Meta Platforms (Facebook) Plummets 20% After Missing Across The Board; US Users Drop, Guidance Disappoints

Heading into today's earnings from social media giant Facebook Meta (FB) (technically, the first quarter since the company changed its name), JPM previews expectations as follows: buyside is at the top end of Q4 guide (21%reported growth), with expectation that management steer to a Q1 deceleration q/q (consensus +16%) and reiterate $91-97b FY expense guide. With the new reporting structure, the bank expects RL to represent a LSD% of total revenue and would like to see additional disclosure around VR unit shipments, engagement, developers, etc. The bank also expects FB to have passed 10m active VR units.

If that sounds a bit too arcane, Loup Funds' Gene Munster simplifies it, tweeting that "the most important metric is MAU/DAU growth. Street is looking for up 5%. If the base is growing, the company can power through IDFA and macro headwinds. If engagement declines, FB will need the metaverse to bail them out."

For $FB tonight, the most important metric is MAU/DAU growth. Street is looking for up 5%. If the base is growing, the company can power through IDFA and macro headwinds. If engagement declines, FB will need the metaverse to bail them out.

— Gene Munster (@munster_gene) February 2, 2022

As for why FB (not to be confused with META) matters, JPM writes that its earnings along with AMZN, Friday's Payrolls and the upcoming CPI print, will determine whether the market can sustainable rise from here.

Unfortunately, if it really depends on Facebook then we have a problem because moments ago Facebook reported revenues, EPS, and DAU which both missed, but the kicker was the company's revenue guidance which was well below expectations, and as a result the stock is crashing a whopping 16% after hours.

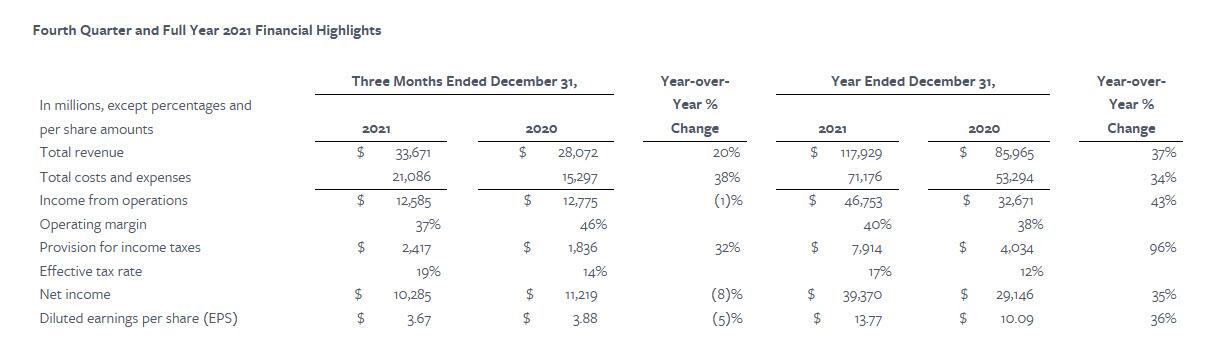

Here is what Facebook reported for Q4:

