MAT2501 Phase 1 Data Look Good, Shares Look Attractive

On March 27, 2017, Matinas Biopharma (MTNB) reported positive topline results from a Phase 1 single ascending dose study of MAT2501 in healthy volunteers. MAT2501 is the company's oral lipid-crystal formulation of amikacin. Amikacin is a powerful antibiotic with limited bacterial resistance. Unfortunately, the injectable formulation of the drug has poor tolerability and high incidence of series adverse events, including severe nephrotoxicity and ototoxicity. The U.S. FDA recommends strict monitoring of amikacin blood levels to avoid these risks.

Although multi-dose studies are still necessary, the results of Matinas' Phase 1 study suggest that oral doses of MAT2501 can safely be administered without raising the concentration of amikacin in the blood to levels known to cause series adverse events. Matinas is developing MAT2501 to treat different types of chronic and acute bacterial infections, including nontuberculous mycobacterium (NTM) infections and various multidrug-resistant Gram negative bacterial infections.

Phase 1 SAD Study Offers Clean Results

The Phase 1 study was designed to show that single ascending doses of MAT2501 do not spike amikacin blood concentration to the dangerously high levels seen with the injectable formulations in healthy volunteers. Results of the 36 subject study showed no serious adverse events. Adverse events were mostly mild in severity and gastrointestinal (GI) in nature, which was minimized by administering MAT2501 with food. Matinas will move quickly into a multiple ascending dose pk, safety, and tolerability study, with a goal to complete the entire Phase 1 program before the end of the year.

Upon completion of the Phase 1 program, management will meet with the U.S. FDA and outline plans for Phase 2. Matinas would like to initiate a Phase 2 study in patients with refractory non-tuberculous mycobacterium (NTM) lung infections in 2018. NTM is an indication for which MAT2501 has been granted QIDP status and orphan drug designation by the U.S. FDA. The company also intends to explore the development of MAT2501 for the treatment of a variety of multi-drug resistant, bacterial infections, including Enterobacteria, Acinetobacter, Pseudomonas, Staphylococcus aureus, and other gram-negative infections.

The Trojan Horse Hypothesis

The Phase 1 results suggest that the first part of the "Trojan Horse Hypothesis" for MAT2501 holds merit. If you are familiar with the myth, the Greek's used the Trojan Horse ruse to end the decade-old Trojan War. It goes as such: The Greeks constructed a large wooden horse and left it outside of the gates of Troy. The Greek army sailed away and the Trojans pulled the horse into the city thinking it was a victory offering to the god Poseidon. That night, a small force of Greeks crept out of the horse and opened the gates for the rest of the Greek army, which had been hiding just off shore. Once inside the gates of the city, the Greeks sacked Troy and ended the war (watch this clip from Troy, 2004).

Step one was sneaking into the city without raising an alarm. In this analogy, the giant wooden horse is Matinas' cochleate crystalline structure. The lipid-crystal nano-particle is the delivery vehicle. The amikacin is Sean Bean and Brad Pitt. Matinas showed with the results of the Phase 1 trial that it can deliver MAT2501 without spiking amikacin blood levels because the amikacin is protected inside the lipid-crystal structure.

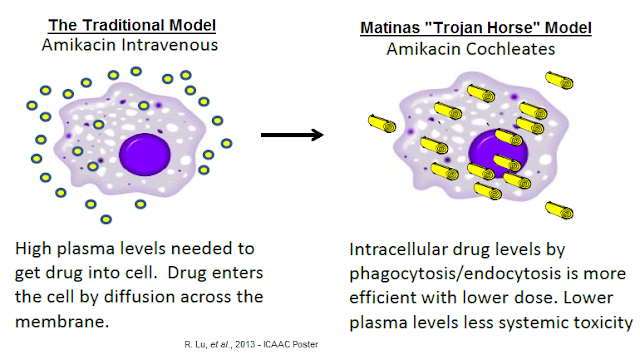

Recall, the high concentration of calcium in the digestive track keeps the nano-particle cochleate structure in crystalline form with the amikacin protected inside. In patients with an active infection, activated macrophages readily engulf cochleates through phagocytosis. The low calcium centration inside the lysosomes causes the lipid crystal cochleate to unroll, thus releasing the amikacin inside the macrophage. Activated macrophages then traffic to the site of the infection by humoral response, slowly releasing the amikacin where it is needed most.

This is in stark contrast to the traditional model for drug delivery in which high concentrations of amikacin in the blood are necessary for intracellular penetration. The conventional approach results in a relatively low percentage of circulating drug entering the cell and nonspecific toxicity. The cartoon below shows this process for MAT2501, but it is analogous to MAT2203 (amphotericin B) as well. Again, the Phase 1 showed the Trojan Horse hypothesis holds. No free amikacin in the blood means it is still inside the crystalline structure, has passed into the lymphatic system and is waiting to be engulfed by activated macrophages. The Greek army is still inside the wooden horse, waiting to get into the city!

Step Two - Sack The City

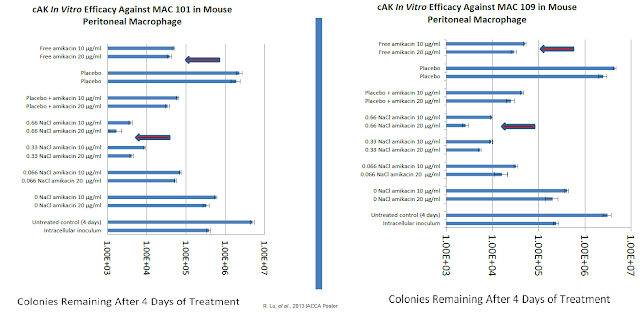

Step two is killing the infection. This is what Matinas will look to demonstrate in an upcoming Phase 2 clinical trial in patients with active NTM infections. However, we are not flying into Phase 2 data blind to the efficacy of MAT2501. The in vitro activity of MAT2501 was presented at the 2013 American Society for Microbiology's Interscience Conference of Antimicrobial Agents and Chemotherapy (ICAAC) scientific session. Work by company R. Lu, et al evaluated the efficacy of the drug using mouse peritoneal macrophage infected with two Mycobacterium avium complex (MAC) strains. The analysis included a positive control (free amikacin) and negative control (empty cochleate). Data show a greater than 10-fold enhanced efficacy for the optimized dose of MAT2501 compared to free amikacin.

