Microsoft: Strength Upon Strength

30,000 Foot View

One thing I have observed in my business career is the growing power of entrenched distribution. If a company controls the distribution platform to enterprises, who trust them in this partnership, and also sells its own products and services on this platform, then it will have the leverage to better understand its customer’s needs and sell more of its own products and services. Busy customer representatives will just call them first to see if they offer product or service XYZ instead of spending the time to fully research other options. Strong customer service fortifies this.

Cloud computing is where technology companies provide computing and storage systems to users through internet technologies so they do not have to own and manage some or all of the hardware, and sometimes operating system, that they run on. Most readers are probably familiar with the fact that cloud computing is transforming the information technology (IT) infrastructure of enterprises. Microsoft (MSFT) is a leader in all three cloud computing service models: Infrastructure-as-a-Service (IAAS), Platform-as-a-Services (PAAS), and Software-as-a-Service (SAAS). Let us dig into what this means.

Infrastructure-as-a-Service is where the technology company provides the networking, storage, and servers to the end customer. In this case, the technology company owns and maintains the hardware, essentially leasing it to the customer. The customer runs its own operating system (platform) and applications on this leased infrastructure.

Customers wanting even less IT management responsibility can opt for Platform-as-a-Service which runs deeper than IAAS. Here, the technology company provides the infrastructure and the operating platform. The customer gets a cloud computing platform where it can develop, test, manage, and host its own applications. The technology company providing Platform-as-a-Service, not only takes care of the hardware infrastructure (IAAS covered in previous paragraph) but also manages the operating system including security.

Finally, there is Software-as-a-Services where the technology company provides everything all the way down to the software application for customers to use. In this case, customers do not install the software application on their computers, they access it through the internet. The technology company handles all the management and upgrading of the software.

These cloud services are offered through 3 deployment models: public cloud, private cloud, and hybrid cloud.

Public cloud is where the technology company provides the customer with access to its data center infrastructure and also provides management and security. Infrastructure-as-a-Service aligns with the public cloud deployment model.

Private cloud is where the customer hosts its own data center through which it manages its own cloud ecosystem. This gives the customer more control over its data.

Hybrid cloud is a combination of public and private clouds.

10,000 Foot View

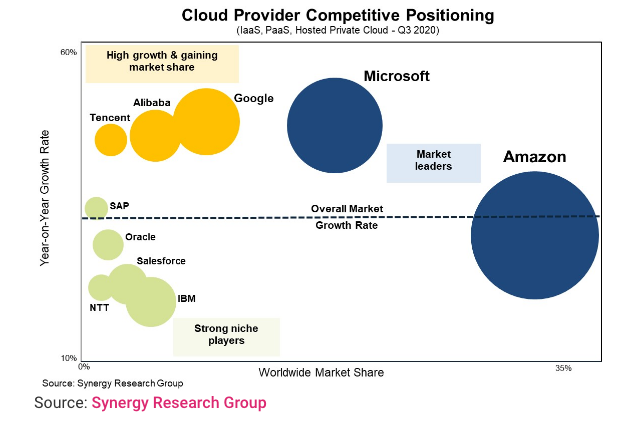

Infrastructure-as-a-Service and Platform-as-a-Service is where I want to focus. The industry leaders are Amazon (AMZN) and Microsoft. Amazon’s IAAS and PAAS offerings are combined under its Amazon Web Services (AWS) segment. Microsoft’s IAAS and PAAS offerings are combined under its Azure business which comprises most of its Intelligent Cloud segment (now its largest of 3 segments).

(Click on image to enlarge)

AWS established itself first as the dominant player in the deployment of IAAS and PAAS through its public cloud. However, as more organizations have embarked on cloud transformations, the majority of them having been choosing hybrid models so that they have total control over at least some of their critical data. Azure is a leader in hybrid cloud. Microsoft noted in its most recent, 2020 Annual Report:

“Azure’s competitive advantage includes enabling a hybrid cloud, allowing deployment of existing datacenters with our public cloud into a single, cohesive infrastructure, and the ability to run at a scale that meets the needs of businesses of all sizes and complexities. We believe our cloud’s global scale, coupled with our broad portfolio of identity and security solutions, allows us to effectively solve complex cybersecurity challenges for our customers and differentiates us from the competition.”

Azure grew revenues by 72% in FY 19 and by 56% in FY 20. Because of its continued strength in hybrid cloud, Microsoft’s Intelligent Cloud (segment) revenue growth accelerated in FY 2020 and may grow even faster in FY 2021. At the same time, AWS’ growth rate has been decelerating as Azure grows market share.