- Revenue $33.67B, missing est. $33.43B

- Advertising revenue $32.64 billion

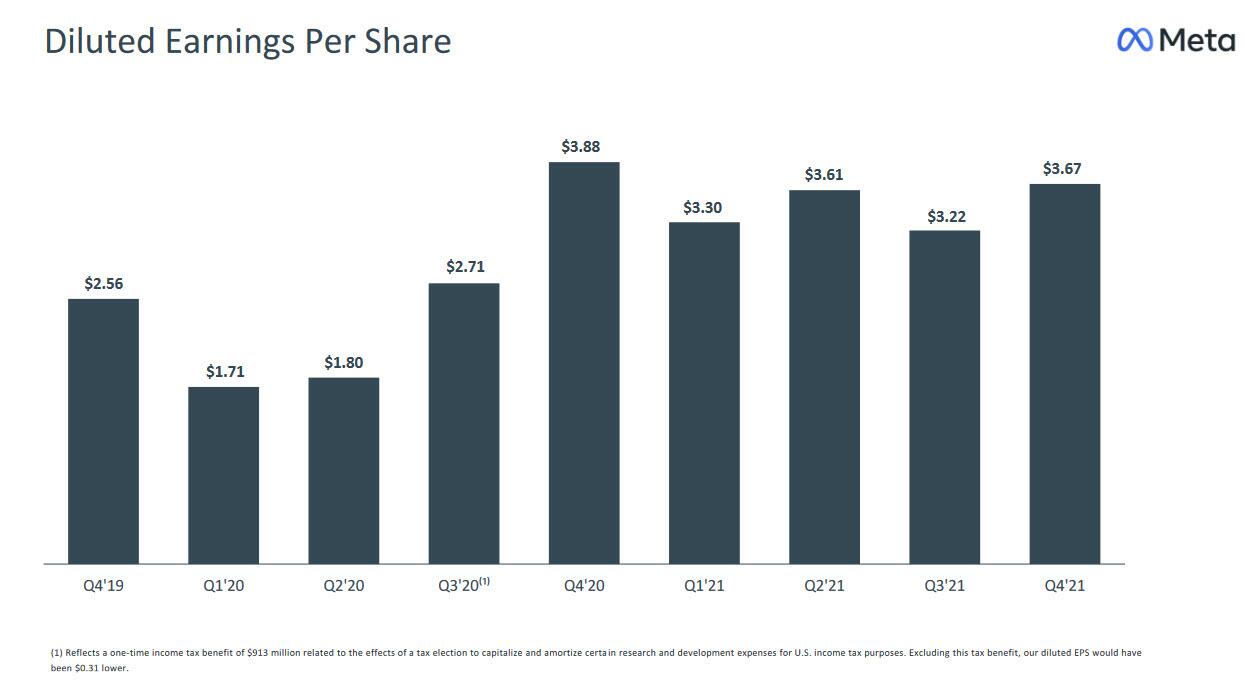

- EPS $3.67, missing estimate $3.84

- Operating margin 37%, missing estimate 38.7%

Some context: earnings were 4% below expectations, and that is enough to make it the company's biggest miss ever.

(Click on image to enlarge)

