Microsoft: Reaching For Infinity And Beyond

- Mcrosoft is an industry leader in software services, and has been a strong company for many years

- They are allocating a large amount of resources to their cloud segment

- The industry as a whole is constantly evolving, but could be prone to a slowdown if the economy contracts

Microsoft (MSFT) is one of the most well-known companies in the entire world. In a perpetual race against Apple (AAPL) and Amazon (AMZN) for “Most Valuable Company”, Microsoft has been able to make a name for themselves over the past 44 years based on their product line and their openness to growth and innovation.

As a company, it has moved line-in-line with the broad Software and Services index, and has outperformed the S&P 500 by 65% over a five-year time frame. The industry itself has promising growth possibilities, with estimates of 4% growth in 2019.

Source: Capital IQ

CompTia notes that “the product mix will be an especially important factor, as the high growth rates of emerging categories are expected to more than offset the slow growth mature categories” when looking at the tech industry. This plays into Microsoft’s strategy, as they carry some slow-growth product lines within their More Personal Computing segment, but have strong exposure to emerging categories, such as the Cloud.

Source: CompTia

As technology continues to integrate into our daily lives, and as big tech becomes increasingly more competitive, it is important to pay attention to key factors that will drive growth in the industry. Artificial Intelligence and the Cloud are two big market opportunities, as well as strategic alliances both inside and outside the industry.

MSFT has strong exposure to each of these three growth factors. Cloud demand, which is evolving constantly, will be a huge play as Microsoft continues to battle for market share. Artificial Intelligence, and all the applications it carries in the healthcare industry and other spaces, will be a another big growth driver. Finally, the company has been building out partnerships and collaborations across companies as they continue to manage their economies of scales.

MSFT: Carving Out a Spot in The Industry Through Partnerships

Source: Capital IQ

MSFT has managed to create a niche for themselves in this $5T software and services industry. They operate through three key business segments, Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Their business ecosystem is rather complex, and continues to grow through acquisitions and partnerships.

Source: Dynamics

Over the past month alone, MSFT has entered into several deals to improve their standing in the industry. On February 4th, they purchased the DataSense platform. On January 15th, they entered into a seven-year agreement with Walgreens (WBA) to provide digital health opportunities. On January 7th, it was announced that they entered a collaboration with Kroger to work on data-driven connected store experiences.

They teamed up with MasterCard (MA) in early December to work on digital identity management. They opened a joint-engineering office with Walmart (WMT) in early November. Finally, they purchased GitHub Inc in a $7.5 billion acquisition in October.

The company is priming itself for growth, and taking each opportunity as they come. Satya Nadella is a key driver of the company’s performance over the past several years. Since he became CEO in 2014, the stock price has increased by 228%, a larger gain than both Apple and the S&P 500. Overall, the governance of the company is strong, driven by a diverse Board of Directors that carries only two external directors. They scored the best score possible on three of the QualityScore pillars, scoring well in Audit, Board, and Shareholder Rights.

Source: Los Financieros

Looking Into the Possibilities: Growth in Artificial Technology

People are afraid of a takeover of machine intelligence. Over one-third of respondents to a survey released by Center for the Governance of AI believe that high-end machine intelligence will have a “bad” effect on humanity. Over 80% of respondents believe that robots and artificial intelligence require careful management. And almost one-third think that high-level machine intelligence should not be developed at all, with another one-third completely neutral in their opinion.

Source: Statista

Despite the uncertainty, MSFT is the company that people have the most trust in for the development of artificial intelligence. The fact that consumers trust MSFT the most to do this job is extremely promising, especially considering that AI is a key industry growth factor.

Source: Statista

Microsoft is also implementing artificial technology in the healthcare space, highlighted by their recent partnership with Walgreens Boot Alliance. They have several key alliances in the industry, highlighting the earlier point about partnerships, ranging from Veradigm, a clinical research company, to ThoughtWire, an EarlyWarning application that can detect the risk of a heart attack.

Source: Microsoft

However, Artificial Intelligence does carry a significant risk, and companies in the process of developing the software have made sure that consumers are aware of the risks that it carries. However, Microsoft is working on “democratizing AI” with aggressive investments across the board.

Artifical intelligence as a market is expected to experienced a 62.9% CAGR from 2016 to 2022, growing from $8B in revenue to almost $50B by 2020. Microsoft will also be implementing their Azure API to share health data across the cloud. The cloud has become a large focus for many of the top companies, with Amazon leading the charge and Google (GOOG, GOOGL) spending $25.5b in 2018 CAPEX to try and gain market share.