AWS’ 2020 revenue was $45 billion while Microsoft’s FY 2020 (ended June 2020) Intelligent Cloud segment revenue was $48.4 billion. This is not an apples-to-apples comparison though because Microsoft’s Intelligent Cloud segment includes other cloud-related businesses besides Azure. As the graphic above shows, AWS is larger on a pure IAAS & PAAS basis, however, it is worth noting that Microsoft’s overall cloud-related revenue is higher. More importantly, Intelligent Cloud’s operating margins are over 10bps higher than those of AWS and expanding.

Looking Forward

The integration of existing data centers (private cloud) with public cloud capabilities (hybrid cloud) to power advanced computing for businesses has been one of my key investment themes. Despite exceptional growth in recent years, the global cloud computing market still has a long growth runway ahead of it.

Microsoft’s strength as a hybrid cloud provider, backed by an extensive global network of data center infrastructure (61 - more than any other provider), and a full breadth of related cloud services gives it an ideal distribution platform for other cloud software services and new technologies set to be deployed through the hybrid cloud model. This goes back to the point that I made at the beginning of the Letter. The company noted in its FY 2020 Annual Report:

“The opportunity to merge the physical and digital worlds, when combined with the power of Azure cloud services, unlocks the potential for entirely new workloads which we believe will shape the next era of computing.”

Microsoft’s leading cloud platform has it well-positioned to advance the nascent new technologies it is developing, such as edge computing, blockchain, machine learning, and quantum computing. The IT departments of many organizations are still focused on the implementation of hybrid cloud initiatives, but this is laying the groundwork for the next phase of technological advancements.

A Buy at Fair Value

I have Microsoft currently trading at 24.5 times fiscal 2022 earnings in my financial model which is slightly above fair value in my stock evaluation model. A 24.5 times forward earnings valuation may appear rich to value-minded investors, but you have to account for the growth rate which my evaluation model does well. Microsoft is growing 7-year average earnings per share in the 25% to 30% range and returns on invested capital are headed to 25%+ in the near term as margins continue to expand across all segments.

The stock took a bit of a pause during the 2nd half of 2020 and I see this as an opportunity to start a position before the U.S. stock market, of which Microsoft is a large component (5%+), begins its next leg higher.

What I love about researching and investing in individual stocks is that it gives you important insights into the macroeconomic environment and specific market drivers. Amazon and Microsoft are 10% of the S&P 500 Index. The growth runway for AWS and Azure has both of these companies—fundamental blocks of the S&P 500—poised to continue to be a component of underlying strength for the U.S. stock market. My analysis of Microsoft reinforces my current stock market outlook.

Final Thoughts

Microsoft’s hybrid cloud leadership has given it a position of strength from which it can continue to grow customer IT spend. I see the stock having the potential to triple from here by the end of the decade.

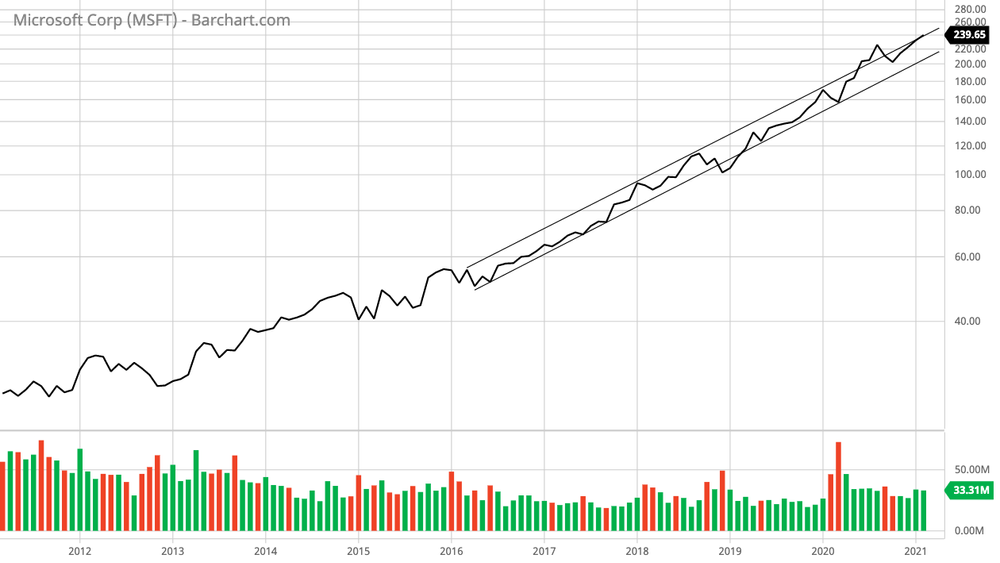

I will leave you with the monthly log chart of MSFT. Does this look like it is going to stop anytime soon?

(Click on image to enlarge)

courtesy of Barchart

Disclosures: I am a shareholder of Microsoft.

The information presented in the True Vine Letter is general in nature and designed for do-it-yourself and professional investors. It does not ...

more