MGM Will Survive This

MGM Resorts International has seen a shellacking of incredible, and oversold, proportions as it and other travel and leisure stocks have seen historic declines as drastic as they have been quick. Yet MGM does not appear to be a company facing any kind of serious liquidity or secular risk from coronavirus and unlike some of the other travel and leisure stocks that have experienced similar declines.

At its current prices MGM makes for an excellent entry point from a risk-reward perspective for long-haul investors who can afford to wait to see it someday rise again when the world has calmed down a bit.

Sin City Shutters Its Lights And Games

The headlines for MGM lately have been nothing but a parade of bad news. The legendary MGM nightclubs and buffets of Las Vegas shuttered. Casino workers are being laid off and/or furloughed. Employees and casino guests are testing positive for coronavirus. MGM is cancelling a $1.25 billion share buyback, even at its low current prices, originally planned on by Thursday night and sending shares spiraling even further initially on Friday.

From its 52-week high of $34.64 just a few months ago MGM on Friday touched a low of $14.03, down over 59.4%. Even after rallying from those lows amid the broader market gains Friday afternoon MGM is still down 53.59% YTD,, 41.89% year-on-year, and 20.45% since its price exactly five years ago.

Data by YCharts

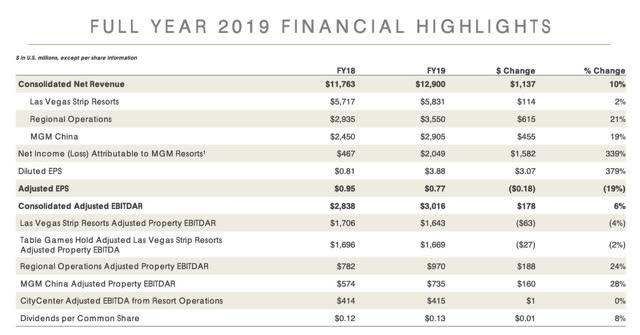

On one hand MGM stock does merit a severe correction based on the sudden shock of coronavirus to what otherwise seemed like a rosy picture for visits and spending at its resorts amid a relatively prosperous economy. Even with a current price-to-earnings trailing-twelve-months ratio of about 3.98, based on its FY19 earnings posted February 12 for diluted FY19 EPS of $3.88, MGM's forward EPS is likely to decrease significantly for at least the upcoming few months due to the variety of lockdowns, quarantines and travel bans preventing visitors from around the world from coming to its resorts. Furthermore, even when those legal restrictions are restricted MGM will have to face a consumer market that may still have some fear and hesitance to put themselves out there.

The major risk for MGM is it is unclear how long these lockdowns and bans will last as well as how long it will take for customers to be willing to venture back to its casinos and resorts in force. This decline could be for a few months at best - causing only a momentary sudden collapse in revenue - or it could go on for several seasons or longer. The only region where it appears at the moment that the revenue decline may have been relatively short is China, rapidly returning back to normality, and which accounted for $2.905 billion of MGM's $12.9 billion FY19 revenue (22.5%). MGM's China revenue growth rapidly outpaced its Vegas growth, 19% to 2% respectively in FY19, meaning this year may have a slight cushion from that imbalance.

(Source: MGM Q4 2019 / FY 2019 Earnings Presentation)

MGM Will Face Challenges But Seems Well-Positioned

Yet unlike many of the other companies experiencing declines well over the market's overall drop, such as airlines and cruise ships, MGM does not appear to be facing any serious liquidity, excessive debt overload, or other financial problems in its balance sheet that would merit a decline similar to some other over-leveraged industries. Based on its most recent disclosure MGM had, as of December 31, 2019, $2.329 billion in cash and $11.3 billion in debt. The overwhelming portion ($11.168 billion) of that debt is long-term and none was current at the time - the company had $3.191 billion in current liabilities with $750 million of that from litigation.

MGM's FY19 interest expense was $847.932 million with total non-operating expense of $1.093 billion as compared to net operating income of $3.940 billion. It appears that MGM's financial situation is now even better, as CEO Jim Murren said on Friday that "the company has ample liquidity to weather the current uncertainties in the marketplace...We do not expect the coronavirus to have a material impact on our business long term" with cash and investments of $2.4 billion.

It Really Is About How Long The Pandemic Will Be

When the coronavirus fight subsides many companies are likely to see resurgences in their revenues and earnings and MGM is no different. The major risk for a lot of the companies put especially close to the crisis, such as travel and leisure, is if they can weather the uncertain drought of business long enough to avoid bankruptcy and come out on the other side.

While MGM is a business facing a lot of risk amid the coronavirus pandemic it nonetheless seems in a good position to likely be able to sail through without as great a risk of restructuring or bankruptcy as some other companies in the hardest hit industries. That all makes MGM's current price a very favorable buying opportunity to edge into.

Disclaimer: These are only my opinions and do not constitute investment advice.