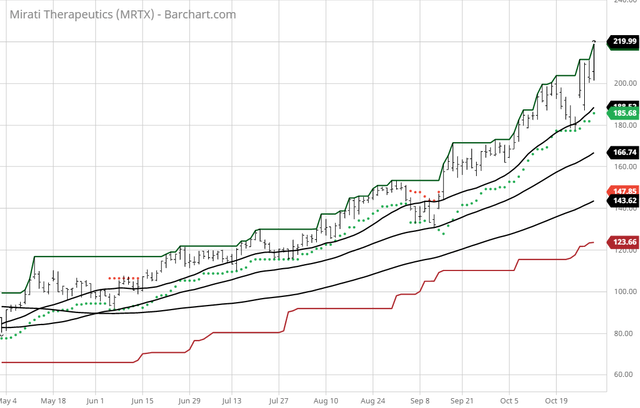

Mirati Therapeutics - All Time High

The Barchart Chart of the Day belongs to the biomedical company Mirati Therapeutics (NASDAQ: MRTX). Since there was not a clear direction in the markets I decided to use Barchart's New All-Time High list and sort by the most frequent number of new highs in the last month, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 9/15 the stock gained 37.48%.

Mirati Therapeutics, Inc., a clinical-stage oncology company, develops product candidates to address the genetic and immunological promoters of cancer in the United States. The company develops MRTX849, a KRAS G12C inhibitor, which is in Phase I/II clinical trial for treating non-small cell lung (NSCL), colorectal, pancreatic, and other cancers; and sitravatinib, a spectrum-selective kinase inhibitor that is in Phase II clinical trial for the treatment of NSCL cancer, as well as a KRAS G12D inhibitor program, which is in preclinical development. It has a collaboration and license agreement with BeiGene, Ltd. to develop, manufacture, and commercialize sitravatinib; and a clinical collaboration agreement with Novartis Pharmaceuticals Corporation. Mirati Therapeutics, Inc. was founded in 1995 and is headquartered in San Diego, California.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers are shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signal

- 158.10+ Weighted Alpha

- 127.18% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50, and 100 day moving averages

- 10 new highs and up 30.08% in the last month

- Relative Strength Index 71.03%

- Technical support level at 198.01

Fundamental factors:

- Market Cap $9 billion

- Revenue expected to grow 566.90% next year

- Earnings estimated to decrease 7.50% next year

- Wall Street analysts issued 7 strong buy and 3 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 22 to 13 that the stock will beat the market

- 5,200 investors are monitoring the stock on Seeking Alpha

Disclosure: None.