Markets Make Fresh Attempt At Swing Lows

Image Source: Pixabay

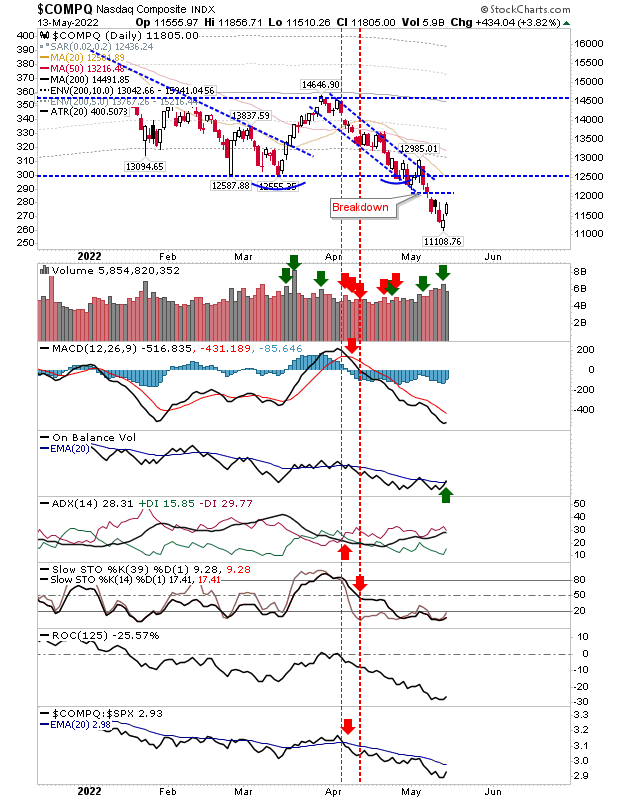

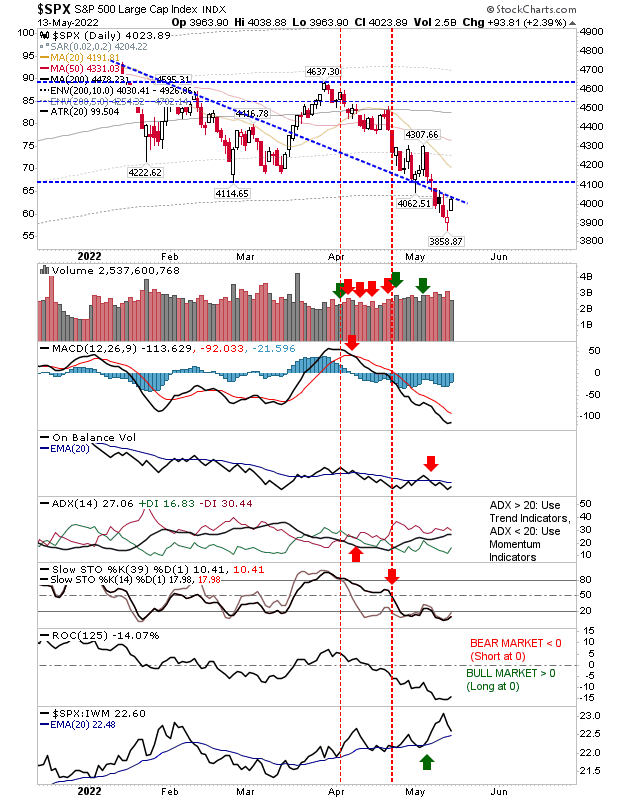

Markets are attempting to build new swing lows from a place of price extremes in both breadth and relative to their long-term (200-day) moving averages.

If we are to get a bottom, then we not only need to see gains, but we also need to see how markets react to the next loss. The March swing low started like what we saw on Friday. Yet when selling emerged, buyers couldn't stop it with consecutive days of buying - at least not until Friday. On the plus side, On-Balance-Volume is on a 'buy' trigger.

The S&P 500 has been trading around a declining trendline - finishing just below the trendline on Friday. Relative performance has been a bit of a roller-coaster, but even while losing ground against the Russell 2000, it still manages to hold the advantage.

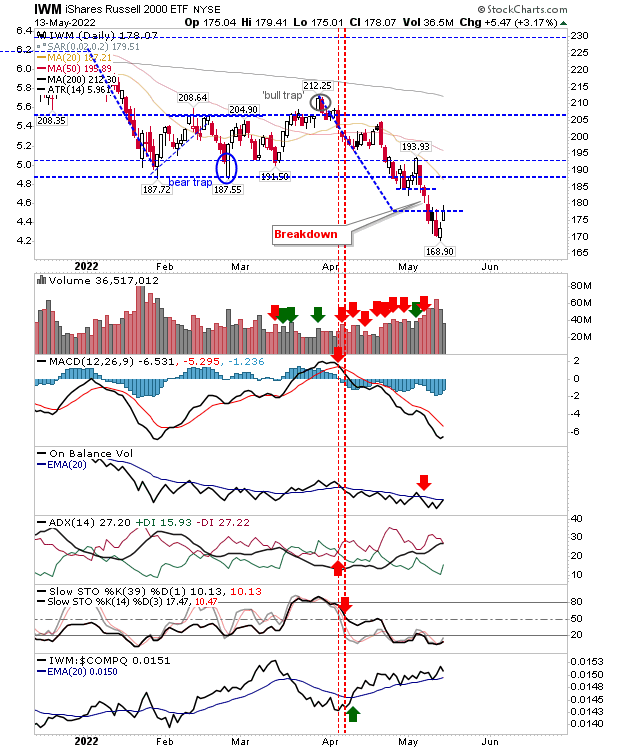

The Russell 2000 still holds the relative advantage over the Nasdaq though, and it is making ground in accumulation (On-Balance-Volume). The index is toying with its measured move target. This index is best placed to lead a larger recovery and (small-caps) offer the best value for investors willing to take the plunge.

For next week, we want to see this nascent gain from Friday build out into a recovery rally, but markets may take baby steps to get there. This is a buyer's market for those willing to take the risk.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more