies with monthly dividend payments. You can see the full list of monthly dividend stocks below:

Exchange Income Corporation’s high dividend yield and monthly dividend payments are two big reasons why this company stands out to income investors.

That said, proper due diligence is still required for any high yield stock, to ensure that its payout is sustainable.

Business Overview

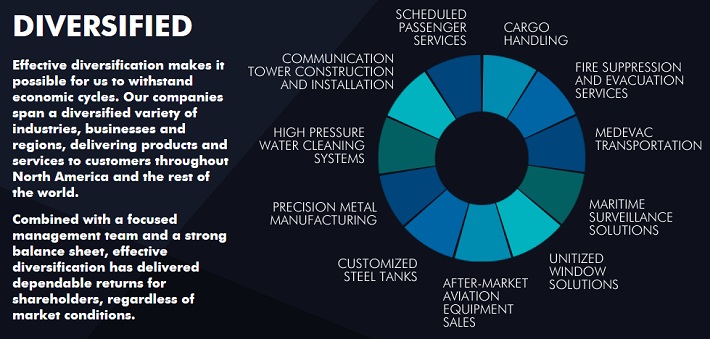

Exchange Income Corporation is a diversified, acquisition-oriented corporation focused on opportunities in aerospace, aviation services and equipment, and manufacturing. It is headquartered in Winnipeg, Manitoba.

EIC has a market capitalization of CAD $1.1 billion ($824 million USD) and is a unique business which has grown from a CAD $7.6 million IPO on the Toronto Exchange in 2004.

The corporation has two operating segments: Aerospace & Aviation and Manufacturing, which are made up of a total of 13 subsidiaries.

(Click on image to enlarge)

Source: Investor Relations

Aerospace & Aviation make up the bulk of EBITDA at $248 million (83% of EBITDA), while Manufacturing contributes $52 million (17% of EBITDA).

The strategy of the company is to grow its portfolio of diversified niche operations through acquisitions, to provide shareholders with a reliable and growing dividend.

The companies acquired are in defensible niche markets, and EIC has made 23 acquisitions since its inception in 2004.

Acquisition candidates must have a track record of profits and strong, continued cash flow generation with committed management focused on building the business post-acquisition.

Growth Prospects

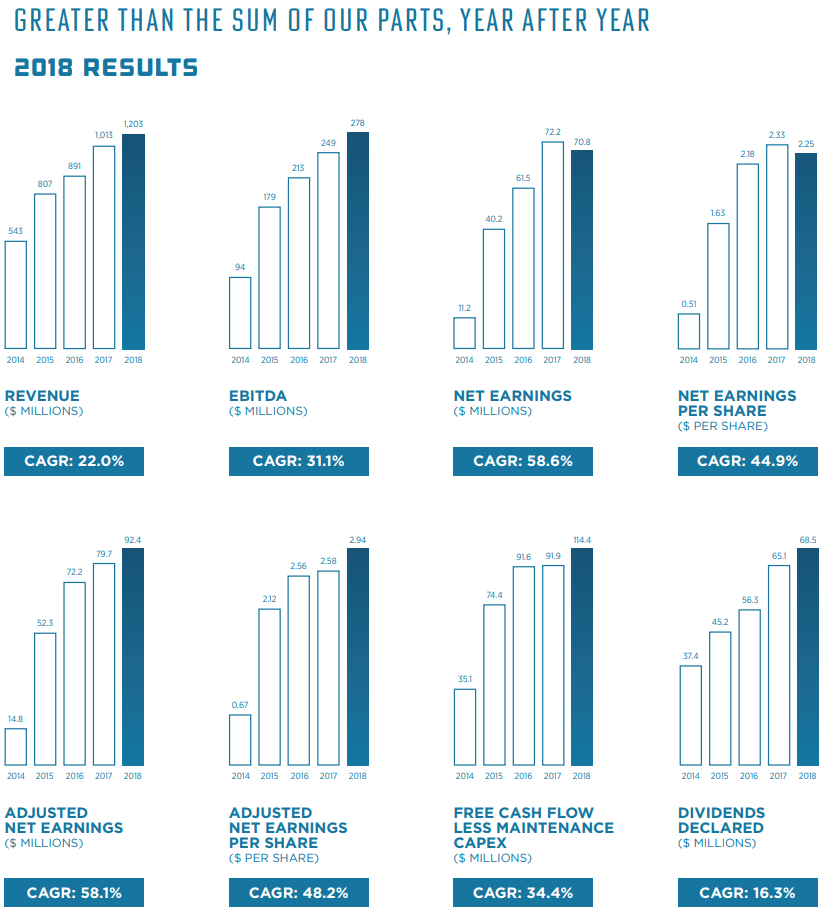

Growth has been stellar in recent years, and EIC achieved record highs across virtually all financial performance metrics in 2018.

