Micron And SMH: Weak Memory Demand Risk

Micron (Nasdaq:MU) delivered strong numbers in the first half of 2020, but going forward they probably face weaker demand.

We had previously highlighted how in the first half of 2020 some OEMs were stocking up on inventory, to assure production in the back half of the year. This pulled forward demand, resulting in strong numbers for Micron. However, we also mentioned this could lead to oversupply and inventory accumulation in the second half of the year, which is playing out.

Several reports coming out recently confirmed the oversupply, highlighting large inventories, weak demand, and lower pricing.

Clearly this is a change, but the stocks are not reflecting it. Given the huge Fed support to the stock market everything has gone up. Micron's lagged. But the shift in demand trends is a fundamental headwind risk to semis and tech in general.

Given the importance of DRAM in almost all tech, weak demand could signal a deceleration of growth for semis (Nasdaq: SMH) and tech in general.

DRAM and NAND Weakness

Recently Micron gave an update at an investor conference.

Micron said they're seeing incremental weakness in enterprise demand.

Here's what they said,

...we have seen some changes in our demand compared to what we had updated our investors at the end of our third fiscal quarter, which is that we are seeing some incremental weakness on the enterprise side, largely stemming from small and medium businesses being weaker due to the economy as well as certain segments of the economy that have not been doing well, like travel and leisure, hospitality, oil, and gas, etc., their combined impact on the enterprise space has been an issue in terms of the demand environment for the second half of this calendar year.

In cloud Micron said cloud is strong but expected to be slower in the second half.

The first half benefited as companies scrambled to meet new stay-at-home demand. That drove cloud spending in the first half. But it looks like that pulled from the second half and is now slowing trends for some semis and tech.

Confirming Micron’s comments there have been other reports that memory chip prices, including DRAM and NAND flash, are expected to fall 10% sequentially in the fourth quarter, and continue to fall in the first half of 2021 due to oversupply. Oversupply is being caused by a slowdown in demand.

Another report estimated that two factors will negatively impact the demand for DRAM and NAND in the second half of 2020:

-

Weak demand from Huawei smartphones

-

Reduction of notebook shipments due to several component shortages

Samsung Electronics (OTC:SSNLF) and other big players in the DRAM/NAND market were reported to have bulging inventory levels, mostly due to a slowdown in orders for data center applications and weak consumer sentiment.

Again this is not reflected in stock prices but should be a red flag in the semi and tech space.

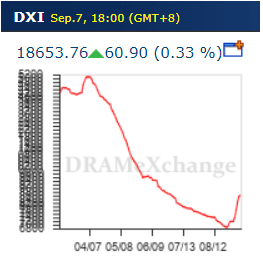

In the graph below you see spot pricing fell considerably since April 2020. A short-term low hit but based on the slowdown this has further risk.

One cause for the sudden rally at the end of the month may have been Huawei's aggressive chip purchasing ahead of new US sanction. If this is in fact the case, then demand for Q4 may be even weaker than expected causing pricing to drop further.

Some Cushion With Slowing Capex

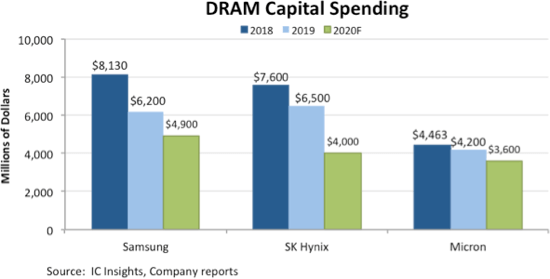

It’s clear that several factors, like the pull forward of demand from the 2nd half, and the Huawei restrictions, will impact the market. Memory companies though already have slashed their capex going into this year, with plans to cut even more, anticipating a slowdown. This can dampen the memory pricing risk.

In the chart above you see the three biggest DRAM producers in the world, which account for over 94% of all production, slashed their capex last year and are expected to continue slashing it by about 20% this year. In particular Micron is expected to reduce DRAM capex by 14%.

This has negative implications for other components in SMH such as Lam Research (Nasdaq:LRCX) and Applied Materials (Nasdaq:AMAT). Both companies have been talking about strong back half expectations as shipments shifted from Q2 to the second half. But if DRAM pricing keeps dropping there could be a capex shoe to drop in the next few quarters.

Huawei Impact

Another important negative for Micron going forward is the loss of Huawei. At the BMO Conference, Micron said Huawei currently accounts for around 10% of revenue but has been as high as 13%.

With current US Commerce Department restrictions, Micron will have to stop selling its products to Huawei by Sept. 14, 2020.

Micron said it takes about four months to flush out unprocessed inventory, and that the US government only gave them a month to comply. Unless the sanctions are changed, this will likely have a negative impact on Micron short term. If the report of the previous section is true, Huawei’s last-minute purchases will help September sales, but will hit future periods.

There's of course further risk that the US government will escalate conflict with the Chinese government after elections pass. If they impose similar sanctions on ByteDance or Tencent, both of which are Micron customers, albeit smaller ones, it will be another headwind.

Tech Outlook

DRAM and NAND are crucial for the semiconductors space (SMH) and tech in general. When demand for DRAM is weak, it hints to tech weakness in general. This is not a good sign for chipmakers, since it also could signal weak demand for CPU’s and GPUs. The consumer has bounced back from Q2 but Micron's take is pointing the other way.

AMD (Nasdaq:AMD) and Nvidia (Nasdaq:NVDA) both are heavy components in the SMH may be somewhat insulated with their own new product ramp schedules.

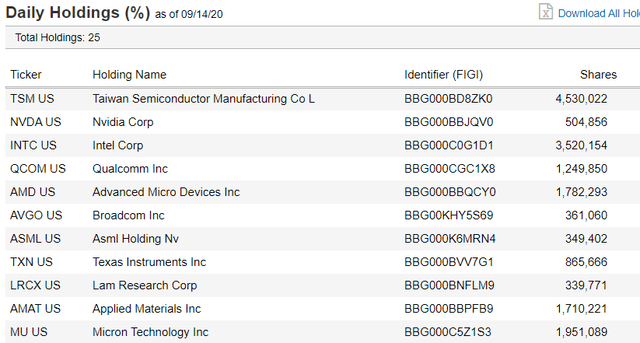

Above is the SMH components. All of these companies get affected if MU and WDC are picking up on something bigger for the overall space.

Cloud slowing though and seeing it confirm showing up in DRAM pricing is a fundamental risk for tech. Enterprise (traditional companies) slowing is another drag. Both slowdowns appear to be happening in real-time.

Both MU and WDC called out cloud weakness in the last few weeks. They would be the first ones to see it so the rest of the space should take heed.

Conclusion

Micron, WDC and other reports are pointing to a cloud led tech slowdown. The pandemic pulled forward cloud spending which risks the second half. With heavy inventory levels, memory prices dropping, and the loss of Huawei, Micron’s fundamentals have some risk. Their weakness also is a sign that tech in general is potentially about to experience a slowdown. Market technicals are not showing it yet, but there may be some fundamental risk in tech and semis.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: All investments have many risks and can ...

more