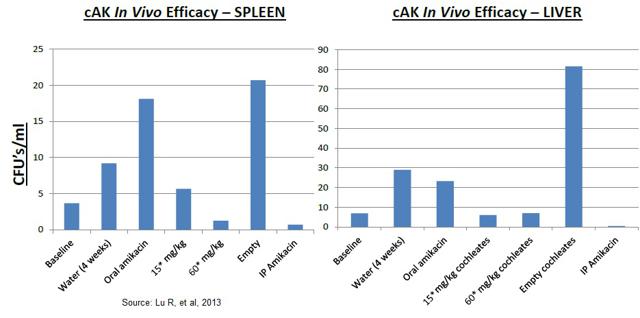

To evaluate the activity of the MAT2501 in vivo, C57 BL/6 mice were infected with M. avium 104 by tail vein injection (disseminated NTM model). The mice were then treated with various intravenous amikacin preparations for two weeks, after which time the mice were harvested and the bacterial load in the spleens was quantified. The results indicate that MAT2501 (cAK) was just as effective as free amikacin and far superior to orally administered amikacin or an "empty" cochleate control.

M. avium has been shown to form biofilms associated with recurrent lung infections. These infections are often resistant to conventional beta-lactam antibiotics. To study the effects of MAT2501 in this difficult to treat infection, the company studied the drug vs. free amikacin (IV) and empty cochleates in polarized A549 alveolar epithelial cells. Encochleated amikacin showed significant activity against M. avium in the in vitro biofilm model and the in vivo respiratory biofilm mouse model. These data were presented at ICAAC in September 2015 and have particular relevance to lung infections like cystic fibrosis (CF).

In March 2017, Matinas released additional in vitro data on MAT2501 conducted in collaboration with Colorado State University.

Finally, a recent study published in Respirology by a team of researchers out of Australia found that amikacin is highly effective in treating NTM, but that the risks of toxicities must be heavily weighed for each patient. Independent work out of India suggests that amikacin may be the most effective antibiotic to fight rapidly growing mycobacteria and treat patients with NTM.

Some Additional Thoughts

I bought Matinas on Friday, March 24, 2017, when an overly negative and erroneous article published on Seeking Alpha. The article made three key points: 1) the company's pipeline was worthless, 2) the shares lack catalysts, and 3) that some shady individuals own the stock. The article has since been removed.

For the record, I completely disagree with the first two points. I think the market opportunity for MAT2501 is tremendous. The NIH estimates the number of infections in the U.S. at 200,000, predominantly in elderly individuals living in the coastal and gulf states. FDA guidance for the treatment of patients with of NTM infections refractory to guideline therapy includes a treatment duration in the range of 12 to 18 months. That is simply not possible with current injectable formulations. Inhaled formulations of amikacin, like the one under Phase 3 development at Insmed Inc. (INSM), has shown mixed results (see here vs. here), yet, Insmed has nearly a $1 billion market cap with little else in its pipeline. I think MAT2501 has a significant market opportunity, potentially in the $1.25 billion range. I'm equally as bullish on MAT2203 and I think the drug could be a game-changer for invasive fungal infections.

As for pending catalysts, MAT2203 is currently in two Phase 2 studies right now. The first is ongoing at the NIH in chronic mucocutaneous Candidiasis. Earlier in March 2017, Matinas announced that the NIH initiated an open-label expansion of the study. I see that as a very good sign because the NIH does not care about Matinas Biopharma - it cares about finding drugs that save lives. NIH investigators would not seek authorization from the FDA to keep gravely ill patients on a drug that they did not think was working. I'm expecting to see the initial data from this study in June 2017. A second Phase 2 in vulvovaginal Candidiasis initiated in November 2016 and show offer data in July 2017. A third study is expected to begin shortly with MAT2203, and as noted above, a multi-dose Phase 1 with MAT2501 should start and complete before the end of the year. That seems like a pretty good number of catalysts!

As for the third point that "shady people own the stock", this may very well be true, but Matinas management has no control over who buys and sells the stock in the open market. I try not to concern myself with things like this. I think the Seeking Alpha article mentioned it as a scare tactic. It really has no impact on my due diligence; nor should it on anyone else's. I have met face-to-face with Matinas management on several occasions. I find them to be highly credible. They are collaborating with several universities, the NIH, and just recently received a grant award from the Cystic Fibrosis Foundation for MAT2501.

Conclusion

I think the science is sound. I think management is excellent. They have plenty of cash and several upcoming catalysts that I think will drive the stock higher throughout the year. I like the Phase 1 results from MAT2501 discussed above and I like the fact that the NIH is keeping its patients on MAT2203 right now. There are several upcoming catalysts in the next 3-6 months. I think the stock is cheap and I can easily see Matinas getting taken out at much higher levels - like most anti-infectant companies do - perhaps after the pipeline matures a bit. I've done my homework. All else is noise.

Disclosure: Please see important information about BioNap and our relationship with companies mentioned in this article in our more