Microsoft Azure Is A Force To Reckon With

Microsoft (MSFT) is continuing to strengthen its footing in the cloud. Its Azure division posted a 68% revenue growth year on year in its latest quarter. Its rate of growth has slowed down over the past few quarters but it’s still significantly higher than AWS’. There are actually reasons to believe that Microsoft Azure’s growth momentum would continue going forward and it’ll continue to impinge on Amazon market share. Let’s take a closer look.

The Growth Story

Microsoft as of now does not report standalone performance of Azure. Instead, it reports revenues of its ‘Commercial cloud business’ which includes Azure, Dynamics 365, Office 365 and some other segments collectively. While this may pose as an obstacle in understanding Azure’s dynamics completely, Microsoft does report Azure’s standalone growth rate. Amazon (AMZN) too had adopted this style of reporting until a few years back.

Presently we can compare the growth rates of both. Looking at the last 12 continuous quarters, Azure is the clear winner with its lowest quarter on quarter growth being 65% +. Operating on a higher base, lower growth rate for AWS is natural. However, what could be compared is the historical growth rate of AWS when it was the present size of Microsoft Azure.

(Click on image to enlarge)

(Source: BusinessQuant.com)

Analysts actually estimate that Azure is growing at a much faster pace as compared to what AWS, when the latter was the size of Azure. AWS reported a growth of 37.3% for the latest quarter which is about 3,070 basis points slower than Azure – a massive difference.

Now, a declining rate of growth may not necessarily be a red flag; it’s a natural outcome of rapid business expansion. So, a substantial mark-up of Azure’s growth rate over AWS may even lead to the possibility of them reaching a parity over the coming couple of years.

Another fact to note here is that both Azure and AWS have reported a lower growth rate in the latest quarter. This may more be an indicator of present market dynamics than any intrinsic company-specific issue for both Microsoft or Azure.

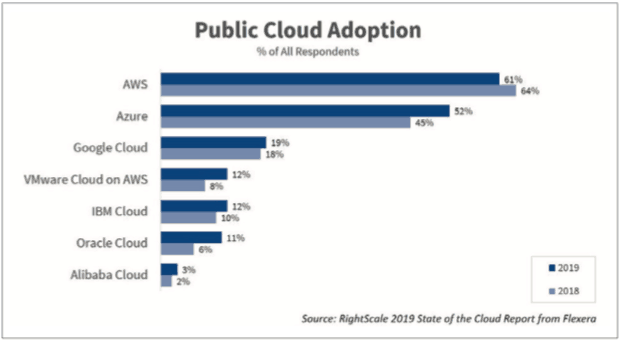

Further, as per the 2019 State of the Cloud report, Azure’s adoption has increased by 700 basis points (bps) year on year, while AWS saw a decline of 300 bps over the period. So, there was an overall surplus of 1,100 bps for Microsoft Azure.

(Source: RightScale report)

We can’t assume that Azure is growing quickly in terms of adoption simply because it’s smaller than AWS in size. If this line of thinking held any merit, then we’d have seen Google’s Cloud Platform to have grown at an even faster pace since it’s the smallest of all three. But the chart below indicates that Google’s adoption rate grew by only 100 basis points. So, we have to give credit where it’s due; Microsoft Azure’s growth rate has fundamentally strong drivers to it, than it being driven merely by a lower base effect.

Can Azure-AWS parity be a reality?

In addition to the vast untapped market, there is also a growing trend of multi-cloud approach. The RightScale report reveals that about 84% of their respondents have been working on multi-cloud platforms, up from 81% last year.

This indicates that many enterprises might be using Azure, AWS, Google cloud, and other such platforms simultaneously than sticking to just one of the platforms This also implies that the growth rates of Microsoft Azure and Amazon AWS could continue to remain high or maybe even accelerate going forward.

My guess is that Azure and AWS’ rivals would have a lot of time, money and strategically planned effort to be able to make a place in the hypercompetitive cloud space. Both Azure and AWS are growing at breakneck rates and their managements are proactively rolling out new features, integrations and software stacks almost every month. This leads to a lot of room for Azure and AWS to bank on their existing infrastructure to materially expand their existence. A duopoly is a fair possibility over the coming years.

While Azure’s growth rate may have tapered of late, it has continued to grow at 65%-plus rates over the last 12 quarters. This is a noteworthy feat and an indication that Microsoft Azure is well on its way to become a prominent growth driver for the overall company.

Final Words

The industry is leaning more towards multi-cloud strategy so this should serve as a tailwind for most cloud vendors. Meanwhile, Microsoft Azure’s management is proactively rolling out new integrations and striking enterprise deals every month. This leads me to believe that Microsoft Azure is a force to reckon with in the cloud space and it’s en-route to becoming a material growth driver for Microsoft and its shareholders over the coming years. Hence, I would reiterate that it’s a good time to be bullish on Microsoft.

Disclaimer: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should ...

more