Mercado Libre: It Is Not Too Late To Join The Party

MercadoLibre (MELI) is expected to deliver colossal revenue growth next year, and the market estimates it will be growing exceptionally well in the following years.

Mercado Libre has 3 key factors pushing it higher, the shift towards e-commerce, Amazon´s troubles reaching Latam, and its ability to integrate an offering similar to Etsy in its platform. Despite trading at a high premium and with significant risks, it is worth getting this stock now.

Will it survive Amazon?

Mercado Libre operates in 18 countries: Brazil, Argentina, Mexico, Chile, Colombia, Peru, Uruguay, Venezuela, Bolivia, Costa Rica, Dominican Republic, Ecuador, Guatemala, Honduras, Nicaragua, Panama, Paraguay, and El Salvador.

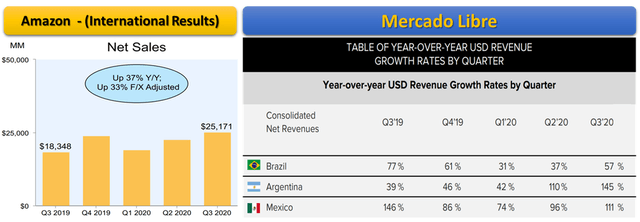

Of these countries, Amazon (AMZN) only operates in Mexico and Brazil. While Amazon does not provide country-specific sales numbers, the international sales growth is around 37%, while Mercado Libre is growing at a much higher rate in Mexico and Brazil.

(Click on image to enlarge)

Source: Investor Relations

While this comparison does not provide sufficient detail to determine each in the region's market share, however, some reports suggest that Mercado Libre is beating Amazon in Brazil. At the same time, in Mexico, it is a much tighter race.

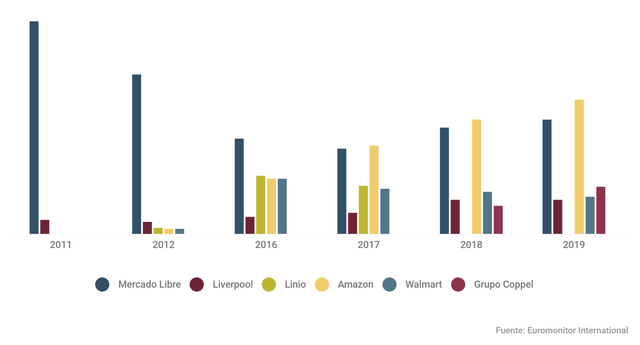

(Click on image to enlarge)

Source: ELCEO

The chart above shows that Amazon is pulling ahead of Mercado Libre in Mexico. Amazon entered the Mexican market in 2015 and the Brazilian market in late 2017; this difference in the time provided Mercado Libre more time to consolidate its leadership position in Brazil, which bodes well for Mercado Libre´s chances of keeping the lead in the rest of Latin America.

As e-commerce grows in Latin America, the company is likely to thrive and may be able to perform on the high side of the estimates.

The Other Moat

Mercado Libre has been in the region for many years, and its strategy has been focused on bringing small firms to the platform. This has created an offering similar to Etsy's(ETSY) within its platform without excluding big companies. Big vendors in Mexico or Brazil might find it easier to integrate their supply chain with Amazon, but small firms are unlikely to put their products on Amazon instead of Mercado Libre as Amazon is less friendly for those firms.

Source: MercadoLibre

On the consumer side, this offering creates value for users that it is difficult for Amazon or other local e-commerce companies to replicate or counter. This edge will allow the company to sustain continuous growth and keep a decent market share, even if Amazon initiates operations in other LATAM countries.

How Mercado Pago stands out

Mercado Libre has thrived in Latin America by providing an easy path for small vendors to put their products online and allow consumers with no bank accounts or distrust of e-commerce to make purchases using different payment methods, including Mercado Pago.

Mercado Pago not only allows the company to ease transactions in its e-commerce platform but provides a way for small companies to accept cards in their business and provides those businesses with small loans.

Source: MercadoPago

Besides providing an advantage for its e-commerce business, Mercado Pago will be a strong growth driver. The use of cash has characterized the Latin American economy, but the winds are shifting, and the market is adopting card payment at a growing pace. This trend could be a small catalyst for Visa (V) and MasterCard (MA), but it would be a big catalyst for Mercado Libre, as it will be a key enabler of this change, and other regions will not dilute its growth.