The Cloud: Clear Skies Ahead

Amazon is a dominant player in this space with their product, Amazon Web Services. They dominate across every single region, and despite MSFT Azure’s 76% growth in sales for the most recent quarter, that dominance isn’t going away any time soon.

Source: SRG Research

Microsoft is close behind, as evidenced by their second place ranking in most geographic locations. MSFT leads in Enterprise SaaS, and also has a leg up on Amazon in private cloud. But this segment of the industry is highly competitive.

Source: Market Realist

The Cloud itself is posed for tremendous growth. Over the past three years, there has been an $80b increase in IaaS + SaaS revenues. These are variances of cloud platforms, with IaaS being more hands on for users, and SaaS completely managed by an outside company.

Over the next five years, there is expected to be an $300B increase revenues for IaaS + SaaS, which represents a growth of $60B per year versus the five-year average yearly growth of $26.7B. Market penetration in the $1.8T tech market is expected to increase to grow to 24% into the coming years, as compared to the 7% penetration in 2018.

MSFT is expected to have 70x revenue growth from their Azure platform versus AMZN’S 11x growth from their AWS platform. AWS has an advantage over Azure because they were first to market back in 2006. It took the company ten years, from 2006 to 2016, to make the first $10B in revenue off the product, but only two years to add the next $10B. Now, they are expected to make $10B in 2019 alone.

Source: Value Biased

Microsoft is working on the same trajectory, but Amazon has a two-year head start. After 2020 is when MSFT should see the quick gains that their top competitor has experienced. They will still lag behind, but momentum will be on their side, with projections to add $10B in revenue in 2021E.

Source: Value Biased

Both companies are not too transparent with the exact amount of money that they make off their products. AWS had experienced 46.94% growth in revenue year-over-year from FY17 to FY18, which is a contraction from previous growth numbers. Doing the same analysis on MSFT yields a 17.6% year-over-year growth, which is much smaller than Amazon’s growth metric. AWS leads in Quarter over Quarter growth too, posting 45.3% growth in revenues from Q318 to Q418 versus MSFT’s 20.3% growth over a similar time frame.

Source: Capital IQ

Source: Capital IQ

Cost Leadership: Azure Leads the Field

Microsoft’s Azure does have some advantages over its competitors, most notably in terms of pricing. They lead across on-demand pricing options. AWS is usually not the cheapest option, but they do offer more services than their counterparts. Google’s Cloud product line tends to be the most expensive.

Source: ZDNet

Microsoft also has a larger reach than their cloud competitors, located in 54 regions across the globe. They also have 120+ new subscribers to their product every month. It has the largest compliance offering in the industry, which is important for longevity in the corporate world.

Source: MSFT

Personal Computing: Focusing on Xbox and Surface

Outside of the Cloud Space, Microsoft has opportunities through its Personal Computing arm, especially in the Surface and Xbox. They are planning on building out an Xbox Cross Live, which would operate as a “Netflix for Video Games”. The platform itself is expanding from over 400 million gaming devices to get access to almost 70 billion players through this cross platform initiative, labeled XDX.

Source: Dom

The Surface device also just posted its “biggest quarter ever“, with $1.86 billion in revenue for Q219, which is a 39% increase year over year. The CFO is expecting 20% revenue growth next quarter. There have been several new devices in the product line, with whispers of a product called “Andromeda”, a “foldable, dual-screen device” that might be Microsoft’s next attempt at penetrating the smartphone market.

Source: Geek Wire

Strong Growth Across the Board

MSFT is experiencing growth in most of their key areas, and in most of the key growth opportunities for the industry. Azure will be a huge opportunity for them, as well as gaming and hardware offerings. They missed on revenue for Personal Computing in the most recent quarter, with the company pointing to a supply chain mishap as the reason behind the this. However, their Intelligent Cloud segment beat expectations by 10.7%.

Source: CNBC

Office 365 Commercial has also been a strong growth segment for the company, with the subscriber base growing 2.5% from Q1. They have had trouble with Office consumer products, and will have to consider how to handle the competition in that space. Okta, which is an integration network for different cloud platforms, has seen an extreme increase in popularity for Microsoft Office 365.

Source: Okta

Diving into the Data: The Financials of Microsoft

Microsoft is strong in terms of operational performance and liquidity, but they lag behind their peers in terms of solvency. Their interest coverage ratios are lower than their competitors, notably their EBITDA / Interest Expense and FFO to Total Debt. Total Debt to Capital is almost double that of their peers, as well as Total Debt to Revenue.

