Microsoft Soars On Blowout Earnings Thanks To Surging Cloud Revenue; Returns $10BN To Shareholders

Heading into today's most important earnings release, Wall Street has been bullish on Microsoft (MSFT) - the one company among the FAAMGs that many view as immune to antitrust overtures from the government as it already went through all that - and expects it to post record quarterly sales underpinned by pandemic-fueled demand for video gaming and accelerated adoption of its cloud-computing services, something its share price which was already trading at an all-time high clearly reflected.

(Click on image to enlarge)

Like so many of its FAAMG peers, the remote work era has been a boon for Microsoft. In addition to its videogaming and cloud-computing products, the company has seen strong sales for its Surface laptops as people bought devices to work remotely and enable distance learning. And use of Microsoft’s Teams workplace collaboration software that includes text chat and videoconferencing, and has been a priority for Chief Executive Satya Nadella, has jumped during the pandemic. Microsoft shares have risen more than 37% over the past year as shown above.

The software giant’s fiscal Q2 earnings reflect a period when demand for the latest versions of its Xbox videogame consoles has outstripped supply. Wall Street expects Microsoft to post $40.2 billion in sales, the highest quarterly revenue ever, and up 9% Y/Y. Net income is expected to jump by $1 billion to $12.6 billion.

So with that in mind what did Microsoft report? Well, in a word - it was a blowout.

- Q2 Revenue $43.1BN, smashing expectations of $40.2

- Q2 EPS $2.03. beating expectations of $1.64

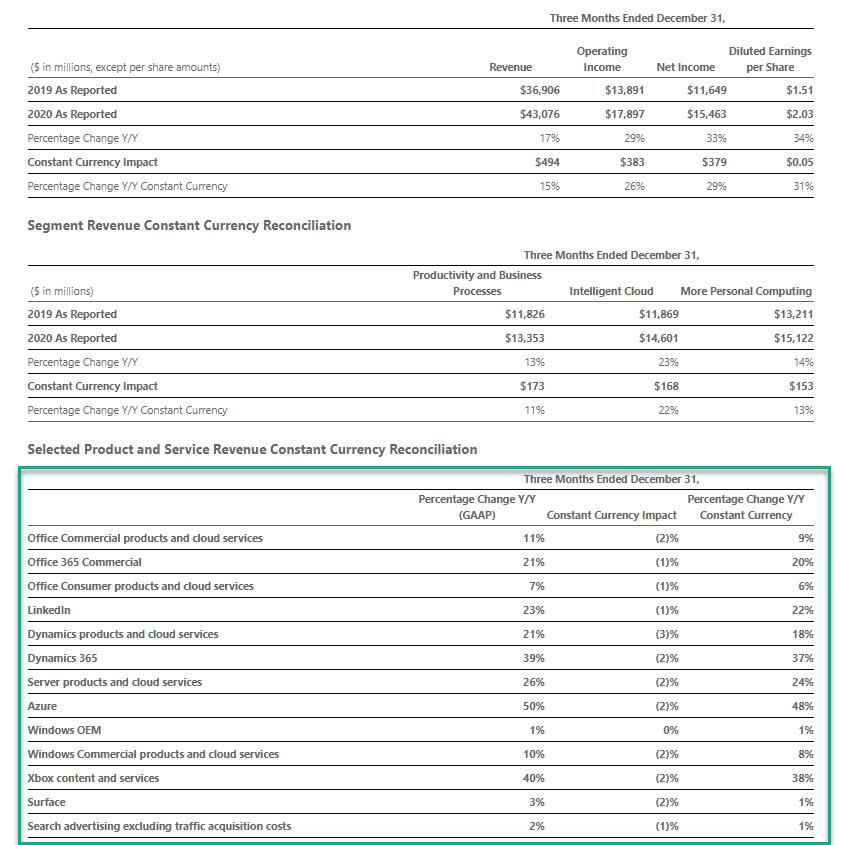

All the supporting data was strong too, with an emphasis on Server Products and Cloud services revenue which surged +26% driven by a whopping 50% in Microsoft's Azure cloud offering.

- Intelligent Cloud revenue $14.60 billion, +23% y/y, estimate $13.75 billion

- Server products and cloud services revenue increased 26% driven by Azure revenue growth of 50%

- Productivity and Business Processes revenue $13.35 billion, +13% y/y, estimate $12.94 billion

- Office Commercial products and cloud services revenue increased 11% driven by Office 365 Commercial revenue growth of 21%

- Office Consumer products and cloud services revenue increased 7% and Microsoft 365 Consumer subscribers increased to 47.5 million

- LinkedIn revenue increased 23%

- Dynamics products and cloud services revenue increased 21% driven by Dynamics 365 revenue growth of 39%

- More Personal Computing revenue $15.12 billion, +14% y/y, estimate $13.55 billion

- Windows OEM revenue increased 1%

- Windows Commercial products and cloud services revenue increased 10%

- Xbox content and services revenue increased 40%

- Surface revenue increased 3%

- Search advertising revenue excluding traffic acquisition costs increased 2%

- Capital expenditure $4.17 billion, +18% y/y, below expectations of $4.79 billion

- Operating income $17.90 billion, +29% y/y, estimate $14.84 billion (range $14.43 billion to $15.47 billion)

And visually:

(Click on image to enlarge)

“Accelerating demand for our differentiated offerings drove commercial cloud revenue to $16.7 billion, up 34% year over year,” said Amy Hood, executive vice president, and chief financial officer of Microsoft. “We continue to benefit from our investments in strategic, high-growth areas.”

And just in case the stellar results were not enough, the company also returned $10 billion to shareholders in the form of share repurchases and dividends in the second quarter of fiscal year 2021, an increase of 18% compared to the second quarter of fiscal year 2020.

Looking ahead, the firm said that it would provide forward-looking guidance on its earnings conference call and webcast.

The stock, not surprisingly, was more than 7% higher after the close, rising to new record highs.

(Click on image to enlarge)