Micron: Turning The Corner, Without No One Noticing It

Summary

- The company missed the COVID-19 play, even though the work-at-home relies on data usage and storage, which suited Micron.

- Business practices seem to justify the outcome so far. But, one can make the case that this will change.

- Early indicators seem to suggest that we are at a turning point. If that materializes in the following quarters, we might see a catalyst for the stock.

(Source: Matt Kieffer)

A while ago, I wrote about how the cyclical swings inherent to Micron’s (MU) underlying business have burned investors.

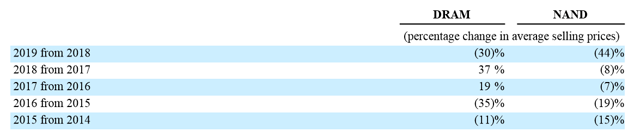

(Source Micron 2019 10-K)

In my opinion, that has caused Micron’s stock price to become stuck in the $30 to $60 range. At the time, I made the case that Micron was ridding a data megatrend that would broaden the market and remove part of the cyclicality from the company. Little did I know that the Covid-19 would accelerate the data trend without leaving a visible reflection in Micron’s bottom-line.

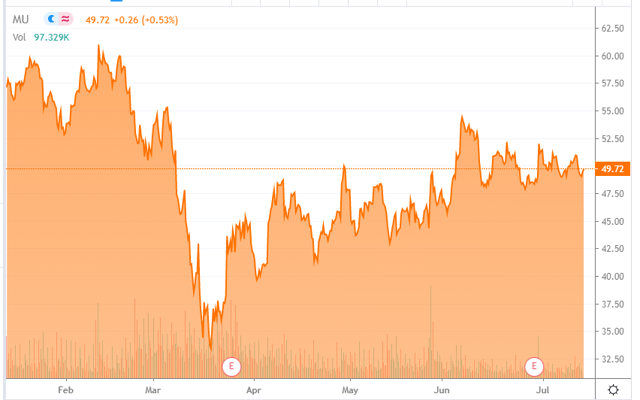

Memory prices were weak during 2019, and part of my thinking relied on improvements in this market. My hopes for a price improvement rely on the secular trend toward more memory usage. And, the Covid-19 debacle seemed to be a catalyst for that move. However, as so happens many times in the investment world, the play didn’t work. Not that it was a disaster, but Micron missed the party in terms of stock price action. The company is still to reach its pre-COVID high.

(Source: Seeking Alpha)

Basically, the use of data has increased since the outbreak of the pandemic. However, the investment in hardware usually lags the increase in usage, and that was, I believe, the flaw in our rationale. Investment decisions are made ahead of time, based on likely scenarios, and the COVID-19 event doesn’t classify as one. Therefore, what happened was that, as the uncertainty grew around the virus, companies have likely delayed part of their expenditures, waiting for better visibility. All-in-all, instead of being a catalyst, the virus muted a recovery for Micron.

Turning the corner

However, the fact that data usage has increased will leave the companies managing the datacenters with the urgency to reinforce the infrastructure. That will, likely, means that the effect on Micron won’t be negative, actually, it will be positive but lagging a couple of months.

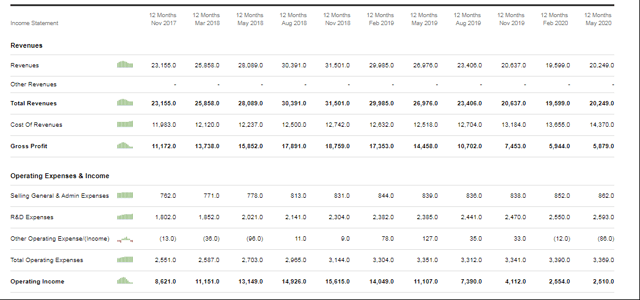

And, in my opinion, we are now starting to see it. Looking at the twelve-month trailing revenues, we can see that for the first time since November 2018, the company has improved its revenue, in comparison with the previous quarter. The operating income has decreased a bit, which was likely since the virus outbreak impacted the company’s operations and supply chain.

