MLP October Outlook

The MLP Update:

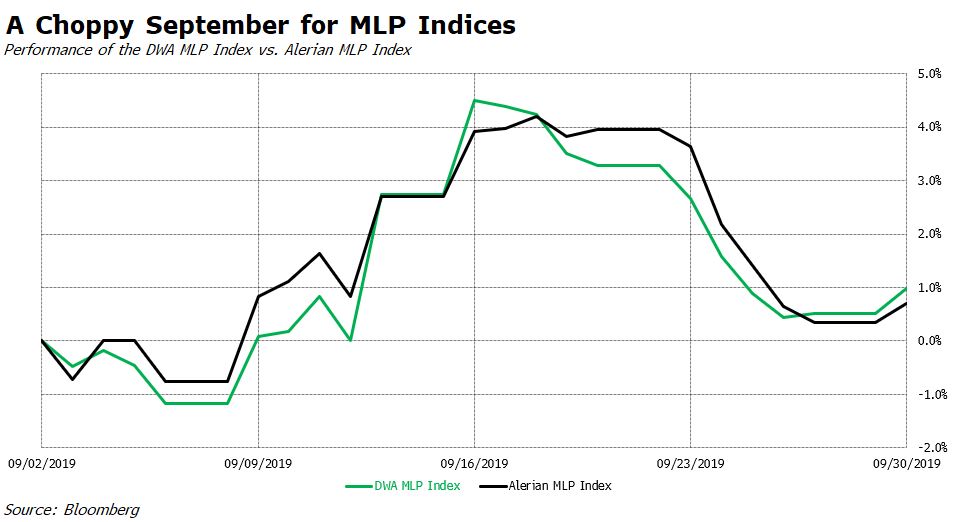

- September was a choppy month for MLPs. DWA MLP and Alerian indices were up over +4.0% each at one point in Sept. before settling for the month +1.0% and +0.7% respectively.

- The U.S. and global oil production have led recent headlines; an attack on Saudi Aramco’s oil facilities, OPEC produced the least amount of oil in a decade for September, U.S. output has fallen since setting all-time highs in April.

- October macro to watch; Saudi/Iran tension & potential for U.S. involvement, U.S. bracing for a possible large stock market sell-off, fragile global economy, U.S./China trade talks.

- October micro to watch; Where does U.S. crude inventories and production go from here? Will OPEC production rebound now that Saudis are back to pre-attack levels? How will Venezuela’s economic strife impact production?

OPEC production dropped to a 10 year low in the month of September.

(Click on image to enlarge)

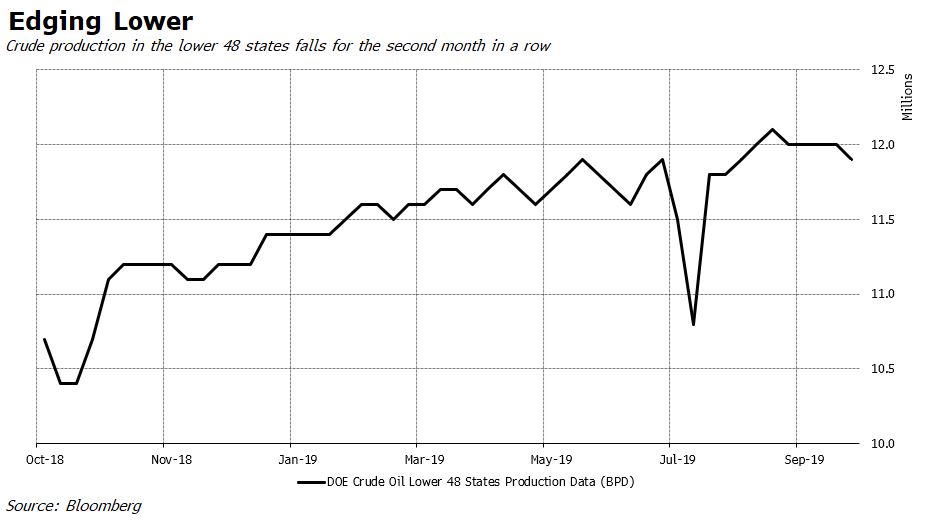

US crude oil production in the lower 48 states has fallen for the second consecutive month after peaking in July.