Consolidated revenue increased 19% year-over-year to CAD $1.2 billion. Aerospace & Aviation revenue was up 9% YoY, while Manufacturing revenue grew 56%, largely due to their subsidiary Quest Window Systems.

Consolidated EBITDA for 2018 increased 12% to $278 million. Adjusted net earnings per share increased by 14% to $2.94 per share. In U.S. dollars, adjusted earnings-per-share reached $2.20 in 2018.

(Click on image to enlarge)

Source: 2018 Annual Report

EIC has a lot in the pipeline for growth moving forward, driven primarily by prior strategic investments in expansion initiatives with existing businesses. Long-term decision making and investments into their subsidiaries over the years have resulted in strong expected organic growth.

In 2019, the Force Multiplier surveillance aircraft, expansion of the Fixed Wing Search and Rescue (“FWSAR”) contract, new partnerships at Regional One and a large expansion of Quest Window System’s manufacturing capacity will lead to growth.

Quest’s new 330,00 square foot facility in Texas will more than double its current capacity over time. Quest has over a $350 million backlog, which hindered its ability to respond to new opportunities.

However, due to this expansion they can better serve repeat U.S. customers and allow them to meet shorter lead times, expand their customer base, and service new regions.

While there are plenty of organic growth opportunities being realized right now, EIC is pushing to expand their services through numerous RFP’s for both new and incumbent contracts.

EIC continues to assess prospects to grow their subsidiaries through additional investment as opportunities arise throughout the year.

EIC is actively seeking potential companies to acquire, however recent multiples have been inflated in many industries due to the capital availability in the market.

Acquisitions are fundamental to the growth strategy, but EIC only invests in companies which fit their acquisition model. Targets must be profitable, with proven management teams and strong cash flows, operating in niche markets with high barriers to entry.

Maintenance capital expenditures will grow in line with the overall business in 2019. Growth capital expenditures are expected to remain stable in comparison to 2018, which was down from prior years as previous investments paid off. Growth capex, however, will increase if EIC is successful on the multiple RFPs.

Management is guiding for EBITDA to grow 10% to 15% in 2019, while Adjusted Net Earnings per share and Free Cash Flow less Maintenance Capital Expenditures per share will increase by 8% to 12%.

Dividend Analysis

Exchange Income Corp.’s dividend is a large component of total returns, yet the stock price has not caught up to its historical valuation. Today EIC trades at a PE of 15.6, a 44% discount to its 5-year average of 27.7.

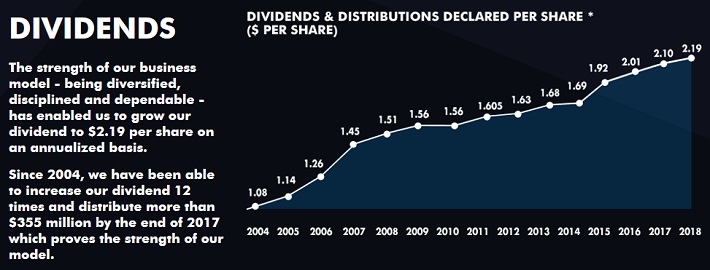

Management has been committed to increasing the dividend and rewarding shareholders, and they have done so since inception.

The cash dividend payment has increased 13 times in the last 14 years, and the outlier year was during the financial crisis, where the company kept the dividend stable.

(Click on image to enlarge)

https://www.exchangeincomecorp.ca/

The company’s dividend has grown at an annual compound rate of 5.1% since the IPO in 2004. Today, it stands at $2.19 per share annually in Canadian dollars.

In U.S. dollars, the annualized dividend payout is approximately $1.64 per share, representing a 6.4% dividend yield. The 5-year dividend CAGR is 5.3%, so EIC’s dividend growth has been stable and consistent over the long term.

Dividends per share were increased by 4% in 2018, and at the same time, adjusted net earnings payout ratio strengthened from 81% to 74%.

For a more accurate picture of payout ratio, EIC likes to use the non-GAAP metric Free Cash Flow Less Maintenance Capital Expenditures payout ratio, which strengthened from 71% to 60%. This 60% payout ratio is the lowest in the history of EIC.

Management also guides that the dividend should continue to grow at 5%, and at the same time that, within the next three years, payout ratio should drop by 10% to 50% on a Free Cash Flow less Maintenance Capital Expenditures basis and to 60% on an Adjusted Net Earnings basis.

Final Thoughts

Exchange Income Corp’s high dividend yield and monthly dividend payments are immediately appealing to income investors such as retirees.

This analysis suggests that the company’s dividend is safe, as measured by the non-GAAP metric Free Cash Flow less Maintenance Capital Expenditures, and that it should grow in the future just as it has in the past decade and a half, around 5%.

The company appears undervalued on a price-to-earnings basis, as it trades 44% below it’s 5-year average price-to-earnings multiple. At the same time, management guides for earnings per share to grow at 8% in the next year.

With that said, Exchange Income Corporation appears to be a good stock pick for income investors and value investors.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more