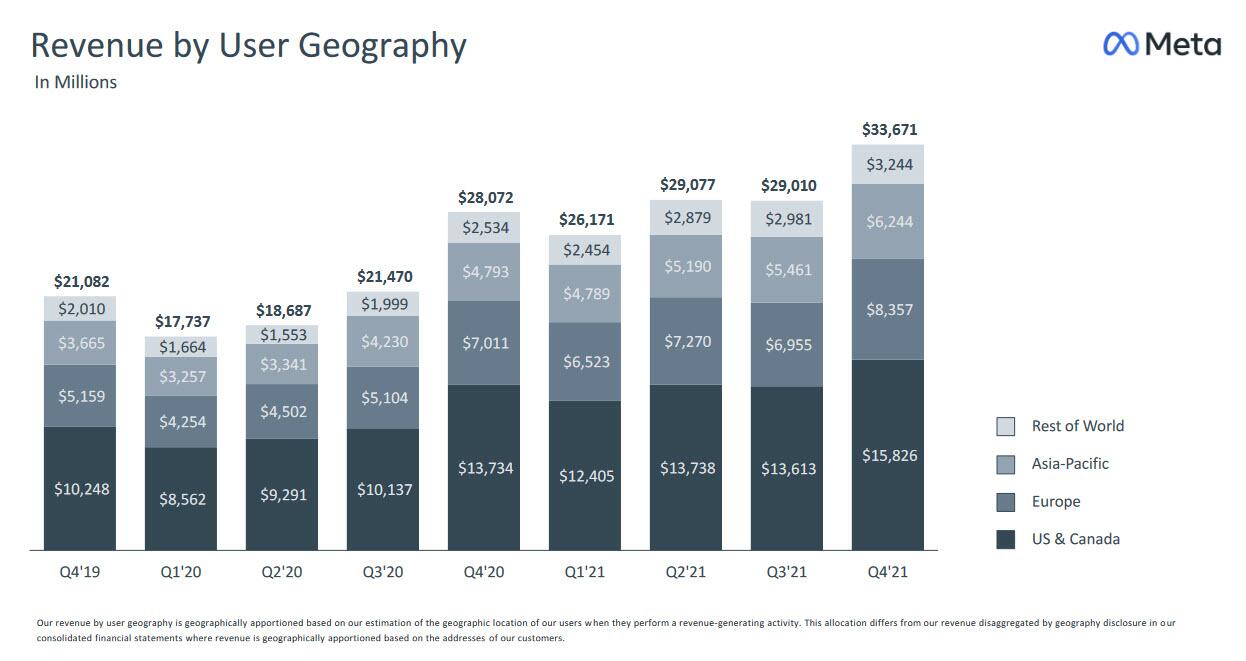

And visually:

(Click on image to enlarge)

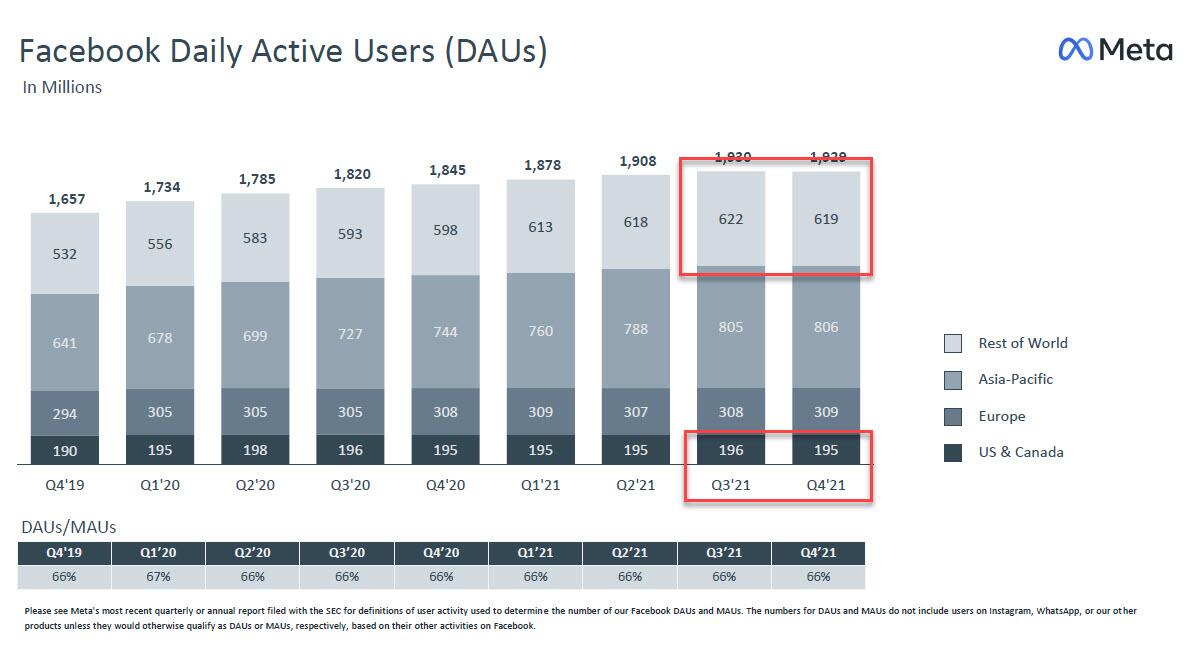

It was also ugly across the board on the user side:

- Monthly Active Users 2.91B, missing estimates 2.95B

- Daily Active Users 1.93B, missing estimates. 1.95B

Digging through the numbers shows that the company's DAUs in the US and ROW actually declined in Q4!