(Click on image to enlarge)

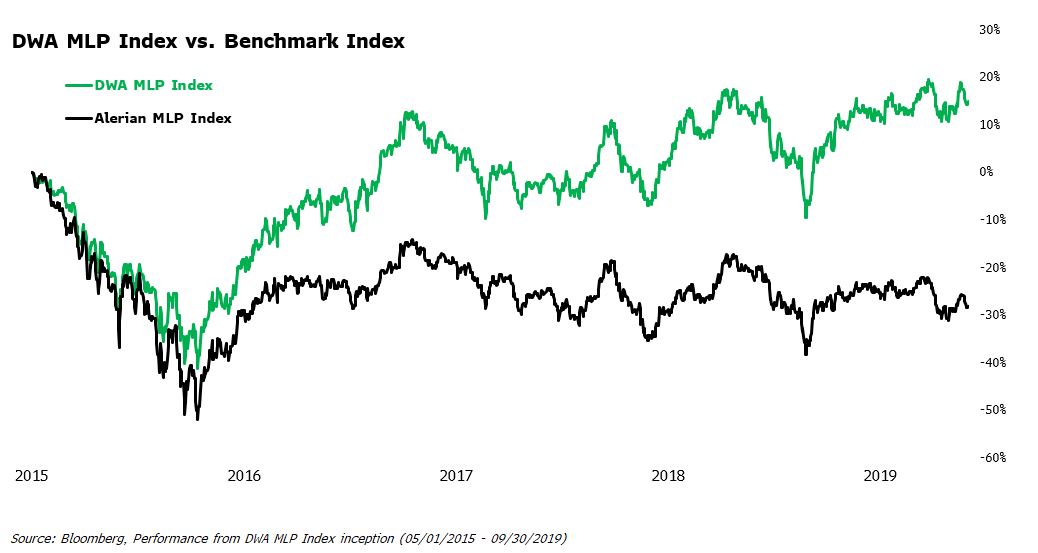

The DWA MLP Index and Alerian MLP Index both peaked over +4% on month but were unable to hold onto these gains but remained positive for September. The DWA MLP Index continues to outperform the Alerian benchmark; September outperformance +0.3%.

(Click on image to enlarge)

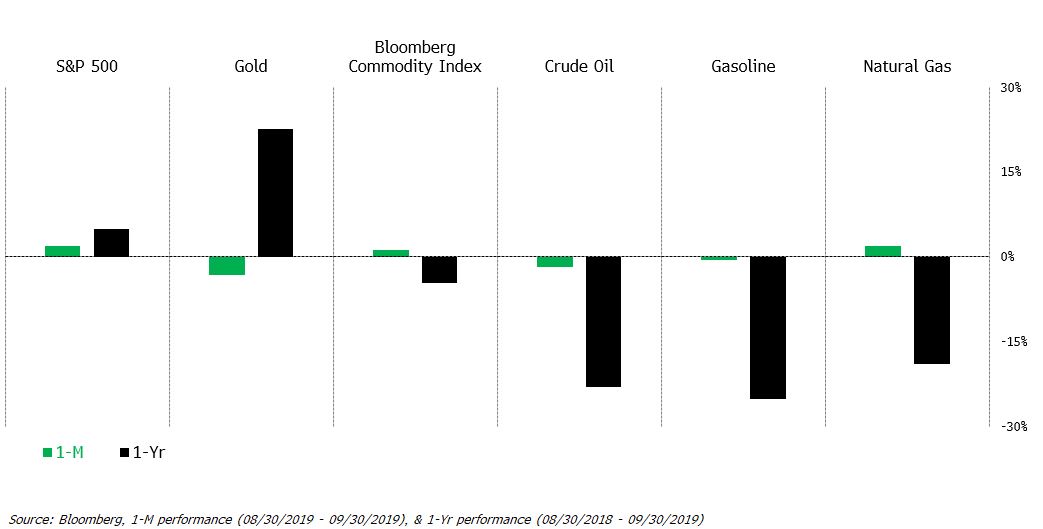

Oil recorded a large one-day gain (spiking 15%) but ended up September almost flat. Brent futures closed the month slightly higher while WTI finished in the red.

