Micron Saying 'Q1 Uncertainty' But Lam Research Saying 'NAND Prices Inflecting Higher'

Micron (Nasdaq: MU) has some mixed news in the next two quarters. But the underlying picture for 2020 seems to be improving. At the CSFB conference yesterday they called out headwinds for the next two quarters. That means the upcoming guide. On the flip side, Lam Research (Nasdaq: LRCX) talked about an "inflection" in NAND pricing.

Cautious Next Two Quarters For Micron

Here's what they said yesterday at CSFB:

"Other factor to keep in mind is that calendar Q1 tends to be a seasonally weak quarter for DRAM, as well as for NAND."

That's going to affect their next quarter guide.

As for this quarter, this could have a downward bias:

"We also talked about that in the September timeframe – in our September earnings call, we also talked about how we had seen some of the Chinese customers buying patterns to be higher than their normal level. And we said, perhaps, some of the Chinese customers given the U.S. China trade tensions, are carrying higher level of inventory than normal. And I think you’ve heard about that from some other companies as well."

China customers pulled forward demand last quarter which likely slowed their current demand. So Micron wanted to remind investors at the CSFB conference that we have a short term headwind this quarter.

And they want to give a heads up that this short-term headwind will add on to the weak seasonality in calendar Q1:

"So in a seasonally weak calendar Q1, some of the impact of some inventory built by the Chinese exactly what they do, how they carry the inventory levels on an ongoing basis, do they shift their strategy and continue to carry higher levels of inventory or change it, brings an element of uncertainty with respect to the calendar first quarter as well."

The Street is at the company's $5B guide for this quarter.

For the next quarter (February Fiscal) the Street's looking for a revenues to be 3% lower than the November quarter. Based on how much Micron is emphasizing a combination of factors that can weigh on that February quarter, I think there's a downside to the Street numbers.

That's the bad news.

But Lam Bullish

But here's what Lam just said at CSFB about NAND pricing:

"Prices have started inflecting higher."

If you are an institutional investor, there's nothing you want to hear more than that except maybe for DRAM prices also starting to inflect.

"Inflection" is probably the keyword any large fund listens for and is hoping for. When things inflect, income statements tend to flow through with earnings leverage and upside. Earnings drive stock prices which is why I'm focused on earnings (here). That's why inflections are so key. I've been doing this for over 20 years and no one word that gets bullish chills to shimmy down the spine like the word "inflect."

NAND is probably benefiting from Apple's (Nasdaq: AAPL) better performance and the look forward to locking down supply for 5G.

NAND was 31% of overall Micron business last quarter.

So really you want DRAM prices to inflect which would be a much bigger impact to the micron P&L.

Here's what Lam said on that,

"And so, we wouldn't expect DRAM to really start improving likely until the second half of next year."

KLA-Tencor (Nasdaq: KLAC) at the CSFB conference also expected a back half 2020 improvement in DRAM.

So the main part of Micron doesn't benefit on the pricing side until maybe late next year. There are reports that pricing declines are lessening which is positive. Pricing is so key because that helps out gross margins. Gross margins keep coming down. A continuation would make EPS go negative on a quarterly basis.

But Micron Earnings Keep Dropping

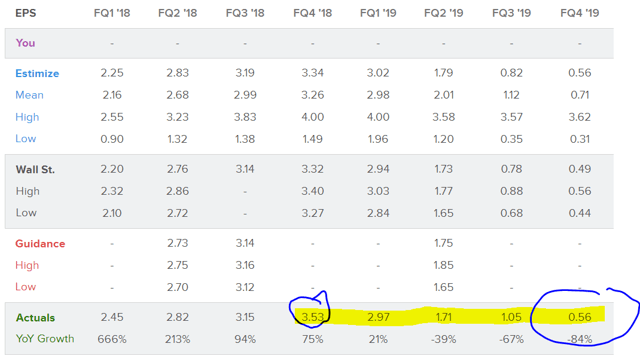

Here's the EPS dropping each quarter despite positive qualitative comments coming out of the company each quarter.

(Click on image to enlarge)

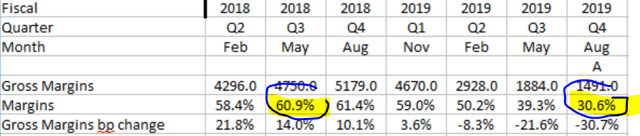

The main driver to lower and lower earnings are gross margins. Lower volumes drive up fixed unit costs. Lower pricing also hits gross margins.

Here you see gross margins getting cut in half in a short period of time.

(Click on image to enlarge)

Source: Elazar Advisors models using data from Micron earnings reports.

Above you see gross margins getting cut in half in just over a year.

Based on the company comments yesterday, I think there's further risk for earnings. The Street expects EPS to be lower by 3 cents November to February. That number may need to come down.

Micron Earnings Report Coming Up

Micron reports Dec. 18, in just a couple of weeks. I think all of the above will be the key drivers to that report.

Conclusion

There are some short-term challenges in the next two quarters which can affect their earnings report later this month. But underlying pricing news is improving and that's so key. I'm neutral right now but watching what wins. Does DRAM pricing improve?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Ready to Nail Tech Earnings? Start your more