Source: Capital IQ

The company has been heavily investing in R&D, which is good for their continued growth. It is also important that they do this in the face of the competitive power that Amazon carries in the cloud space.

Source: Capital IQ

Cash: The Only Thing That Really Matters

Their cash flows haven’t been as strong as they used to be, with year over year growth compressing almost 9% for the most recent quarter. Their free cash flow has also compressed, but only by 1.8% for year-over-year in December 18. That’s a much stronger metric than the 17.2% negative growth that occurred in the earlier part of 2018.

Hiking through the AMZN: A Peer to Peer Comparison

A benefit that Microsoft carries relative to competitors is their product differentiation and their geographical reach. The company gets about equal revenue streams from their Productivity and Business Processes, Intelligent Cloud, and More Personal Computing segments. The latter segment has experienced the slowest growth year-over-year at 7.6%, but the other two segments are line-in-line, at 20.1% and 17.6%, respectively.

Source: Capital IQ

For comparison, Amazon gets approximately 50% of their sales from online stores, but they have experienced monumental growth in each of their respective categories. AWS growth numbers, as discussed throughout this article, is going to be a continued benchmark that the rest of the industry will try to meet.

Source: Capital IQ

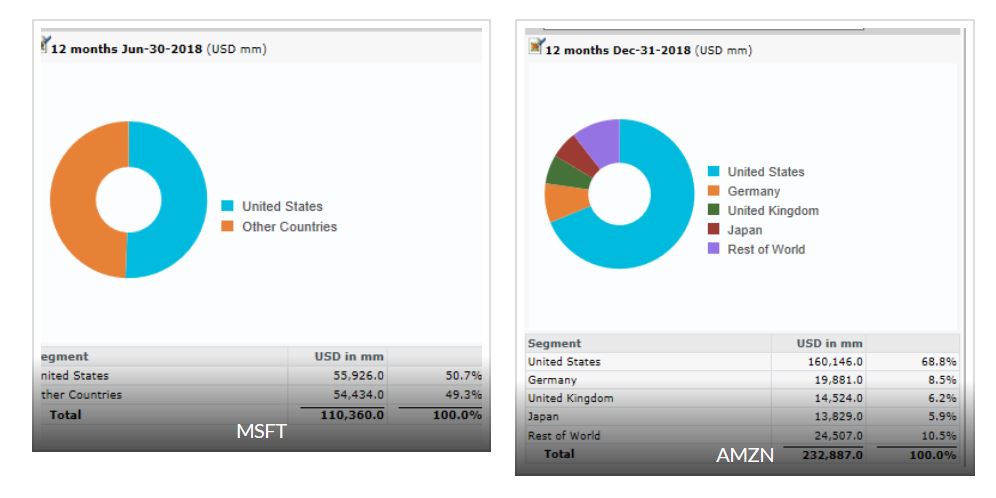

Amazon is much more reliant on US based sales, with 68% of their revenue coming from domestic sources. MSFT gets approximately 50.7% of their revenue from the US, and the other half from other countries. Amazon gets 20.6% of their revenue from Germany, the UK, and Japan with the rest of the world representing 10.5% of a revenue source.

Source: Capital IQ

Amazon has outperformed Microsoft and the industry over the past three years. Microsoft has moved right in line with the S&P 500 Software Index, returning 111.8% versus the index’s 115.18% performance. This means that Microsoft has room to close the gap, and potentially catch up to Amazon’s 215.79% return.

Source: Capital IQ

In terms of valuation, it is common knowledge that Amazon is expensively traded. The tech sector as a whole has carried massive valuations for the past several years. Microsoft has a TEV / EBITDA of 15.44 as compared to Amazon’s 28.43. The industry, represented by the orange line, has a value of 19.92, so using that metric, MSFT trades at a less expensive valuation as compared to the industry as a whole.

Source: Capital IQ

Conclusion: MSFT Has Room to Grow

Microsoft has a strong brand name, and a diversified product portfolio. They are open to collaboration and partnerships. They are exposed to some weaknesses, like not taking advantage of potential economies of scale, and potential overexposure in some aspects of the industry that they underperform in, such as consumer products.

If we enter into a global slowdown, demand for products that Microsoft offers will more than likely decline, and there is the potential for regulatory framework to hurt the business. But overall, the cloud space offers them continued growth, they are fairly valued, and they have a number of growth opportunities outside the cloud space through gaming and the expansion of their Surface product line.

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more

Nicely done.

This is excellent work. Your articles are thoroughly researched, well cited, and are overall well done. I am even more impressed due to your young age. Many veteran authors with more experience could learn a lot from you.