(Click on image to enlarge)

Macro Backdrop: Energy, equity, & commodity performance for the month of September & YTD

(Click on image to enlarge)

MLP Spotlight

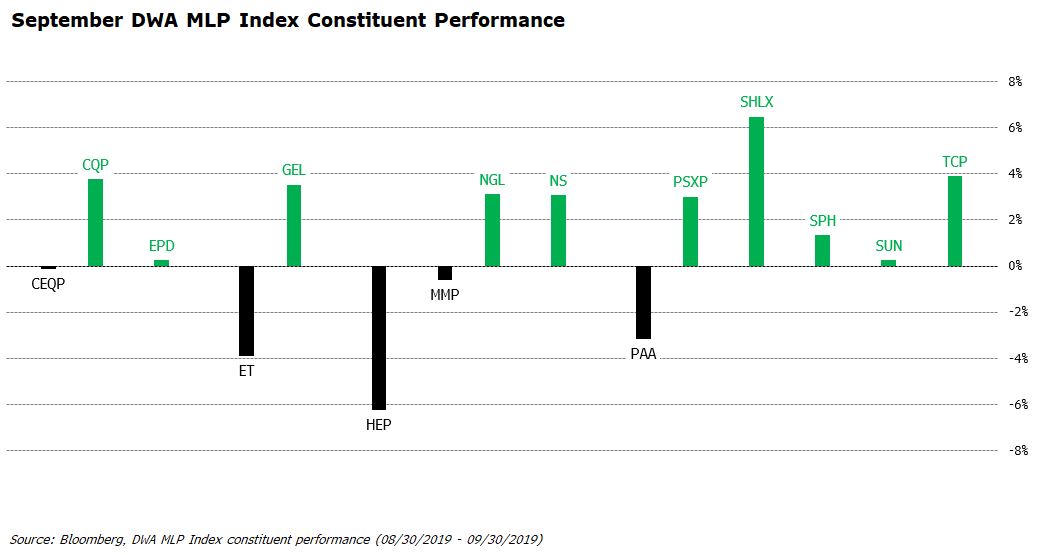

- Energy Transfer (ET) makes a splash – recently announcing the acquisition of SemGroup for $5 billion. This move contradicts the current mindset of other energy players. Volatility in commodity prices has made midstream reluctant to spend big. Energy Transfer, not concerned with this risk, will bolster their crude transportation, terminalling, and export capabilities with the new addition.

- Blackstone (BX) announced that its willing to consider offers for its Cheniere Energy Partners (CQP) stake. The PE firm’s $1.5 billion investment in 2012 is now valued at roughly $9.7 billion.

- Enterprise Products Partners (EPD) unveiled plans to extend its Acadian natural gas pipeline. The expansion project is designed to transport increased volumes of natural gas from the Haynesville Shale to the liquefied natural gas (LNG) market in South Louisiana. Additionally, the project will grow nat. gas production in the Haynesville region (Louisiana/ Texas/ Arkansas) from 11 Bcf/d to 14 Bcf/d over the next 6 years.

- Post Anadarko deal, Occidental Petroleum (OXY) has aggressively tried to sell off assets. The latest attempt to unload came in mid-September with the announcement that it will be selling its stake in Plains All American Pipeline (PAA). In combination with PAA’s general partner, Plains GP Holdings LP (PAGP), the offer could likely generate Occidental roughly $650 million.