(Source: Seeking Alpha)

Since the revenue improvement is frail, and the operating performance is unimpressive, the conjugation of both is likely the cause for the lack of stock price action. So, I have formulated the following thesis:

H0: Micron’s revenues are improving, and the cycle is turning for the company.

Since these are feeble signs, the market has overlooked them yet. Likely, we will need more data to be able to confirm or refute this thesis. However, I will add an extra hint:

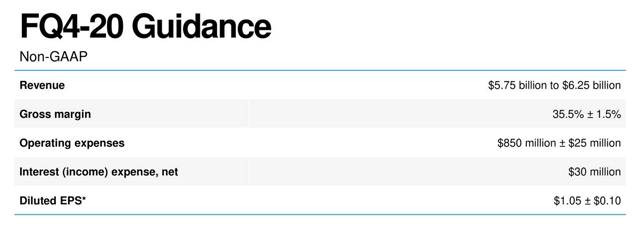

(Source: Seeking Alpha)

If this outlook materializes, our thesis will gain a lot of traction because the trailing twelve-month figures will keep improving. In other words, it would be a beat on FQ4-19. The fact that the company feels confident enough to publish this guidance increases my conviction on this thesis.

The rest of the story remains intact. The company’s main markets still promise huge growth driven by data growth, both in the short and long terms. The balance sheet is very robust, with a current ratio well above two, and a low debt profile. Likely, FY20 will mark a low point for the EPS, but looking underneath, we can see that the tide is changing. Trading at around 12 times its 5-year average EPS (5-year average EPS: $4.73), the company seems very attractive for a buy-and-hold investor.

Scenario analysis for Micron

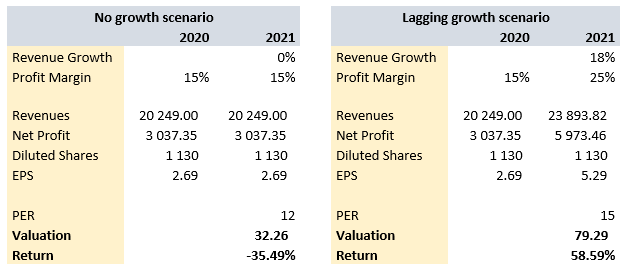

Assuming that our thesis has a high probability of materializing, let us analyze the impact on Micron stock. Therefore, let’s design two main scenarios. In the first one, the thesis passes the test, and in the other one, we refute the thesis.

For FY20, we are estimating revenues close to 20 billion, and a profit margin of 15%, yielding around $3 billion in profits (EPS 2.69). That’s our baseline scenario, and not far from the analysts’ estimates. For the “lagging growth” scenario, we’ll use the lower end of the company’s guidance to extrapolate revenue growth. In FQ-19, Micron reported revenues of $4,870 million, now it is guiding $5,750 million or an 18% growth. We will also assume an improvement in the profit margin to 25%, closer to the company’s track record in recent years. As for the “no-growth” scenario, we are assuming exactly that, no growth, and no improvements in margins.

(Source: Author’s computations)

In the “no growth,” I’ve assumed degradation of the earnings multiple, while on the “lagging growth,” I’ve just used a conservative multiple of 15. I leave to the readers’ consideration the evaluation of the assumption’s fairness. I tried to be conservative, and, if my analysis is right, that numbers suggest that there is an asymmetrical play here.

What might go wrong

The dangers to our thesis might come from different sources. First, the “lagging growth” thesis might not materialize. Second, the company operates in a very competitive sector, and it might be unable to tap into the secular growth that data consumption presents. Finally, external factors, like the reigniting of the trade war, might present headwinds for the company. These are just examples of what might go wrong and serve to keep us aware of the uncertainty that always abounds in the investing world.

However, I’ve tried to present a synthesis of the most likely scenarios, at least, from my perspective. Additionally, I offer a simple thesis to guide you through the investment process. To refute, or to validate the thesis are the core of this investment process.

Disclosure: I am/we are long MU.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author ...

more