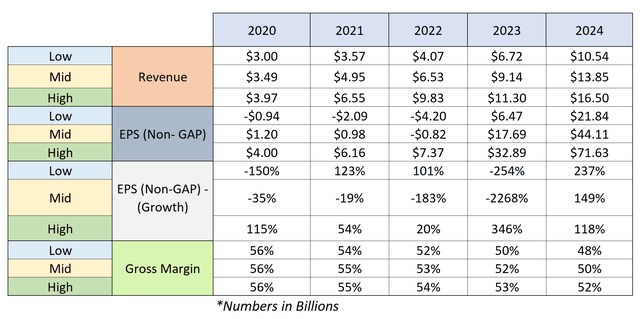

Valuation

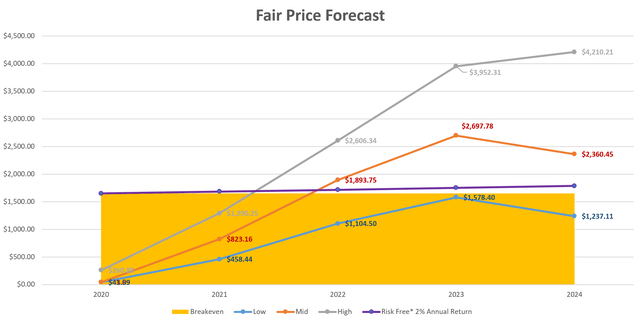

In the recent past, revenue growth has ranged between 18.3% and 59.5%, with a tendency to increase. The prediction estimates average revenue growth of 41.3% compared to the past average of 37.9%, and a gross margin of 52.3% compared to the past average of 66%. Taking a look at G&A as a percentage of revenue, it has had a maximum and minimum of 28.8% and 44.9% with a tendency to increase. The forecast modeled an average G&A as a percentage of revenue of 35.1% compared to the past average of 37%.

(Click on image to enlarge)

Source: Author´s Charts

I like to use Peter Lynch's ratio when valuing a stock. This method uses the ratio between the expected earnings growth plus dividends and the P/E of the stock to determine its fair value. A stock that has a 1:1 ratio is reasonably priced. The higher the number, the more underpriced the stock is.

(Click on image to enlarge)

Source: Author´s Charts

This valuation considers the company's assets and liabilities and the expected change in equity the company will have in the future. The growth considered in the valuation is the expected growth for the next year. Considering Iterated growth allows us to analyze better stocks that have uneven growth rates in time.

With this valuation, arguably, the stock is at worst overvalued by 97% and at best overvalued by 84%. So the stock is overvalued in the short term.

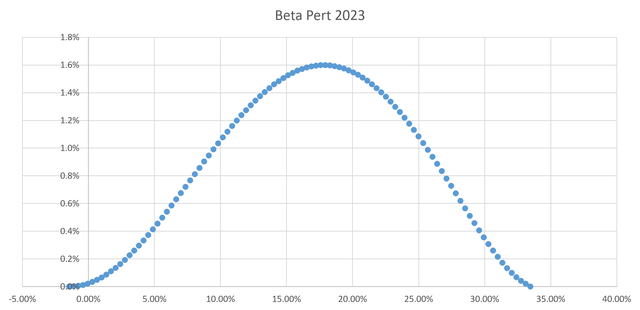

Constructing an adjusted Beta Pert risk profile for the stock's long-term prospects, we can calculate its risk profile.

(Click on image to enlarge)

Source: Author´s Charts

The risk profile shows an 8.4% probability that MercadoLibre will end up trading at a lower price than it is today. Considering the potential downside, upside, and the likelihood of each, the statistical value of the opportunity of investing now is 14.7%.

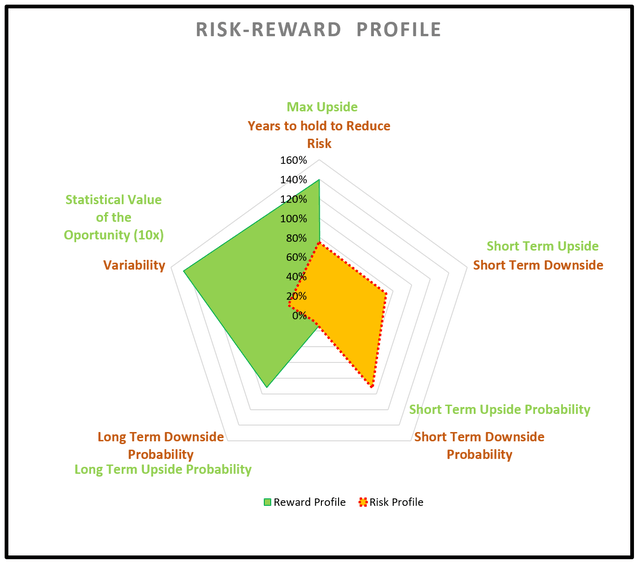

(Click on image to enlarge)

Source: Author´s Charts

The risk-reward profile above shows that the company has an asymmetric relationship between its risks and potential rewards. The risks are still considerable and mostly concentrated in the short to mid-term, putting the upside in the long term.

Conclusions

Given the wonderful growth in revenue that the company has shown in the past, the decent financials, and the minor level of debt that the company has, it has the chance to become a home-runner and significantly improve the returns of the whole portfolio. If the company does not manage to get into the high end of the spectrum, it is likely to perform in the market in the long run.

The stock would increase the risk in many portfolios, but the potential upside compensates for the risk handsomely. Ideally, this would be a better price to get in, but its current price is understandable with the fantastic run it had in 2020.

If there is anything in this article, you agree or disagree with or would like me to expand further; I would sincerely appreciate you leaving a comment. I will address it as soon as possible.

Disclosure: I am long MELI, AMZN