- Magellan Midstream Partners (MMP) completed its 135-mile pipeline project connecting Houston and Hearne, Texas which will provide additional capacity of refined products. Magellan also expects to finish construction on new terminals in Midland, Texas and be fully operational sometime next year.

- Genesis Energy (GEL) plans on investing roughly $300 million into its Granger production facility. The MLP is looking to expand soda ash production capabilities by 750 tons per year. Ideally, the project will span from 2019-2022 with the increased ash production available by mid-2022.

- NGL Energy Partners (NGL) announced a deal to purchase Hillstone Environment Partners for from Golden Gate Capital. The acquisition of Hillstone will add more water pipeline and disposal service exposure for the already diversified midstream MLP. The deal is not finalized but expected to close sometime this year.

(Click on image to enlarge)

MLP Index Update:

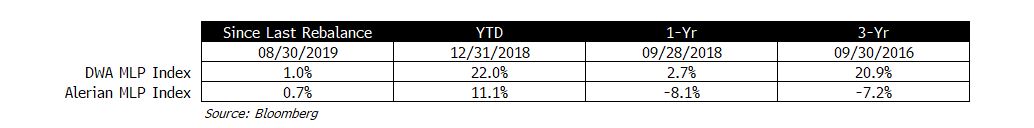

- The DWA MLP Index continues to outperform the Alerian benchmark; September outperformance +0.3% and YTD outperformance +10.9%

- The DWA MLP Index vs. Alerian MLP Index historical total return performance:

(Click on image to enlarge)

(Click on image to enlarge)

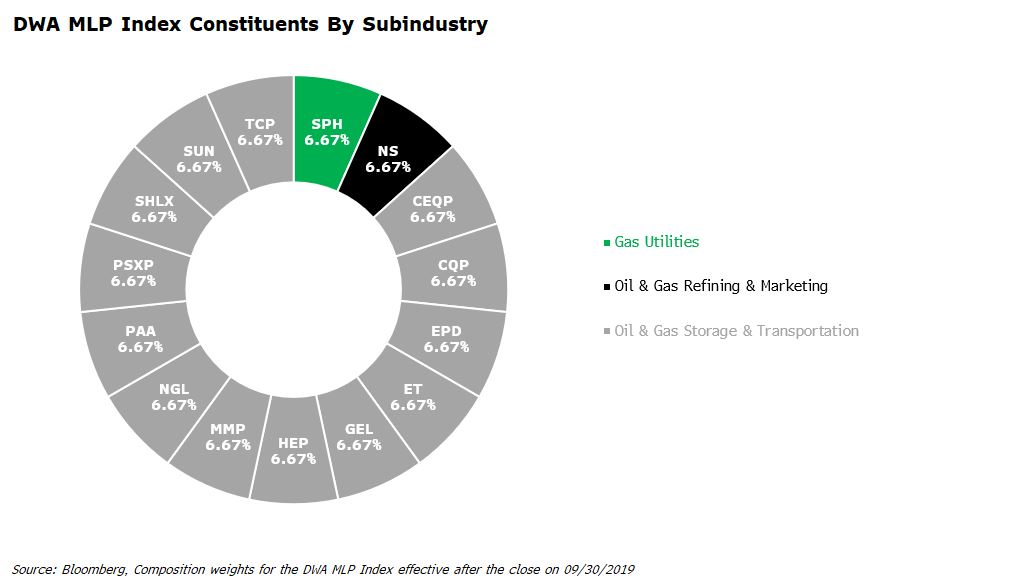

MLP Index Constituents by Subindustry

- The current holdings and weights for the DWA MLP Index as of October 1st, 2019

(Click on image to enlarge)

- Monthly, the DWA MLP Index rebalances to equal-weight after selecting the top 15 MLPs exhibiting the largest positive relative strength characteristics according to the proprietary Dorsey Wright Relative Strength Ranking Methodology.

Disclaimer: Source: Bloomberg L.P. DWA MLP Select™ Index was launched on 5/1/2016. DWA MLP Select™ Index data prior to that date is hypothetical and reflects the application of the index ...

more