Momentum-Based Short-term Uptrend In Effect

The market is in a short-term uptrend based on the momentum of the majority of stocks as calculated by the PMO indicator.

However, the major indexes have been going up fairly consistently since early October without much regard for what the majority of stocks have been doing, so it hasn't been a good period for timing

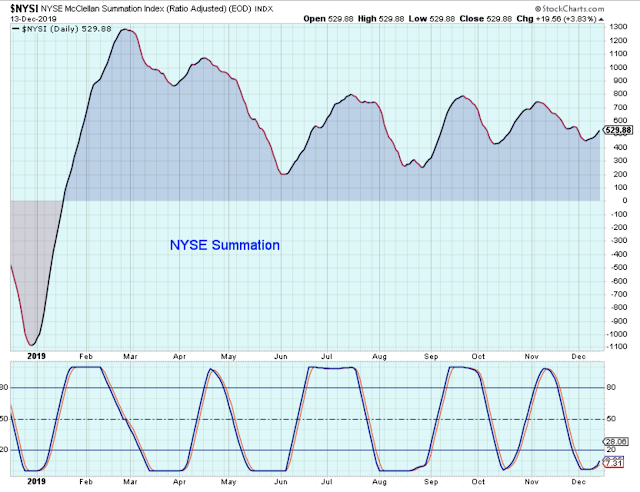

The chart below of the NYSE Summation Index is a different look at similar breadth data that confirms the short-term uptrend.

Here is a look at this very nice uptrend since early October.

All my cash is currently invested and I am sticking with this trend for now, but we all know there will a short-term correction at some point, and I would like to lock in some profits before the correction occurs. Not just to realize gains, but also to have available cash for the next buying opportunity. So I am starting to wonder about when to begin taking profits again?

As a rule-of-thumb, during a strong market, it is generally a good idea to start to get cautious when the NYSE bullish percent exceeds 70% or so. We have a way to go before this indicator flashes that the market is overbought, but I see from previous periods that it can move higher very quickly.

The weekly RSI is also helpful. Any reading over 70 indicates caution to me and we are really close to that level.

So, the bullish percent says we have a bit more time, but the RSI indicates we are close to overbought conditions.

I think that means to me that as soon as the PMO Index reaches up to the top of its range again, then I will need to resist any new purchases and look for opportunities to raise some cash.

What else is interesting in this market? I am always interested in the gold miners although don't ask me why. It seems that market technicians are always mysteriously interested in gold stocks.

This chart shows the ETF forming the left side of a very nice looking rounded base. And the leading stocks in this group are doing well.

The shortage of housing on the two coasts is well known, and with such low rates home building is an interesting theme. It looks like this ETF is forming a bullish handle near the early 2018 high. I like the looks of this.

Outlook Summary

The long-term outlook is weak growth as of Oct. 5.

The short-term trend is up as of Dec. 12.

The medium-term trend for the price of bonds is down as of Oct.11 (prices lower, yields higher).

Investing Themes:

Technology, Biotechnology, Health Care, Clean Energy, Infrastructure, Insurance, Brokers, Payment Processors, Home Construction, Consumer Goods, Water Resources

Strategy During a Bull Market:

- Buy large-cap stocks and ETFs at the lows of the medium or short-term market trends

- Buy small-cap growth stocks on breaks to new highs in the early stages of market trends

- Reduce buying when the market trend is at the top of the range

- Take partial profits when the market uptrend starts to struggle at the highs

- The cardinal rule is never invest based on personal politics because the stock market can do well regardless of which political party is in control

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more