(Click on image to enlarge)

And then there was guidance which was even worse:

- Q1 Rev. $27B to $29B, Est. $30.25B: FB expects year-over-year growth in the first quarter "to be impacted by headwinds to both impression and price growth."

- Sees 2022 total expenses in the range of $90-95 billion, updated from the prior outlook of $91-97 billion: FB: "Our anticipated expense growth is driven by investments in technical and product talent and infrastructure-related costs."

- Sees 2022 capital expenditures, including principal payments on finance leases, in the range of $29-34 billion, unchanged from the prior estimate

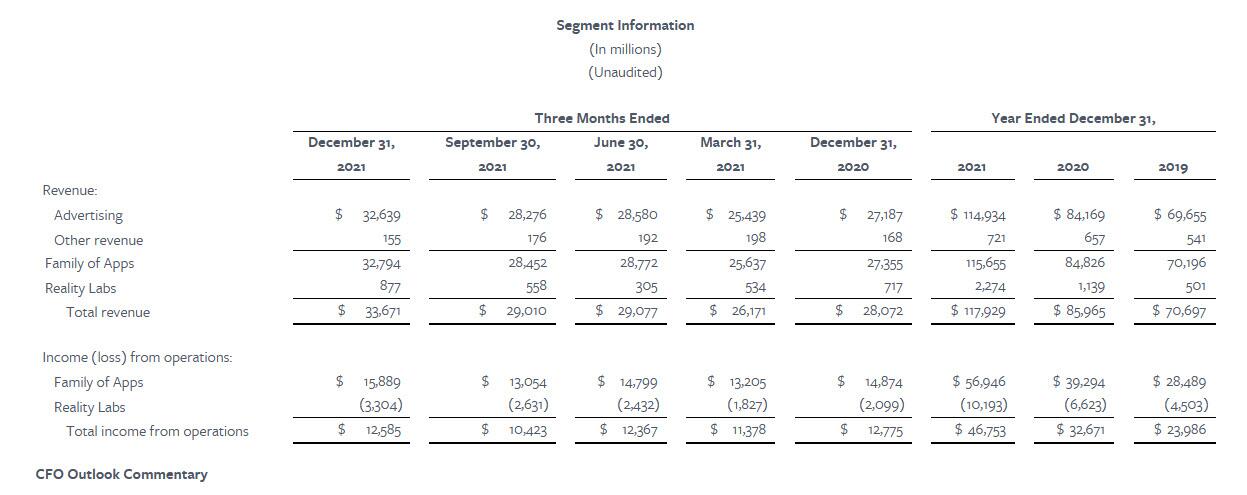

As a reminder, starting this quarter, the company reports its financial results based on two reportable segments:

- Family of Apps (FoA), which includes Facebook, Instagram, Messenger, WhatsApp, and other services.

- Reality Labs (RL), which includes augmented and virtual reality related consumer hardware, software, and content

These are shown below:

(Click on image to enlarge)

Commenting on what was a dismal quarter, the CFO had this to say:

- On the impressions side, we expect continued headwinds from both increased competition for people's time and a shift of engagement within our apps towards video surfaces like Reels, which monetize at lower rates than Feed and Stories.

- On the pricing side, we expect growth to be negatively impacted by a few factors:

- First, we will lap a period in which Apple's iOS changes were not in effect and we anticipate modestly increasing ad targeting and measurement headwinds from platform and regulatory changes.

- Second, we will lap a period of strong demand in the prior year and we're hearing from advertisers that macroeconomic challenges like cost inflation and supply chain disruptions are impacting advertiser budgets.

- Finally, based on current exchange rates, we expect foreign currency to be a headwind to year-over-year growth.

- In addition, as previously noted, we also continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations.

In kneejerk reaction to this dismal quarter, Facebook is down 23% or $75 to $245, the lowest price since Jan 2021.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more